Exhibit 99.1

STRICTLY CONFIDENTIAL Lender Presentation June 4, 2021

STRICTLY CONFIDENTIAL 2 Notice To and Undertaking By Recipients This presentation (the "Lender Presentation"; and together with any other information regarding the Company or the Facilities (a s defined below) (whether prepared or communicated by the Company or the Arranger or their respective advisors or otherwise), the “Evaluation Material”) has been p rep ared solely for informational purposes by or on behalf of MaxLinear (“Company”) and is being furnished by the Company and/or Wells Fargo Securities, LLC (the "Arranger") to you in your capacity a s a prospective lender (the "Recipient") in considering the proposed described facilities described in the Lender Presentation (t he "Facilities"). YOUR RECEIPT AND REVIEW OF THE LENDER PRESENTATION CONSTITUTES ACCEPTANCE OF THE TERMS AND CONDITIONS OF THE NOTICE TO AND UN DER TAKING BY RECIPIENTS SET FORTH BELOW AND AN ACKNOWLEDGMENT OF AND AGREEMENT TO BE BOUND BY THE TERMS OF THIS NOTICE TO AND UNDERTAKING BY RECIPIENTS. IF THE RECIPIENT IS NOT WILLING TO ACCEPT THE LENDER PRESENTATION AND OTHER EVALUATION MATERIAL ON THE TERMS SET FO RTH IN THIS NOTICE TO AND UNDERTAKING, IT MUST RETURN THE LENDER PRESENTATION AND ANY OTHER EVALUATION MATERIAL TO THE COMPANY OR THE ARR ANG ER IMMEDIATELY WITHOUT REVIEWING OR MAKING ANY COPIES THEREOF, EXTRACTS THEREFROM OR USE THEREOF. The Recipient acknowledges and agrees that ( i ) the Arranger received the Evaluation Material from third party sources, including the Company, and it is provided to the Recipient for informational purposes, (ii) the Arranger and its affiliates bear no responsibility (and shall not be liable) f or the accuracy or completeness (or lack thereof) of the Evaluation Material or any information contained therein, (iii) no representation regarding the Evaluation Material is ma de by the Arranger or any of its affiliates, (iv) neither the Arranger nor any of its affiliates have made any independent verification as to the accuracy or completeness of t he Evaluation Material, and (v) the Arranger and its affiliates shall have no obligation to update or supplement any Evaluation Material or otherwise provide additional i nfo rmation.

STRICTLY CONFIDENTIAL 3 Notice To and Undertaking By Recipients (Cont.) The Evaluation Material has been prepared to assist interested parties in making their own evaluation of the Company and the Fac ilities and does not purport to be all - inclusive or to contain all of the information that a prospective participant may consider material or desirable in making it s d ecision to become a lender. Each Recipient of the information and data contained herein should take such steps as it deems necessary to assure that it has the information it considers material or desirable in making its decision to become a lender and should perform its own independent investigation and analysis of the Facilities or the tr ans actions contemplated thereby and the creditworthiness of the Company. The Recipient represents that it is sophisticated and experienced in extending credit to ent iti es similar to the Company. The information and data contained herein are not a substitute for the Recipient's independent evaluation and analysis and should not be cons ide red as a recommendation by the Arranger or any of its affiliates that any Recipient enter into the Facilities. Defined terms used in this presentation are n ot the equivalent of the same terms used in the Facilities. The Recipient acknowledges that the Arranger’s activities in connection with the Facilities are undertaken by the Ar ranger as a principal on an arms - length basis and the Arranger has no fiduciary, advisory or similar responsibilities in favor of the Recipient in connection with th e F acilities or the process related thereto. The Arranger and/or one of its affiliates may ( i ) have, from time to time, performed, and may in the future perform, various financial advisory and investment banking services for the Company and/or its affiliates, (ii) make or hold a broad array of investments and actively trade debt and eq uit y securities (or related derivative securities) and financial instruments (including bank loans) for their own account and for the accounts of their customers, which may inv olv e assets, securities and/or instruments of the Company and/or its affiliates, (iii) make investment recommendations and/or publish or express independent research views in respect of such securities or instruments, and (iv) provide loans under the Facilities for their own account and such loans may comprise, individually or i n t he aggregate, a substantial portion of the Facilities. In connection with the Facilities, the Company will pay certain fees, including commitment fees, to the Arranger and /or one or more of its affiliates, as well as fees payable or given to the Arranger and/or one or more of its affiliates in consideration for their respective commitments to provide loans, which commitments were made to the Company in advance of the commencement of the general syndication of the Facilities. It is understood that unless and until a definitive agreement regarding the Facilities between the parties thereto has been e xec uted by the Recipient, the Recipient will be under no legal obligation of any kind whatsoever with respect to the Facilities by virtue of this Notice to and Undertaking e xce pt for the matters specifically agreed to herein. This Notice to and Undertaking shall be governed by and construed in accordance with the law of the State of New York, withou t r egard to principles of conflicts of law (except Section 5 - 1401 of the New York General Obligation Law to the extent that it mandates that the law of the State of New Yo rk govern).

STRICTLY CONFIDENTIAL 4 Disclaimer Forward - Looking Statements This presentation contains forward - looking statements within the meaning of Section 27A of the Securities Act of 1933, as amende d, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward - looking statements include, among others, statements concerning forecasts of our futur e operating results, including future revenues, free cash flows, and EBITDA; our views of perceived opportunities as well and trends and growth prospects wi thi n our target markets; expectations with respect to our product development initiatives; and our future business and financial prospects generally. These forward - looking statements involve known and unknown risks, uncertainties, and other factors that may cause actual results to be materially different from any future resu lts expressed or implied by the forward - looking statements. Forward - looking statements are based on management’s current, preliminary expectations and are subject to va rious risks and uncertainties. Risks and uncertainties affecting our business, operating results, financial condition, and stock price include, among others, the pot ential impact on our revenues and operating expenses of current supply and distribution challenges facing the semiconductor industry generally and MaxLinear sp eci fically; uncertainty concerning the impact on demand in our broadband markets of return - to - work initiatives as the Covid - 19 pandemic abates; intense competition wit hin the semiconductor industry generally as well within our target markets; our dependence on a limited number of customers for a substantial portion of our re venues; uncertainties concerning how end user markets for our products will develop; potential uncertainties arising from continued consolidation among cable tele vis ion and satellite operators in our broadband target markets; continued consolidation among competitors within the semiconductor industry generally; our ability to develop and introduce new and enhanced products on a timely basis and achieve market acceptance of those products, particularly as we seek to expand outsid e o f our historic markets; potential decreases in average selling prices for our products; risks relating to intellectual property protection and the prevalence o f i ntellectual property litigation in our industry; the impact on our financial condition of the incremental indebtedness arising from our recent acquisition of Intel’ s H ome Gateway business; and our lack of long - term supply contracts and dependence on limited sources of supply. In addition to these risks and uncertainties, investors should review the risks and uncertainties contained under the caption “Risk Factors” in our filings with the Securities and Exchange Commission (SEC), in clu ding our most recent Annual Report on Form 10 - K for the year ended December 31, 2020, which we filed with the SEC on February 11, 2021, and our Quarterly Report on Fo rm 10 - Q for the quarter ended March 31, 2021, which we filed with the SEC on April 28, 2021. Unless otherwise indicated herein, all forward looking statements are based on estimates, projections, and assumptions of MaxLinear as of the date of this presentation. These slides do not constitute confirmation or an update of pre vio usly provided guidance. MaxLinear is under no obligation (and expressly disclaims any such obligation) to update or revise any forward - looking statements whether as a result of new information, future events, or otherwise. Non - GAAP Financial Measures This communication may contain certain non - GAAP financial measures, which MaxLinear management believes are useful to investors and reflect how management measures MaxLinear’s business. Further detail and reconciliations between the non - GAAP financial measures and the GAAP financial measures are availa ble on the Investor Relations section of MaxLinear website as part of its published financial results press release. Because of the inh ere nt uncertainty associated with our ability to project future charges, particularly those related to stock - based compensation and its related tax effects as well as potential impairments, we do not provide reconciliations to forward - looking non - GAAP financial information.

STRICTLY CONFIDENTIAL 5 Agenda I Transaction Overview III End - Market Overview IV Financial Summary V Appendix II Company Overview and Credit Highlights

STRICTLY CONFIDENTIAL Transaction Overview

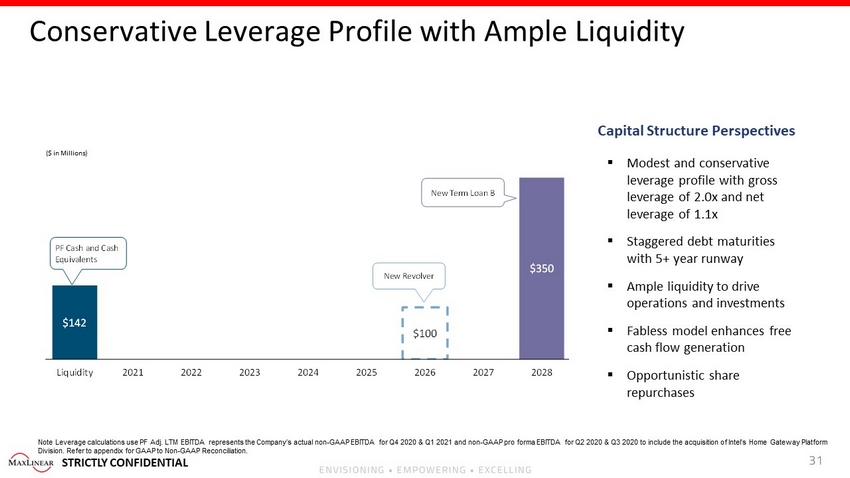

STRICTLY CONFIDENTIAL STRICTLY CONFIDENTIAL 7 Summary Transaction Overview ▪ MaxLinear, Inc. (“MXL” or the “Company”) is seeking to issue a $350 million Term Loan B due 2028 to refinance its existing Term Loan A due 2023 and Term Loan B due 2024 ▪ The Company also intends to establish a new $100 million Revolving Credit Facility due 2026 Transaction Rationale ▪ Take advantage of favorable market conditions to repay current outstanding Term Loans ▪ Proposed transaction allows for the Company to manage nearing maturities ▪ New revolver bolsters liquidity and improves flexibility ▪ The pro forma capital structure does not increase leverage levels but extends maturities on pre - payable debt to continue de - risking over time while providing additional liquidity and financial flexibility

STRICTLY CONFIDENTIAL Company Overview and Credit Highlights

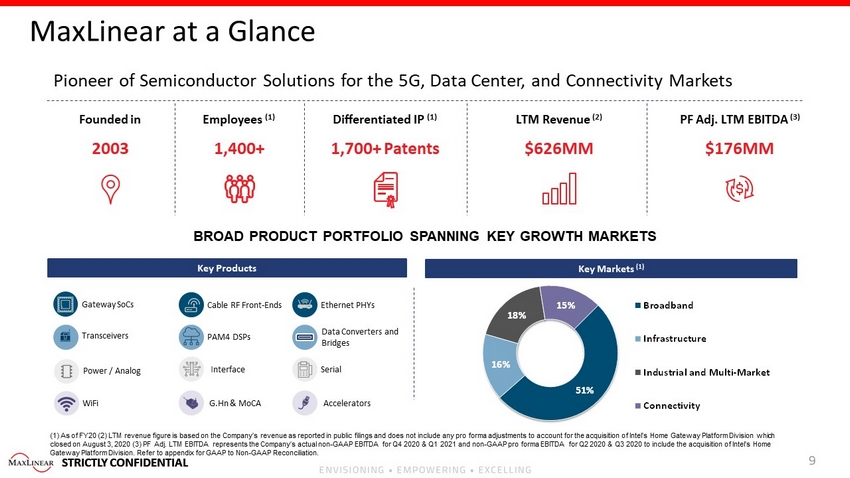

STRICTLY CONFIDENTIAL STRICTLY CONFIDENTIAL 9 51% 16% 18% 15% Broadband Infrastructure Industrial and Multi-Market Connectivity MaxLinear at a Glance BROAD PRODUCT PORTFOLIO SPANNING KEY GROWTH MARKETS Pioneer of Semiconductor Solutions for the 5G, Data Center, and Connectivity Markets (1) As of FY20 (2) LTM revenue figure is based on the Company’s revenue as reported in public filings and does not include an y p ro forma adjustments to account for the acquisition of Intel’s Home Gateway Platform Division which closed on August 3, 2020 (3) PF Adj. LTM EBITDA represents the Company’s actual non - GAAP EBITDA for Q4 2020 & Q1 2021 and non - GA AP pro forma EBITDA for Q2 2020 & Q3 2020 to include the acquisition of Intel’s Home Gateway Platform Division. Refer to appendix for GAAP to Non - GAAP Reconciliation. Key Products Interface Power / Analog Serial Data Converters and Bridges Transceivers PAM4 DSPs Cable RF Front - Ends Gateway SoCs Ethernet PHYs Accelerators G.Hn & MoCA WiFi Key Markets (1) Founded in 2003 Employees (1) 1,400+ Differentiated IP (1) 1,700+ Patents LTM Revenue (2) $626MM PF Adj. LTM EBITDA (3) $176MM

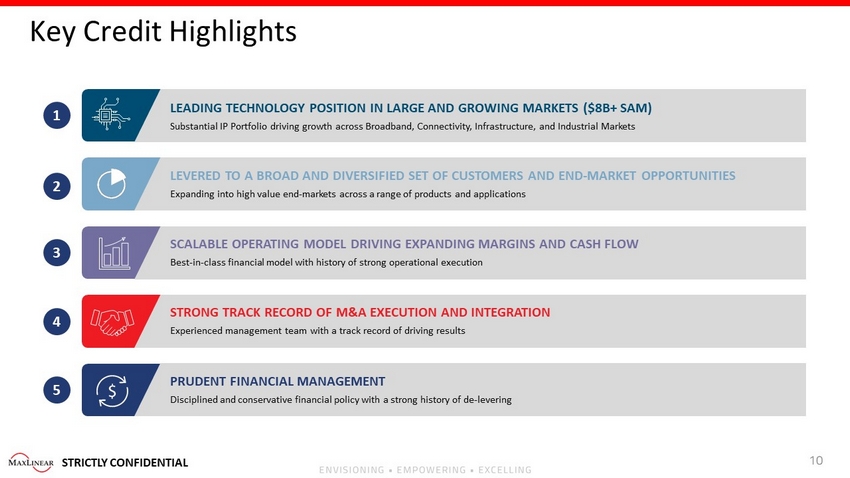

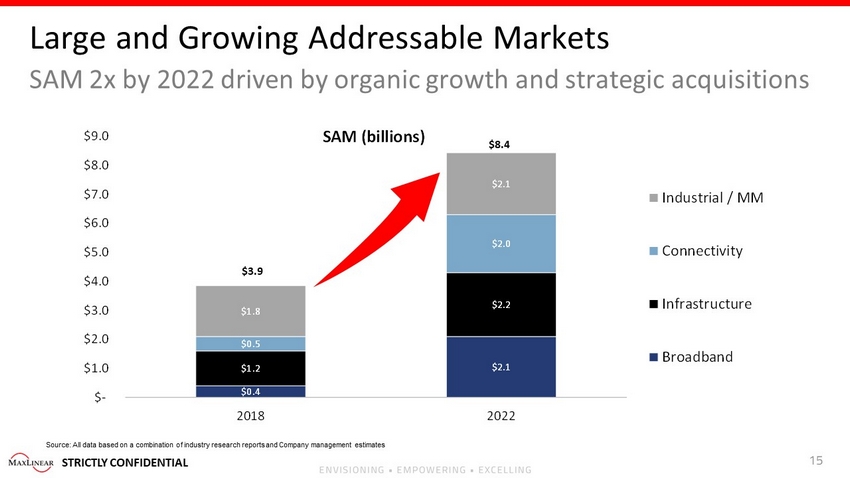

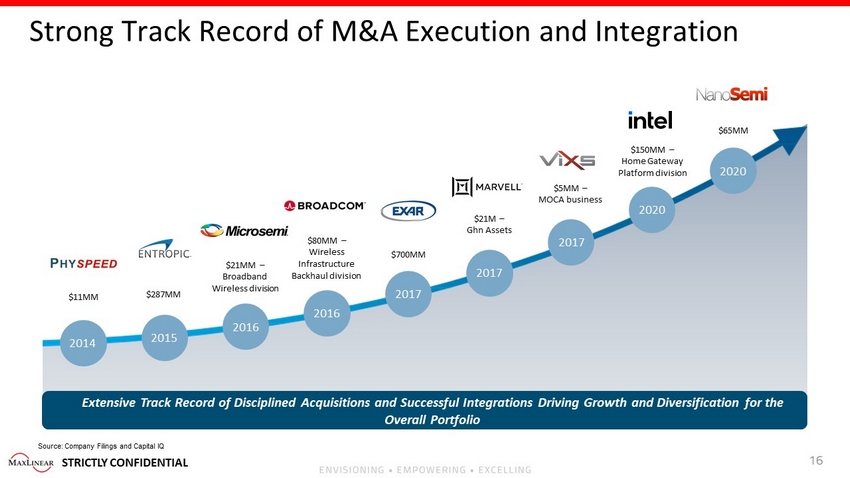

STRICTLY CONFIDENTIAL 10 Key Credit Highlights LEADING TECHNOLOGY POSITION IN LARGE AND GROWING MARKETS ($8B+ S AM) Substantial IP Portfolio driving growth across Broadband, Connectivity, Infrastructure, and Industrial Markets 1 SCALABLE OPERATING MODEL DRIVING EXPANDING MARGINS AND CASH FLOW Best - in - class financial model with history of strong operational execution 3 STRONG TRACK RECORD OF M&A EXECUTION AND INTEGRATION Experienced management team with a track record of driving results 4 PRUDENT FINANCIAL MANAGEMENT Disciplined and conservative financial policy with a strong history of de - levering 5 LEVERED TO A BROAD AND DIVERSIFIED SET OF CUSTOMERS AND END - MARK ET OPPORTUNITIES Expanding into high value end - markets across a range of products and applications 2

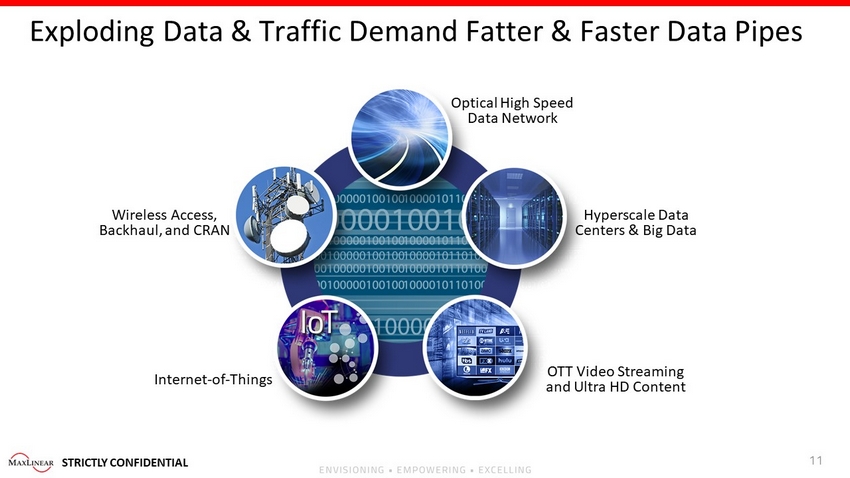

STRICTLY CONFIDENTIAL 11 Exploding Data & Traffic Demand Fatter & Faster Data Pipes Hyperscale Data Centers & Big Data Wireless Access, Backhaul, and CRAN Optical High Speed Data Network Internet - of - Things OTT Video Streaming and Ultra HD Content

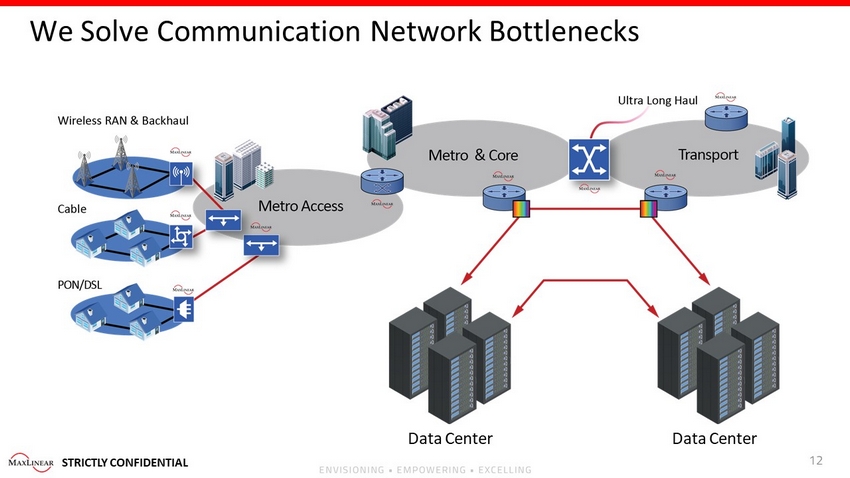

STRICTLY CONFIDENTIAL 12 We Solve Communication Network Bottlenecks Data Center Data Center

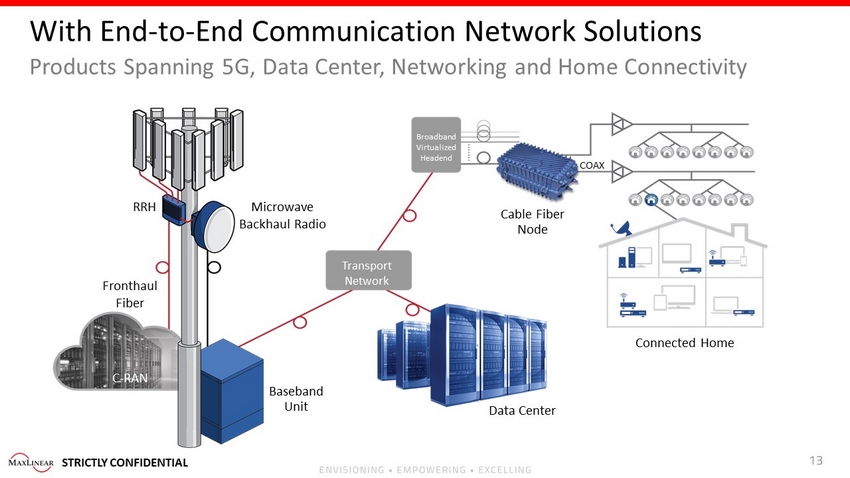

STRICTLY CONFIDENTIAL 13 With End - to - End Communication Network Solutions Broadband Virtualized Headend Transport Network RRH Fronthaul Fiber Microwave Backhaul Radio Cable Fiber Node Connected Home Data Center COAX Baseband Unit C - RAN Products Spanning 5G, Data Center, Networking and Home Connectivity

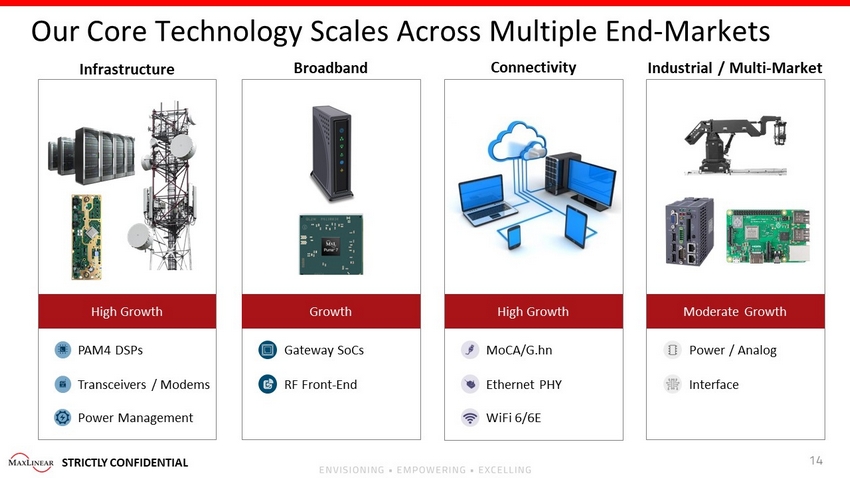

STRICTLY CONFIDENTIAL 14 Our Core Technology Scales Across Multiple End - Markets High Growth Connectivity Moderate Growth Industrial / Multi - Market MoCA/G.hn Interface Infrastructure High Growth PAM4 DSPs Broadband Gateway SoCs Growth Transceivers / Modems RF Front - End Ethernet PHY WiFi 6/6E Power / Analog Power Management

STRICTLY CONFIDENTIAL 15 Large and Growing Addressable Markets SAM 2x by 2022 driven by organic growth and strategic acquisitions Source: All data based on a combination of industry research reports and Company management estimates $0.4 $2.1 $1.2 $2.2 $0.5 $2.0 $1.8 $2.1 $- $1.0 $2.0 $3.0 $4.0 $5.0 $6.0 $7.0 $8.0 $9.0 2018 2022 SAM (billions) Industrial / MM Connectivity Infrastructure Broadband $3.9 $8.4

STRICTLY CONFIDENTIAL 16 Strong Track Record of M&A Execution and Integration Extensive Track Record of Disciplined Acquisitions and Successful Integrations Driving Growth and Diversification for the Overall Portfolio $21M – Ghn Assets $11MM 2014 2015 $287MM $21MM – Broadband Wireless division 2016 2016 2017 2017 2017 2020 2020 $700MM $80MM – Wireless Infrastructure Backhaul division $5MM – MOCA business $150MM – Home Gateway Platform division $65MM Source: Company Filings and Capital IQ

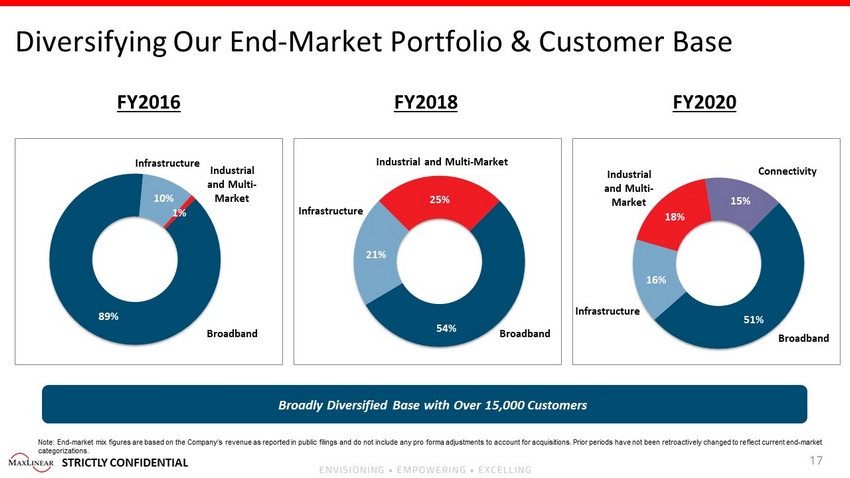

STRICTLY CONFIDENTIAL 17 89% 10% 1 % FY2016 Diversifying Our End - Market Portfolio & Customer Base FY2018 Industrial and Multi - Market 51% 16% 18% 15% FY2020 54% 21% 25% Infrastructure Infrastructure Industrial and Multi - Market Infrastructure Industrial and Multi - Market Broadband Broadband Connectivity Broadband Note: End - market mix figures are based on the Company’s revenue as reported in public filings and do not include any pro forma a djustments to account for acquisitions. Prior periods have not been retroactively changed to reflect current end - market categorizations. Broadly Diversified Base with Over 15,000 Customers

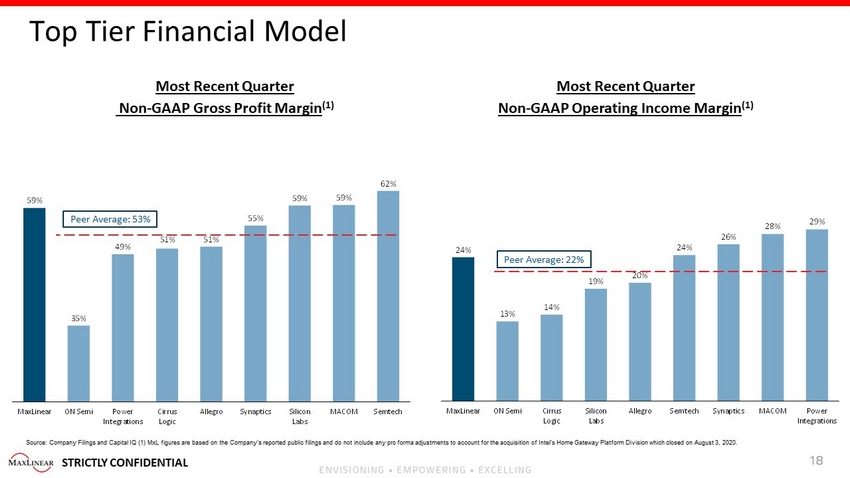

STRICTLY CONFIDENTIAL 18 59% 35% 49% 51% 51% 55% 59% 59% 62% MaxLinear ON Semi Power Integrations Cirrus Logic Allegro Synaptics Silicon Labs MACOM Semtech 24% 13% 14% 19% 20% 24% 26% 28% 29% MaxLinear ON Semi Cirrus Logic Silicon Labs Allegro Semtech Synaptics MACOM Power Integrations Top Tier Financial Model Most Recent Quarter Non - GAAP Gross Profit Margin (1) Most Recent Quarter Non - GAAP Operating Income Margin (1) Source: Company Filings and Capital IQ (1) MxL figures are based on the Company’s reported public filings and do not include any pro forma adjustments to account for the acquisition of Intel’s Home Gateway Platform Division which closed on August 3, 2020 . Peer Average: 53% Peer Average: 22%

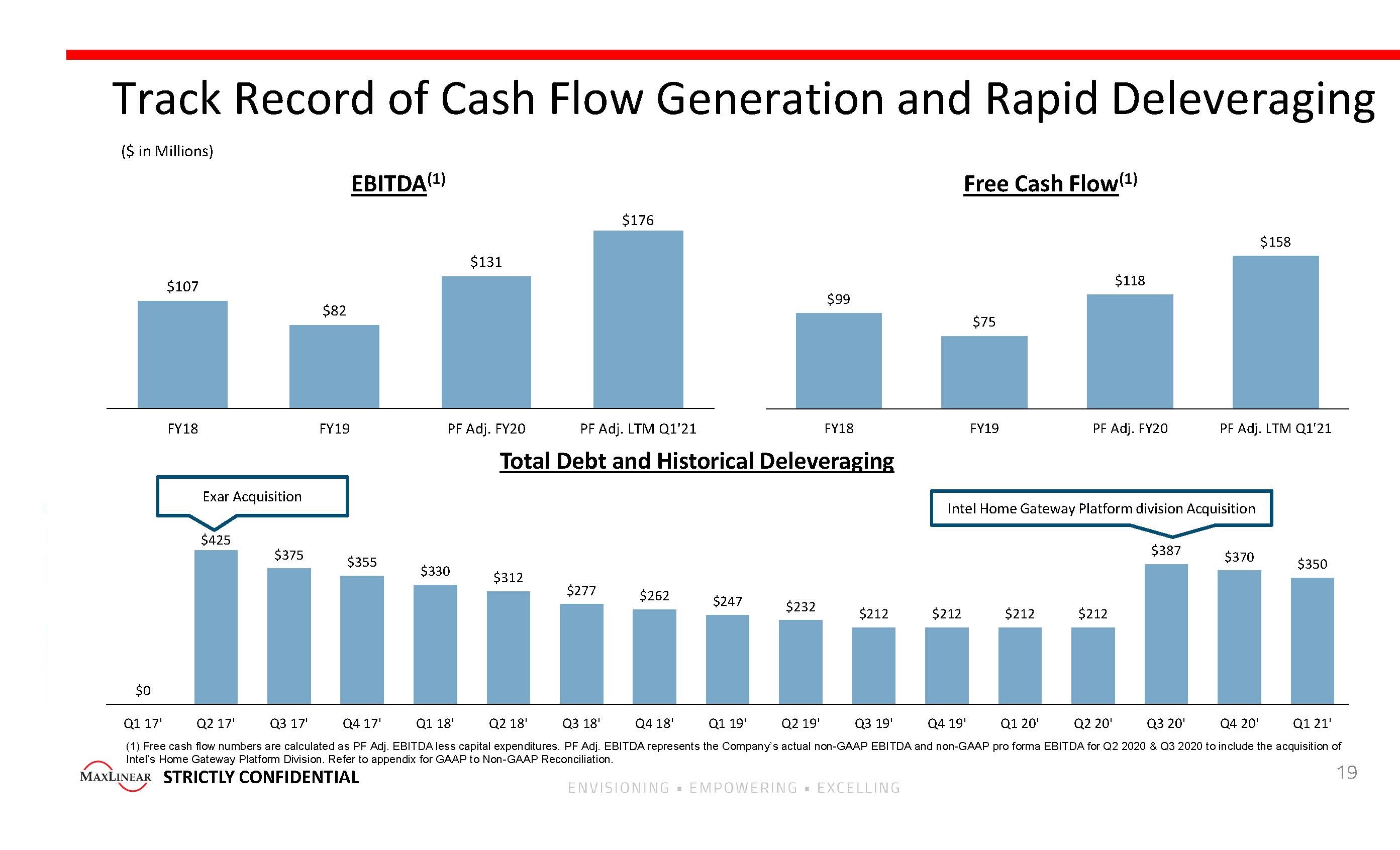

STRICTLY CONFIDENTIAL 19 Track Record of Cash Flow Generation and Rapid Deleveraging $0 $425 $375 $355 $330 $312 $277 $262 $247 $232 $212 $212 $212 $212 $387 $370 $350 Q1 17' Q2 17' Q3 17' Q4 17' Q1 18' Q2 18' Q3 18' Q4 18' Q1 19' Q2 19' Q3 19' Q4 19' Q1 20' Q2 20' Q3 20' Q4 20' Q1 21' Exar Acquisition Intel Home Gateway Platform division Acquisition ($ in Millions) Total Debt and Historical Deleveraging Free Cash Flow (1) EBITDA (1) $107 $82 $131 $176 FY18 FY19 FY20 PF Adj. LTM Q1'21 (1) Free cash flow numbers are calculated as PF Adj. EBITDA less capital expenditures. PF Adj. EBITDA represents the Company’ s a ctual non - GAAP EBITDA and non - GAAP pro forma EBITDA for Q2 2020 & Q3 2020 to include the acquisition of Intel’s Home Gateway Platform Division. Refer to appendix for GAAP to Non - GAAP Reconciliation. $99 $75 $118 $158 FY18 FY19 FY20 PF Adj. LTM Q1'21

STRICTLY CONFIDENTIAL End - Market Overview

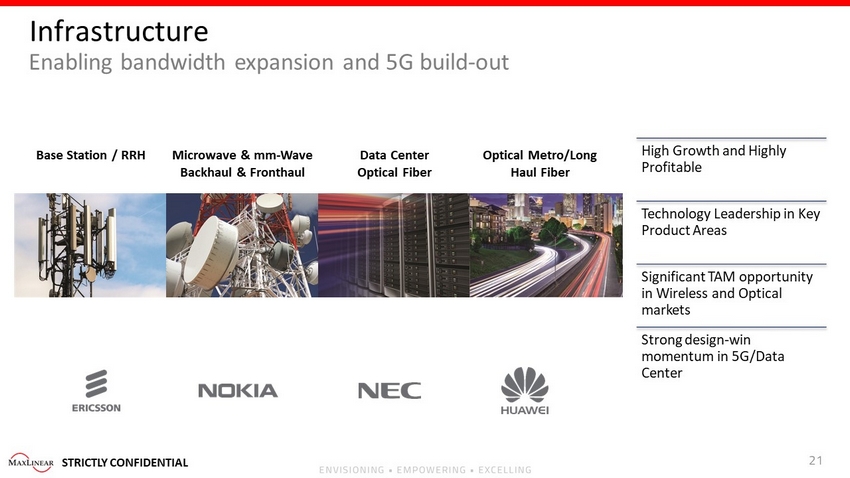

STRICTLY CONFIDENTIAL 21 Infrastructure Enabling bandwidth expansion and 5G build - out Base Station / RRH Microwave & mm - Wave Backhaul & Fronthaul Data Center Optical Fiber Optical Metro/Long Haul Fiber High Growth and Highly Profitable Technology Leadership in Key Product Areas Significant TAM opportunity in Wireless and Optical markets Strong design - win momentum in 5G/Data Center

STRICTLY CONFIDENTIAL 22 Broadband Portfolio enables bandwidth expansion into and throughout the home Broadband Gateways Cable RF Front - Ends Satellite Video Gateways & ODUs Market leader in Cable with growth expansion opportunities across Copper, Fiber, and FWA Well positioned to benefit from increasing home bandwidth needs driven by video conferencing, streaming, and gaming Broad portfolio provides end - to - end solutions

STRICTLY CONFIDENTIAL 23 Connectivity Solutions that deliver up to 10Gbps throughout the home Wi - Fi G.hn and MoCA Ethernet Connectivity offering drives substantial increase in content per platform Market share gain opportunity fueled by end - to - end solution across broadband and connectivity Well positioned in large growing wifi market capitalizing on WiFi6 refresh cycle with leading product offering

STRICTLY CONFIDENTIAL 24 Industrial & Multi - Market Broad portfolio across power, analog, and interface Point - of Sale Audio/Video Equipment Building/Factory Automation Single - Board - Computer Industrial Process Control

STRICTLY CONFIDENTIAL Financial Summary

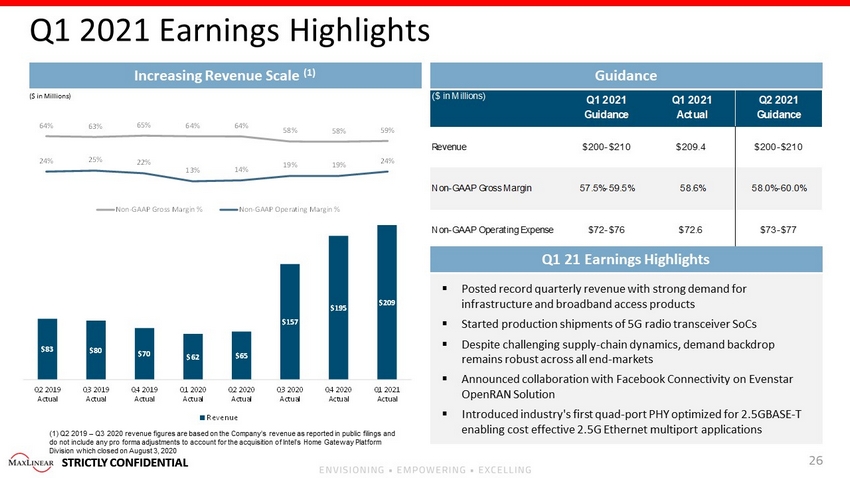

STRICTLY CONFIDENTIAL STRICTLY CONFIDENTIAL 26 Q1 2021 Earnings Highlights Increasing Revenue Scale (1) Guidance ($ in Millions) Q1 2021 Guidance Q1 2021 Actual Q2 2021 Guidance Revenue $200-$210 $209.4 $200-$210 Non-GAAP Gross Margin 57.5%-59.5% 58.6% 58.0%-60.0% Non-GAAP Operating Expense $72-$76 $72.6 $73-$77 ▪ Posted record quarterly revenue with strong demand for infrastructure and broadband access products ▪ Started production shipments of 5G radio transceiver SoCs ▪ Despite challenging supply - chain dynamics, demand backdrop remains robust across all end - markets ▪ Announced collaboration with Facebook Connectivity on Evenstar OpenRAN Solution ▪ Introduced industry's first quad - port PHY optimized for 2.5GBASE - T enabling cost effective 2.5G Ethernet multiport applications $83 $80 $70 $62 $65 $157 $195 $209 Q2 2019 Actual Q3 2019 Actual Q4 2019 Actual Q1 2020 Actual Q2 2020 Actual Q3 2020 Actual Q4 2020 Actual Q1 2021 Actual Revenue ($ in Millions) (1) Q2 2019 – Q3 2020 revenue figures are based on the Company’s revenue as reported in public filings and do not include any pro forma adjustments to account for the acquisition of Intel’s Home Gateway Platform Division which closed on August 3, 2020 64% 63% 65% 64% 64% 58% 58% 59% 24% 25% 22% 13% 14% 19% 19% 24% Non-GAAP Gross Margin % Non-GAAP Operating Margin % Q1 21 Earnings Highlights

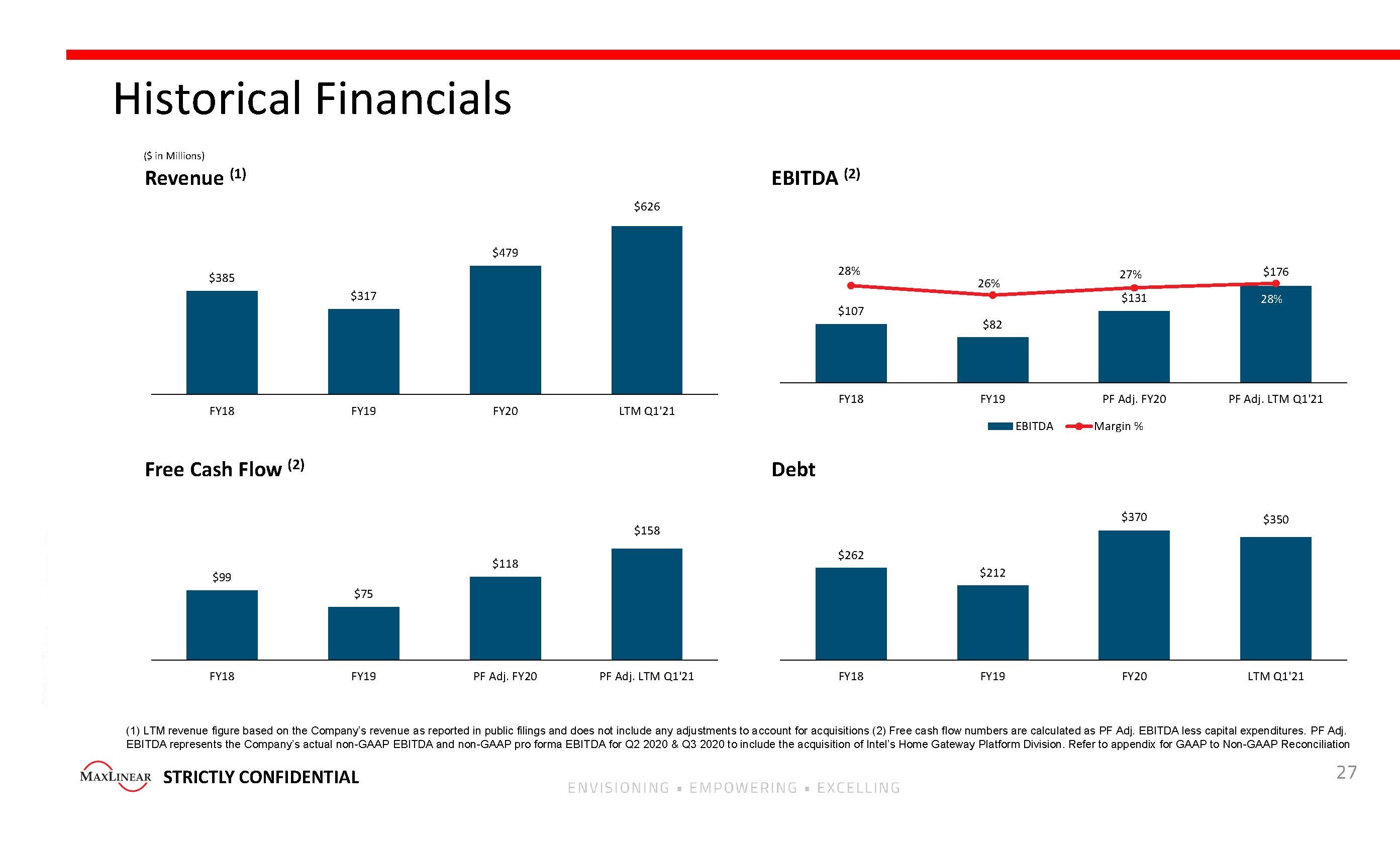

STRICTLY CONFIDENTIAL 27 $99 $75 $118 $158 FY2018A FY2019A FY2020A PF Adj. LTM Q1'21 Historical Financials Revenue (1) ($ in Millions) Free Cash Flow (2) Debt $385 $317 $479 $626 FY2018A FY2019A FY2020A LTM 3/31/2021 $262 $212 $370 $350 FY2018A FY2019A FY2020A LTM 3/31/2021 (1) LTM revenue figure based on the Company’s revenue as reported in public filings and does not include any adjustments to a cco unt for acquisitions (2) Free cash flow numbers are calculated as PF Adj. EBITDA less capital expenditures. PF Adj. EBITDA represents the Company’s actual non - GAAP EBITDA and non - GAAP pro forma EBITDA for Q2 2020 & Q3 2020 to include the acquis ition of Intel’s Home Gateway Platform Division. Refer to appendix for GAAP to Non - GAAP Reconciliation EBITDA (2) $107 $82 $131 $176 28% 26% 27% 28% FY2018A FY2019A FY2020A PF Adj. LTM Q1'21 EBITDA Margin %

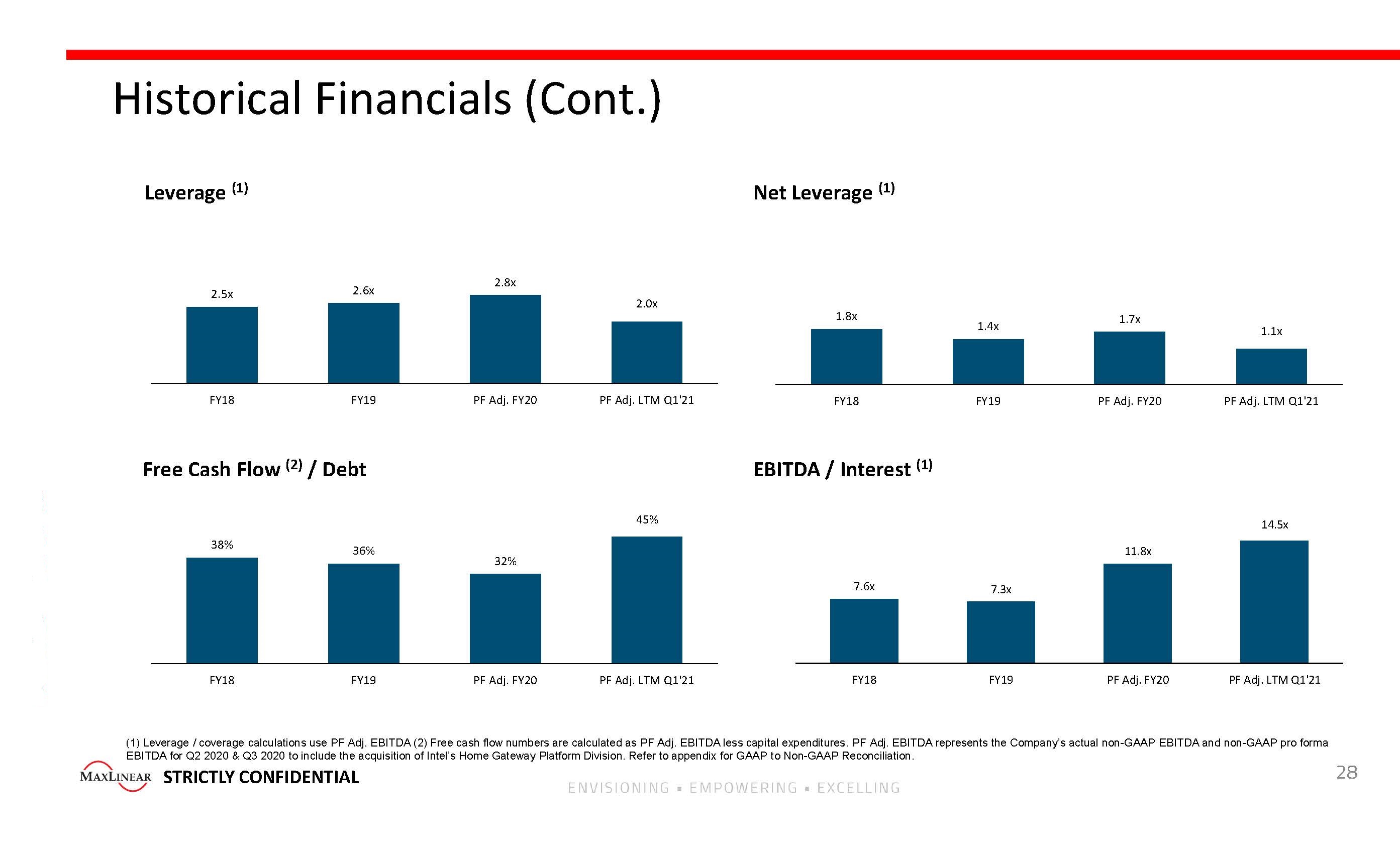

STRICTLY CONFIDENTIAL 28 Historical Financials (Cont.) Leverage (1) Net Leverage (1) Free Cash Flow (2) / Debt 2.5x 2.6x 2.8x 2.0x FY2018A FY2019A FY2020A LTM 3/31/2021 1.8x 1.4x 2.2x 1.1x FY2018A FY2019A FY2020A LTM 3/31/2021 38% 36% 23% 45% FY2018A FY2019A FY2020A LTM 3/31/2021 (1) Leverage / coverage calculations use PF Adj. EBITDA (2) Free cash flow numbers are calculated as PF Adj. EBITDA less capi tal expenditures. PF Adj. EBITDA represents the Company’s actual non - GAAP EBITDA and non - GAAP pro forma EBITDA for Q2 2020 & Q3 2020 to include the acquisition of Intel’s Home Gateway Platform Division. Refer to appendix for GAAP to Non - GAAP Reconciliation. EBITDA / Interest (1) 7.6x 7.3x 11.8x 14.5x FY2018A FY2019A FY2020A LTM 3/31/2021

STRICTLY CONFIDENTIAL 29 Key Credit Highlights LEADING TECHNOLOGY POSITION IN LARGE AND GROWING MARKETS ($8B+ S AM) Substantial IP Portfolio driving growth across Broadband, Connectivity, Infrastructure, and Industrial Markets 1 SCALABLE OPERATING MODEL DRIVING EXPANDING MARGINS AND CASH FLOW Best - in - class financial model with history of strong operational execution 3 STRONG TRACK RECORD OF M&A EXECUTION AND INTEGRATION Experienced management team with a track record of driving results 4 PRUDENT FINANCIAL MANAGEMENT Disciplined and conservative financial policy with a strong history of de - levering 5 LEVERED TO A BROAD AND DIVERSIFIED SET OF CUSTOMERS AND END - MARK ET OPPORTUNITIES Expanding into high value end - markets across a range of products and applications 2

STRICTLY CONFIDENTIAL Appendix

STRICTLY CONFIDENTIAL 31 Conservative Leverage Profile with Ample Liquidity ▪ Modest and conservative leverage profile with gross leverage of 2.0x and net leverage of 1.1x ▪ Staggered debt maturities with 5+ year runway ▪ Ample liquidity to drive operations and investments ▪ Fabless model enhances free cash flow generation ▪ Opportunistic share repurchases Capital Structure Perspectives ($ in Millions) Note Leverage calculations use PF Adj. LTM EBITDA represents the Company’s actual non - GAAP EBITDA for Q4 2020 & Q1 2021 and non - GAAP pro forma EBITDA for Q2 2020 & Q3 2020 to include the acquisition of Intel’s Home Gateway Platform Division. Refer to appendix for GAAP to Non - GAAP Reconciliation. $142 $100 $350 Liquidity 2021 2022 2023 2024 2025 2026 2027 2028 New Term Loan B PF Cash and Cash Equivalents New Revolver

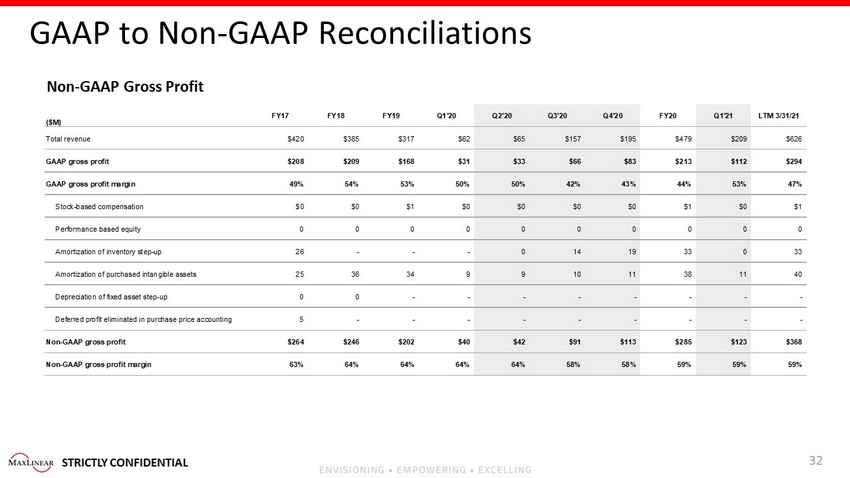

STRICTLY CONFIDENTIAL 32 GAAP to Non - GAAP Reconciliations Non - GAAP Gross Profit ($M) FY17 FY18 FY19 Q1'20 Q2'20 Q3'20 Q4'20 FY20 Q1'21 LTM 3/31/21 Total revenue $420 $385 $317 $62 $65 $157 $195 $479 $209 $626 GAAP gross profit $208 $209 $168 $31 $33 $66 $83 $213 $112 $294 GAAP gross profit margin 49% 54% 53% 50% 50% 42% 43% 44% 53% 47% Stock-based compensation $0 $0 $1 $0 $0 $0 $0 $1 $0 $1 Performance based equity 0 0 0 0 0 0 0 0 0 0 Amortization of inventory step-up 26 - - - 0 14 19 33 0 33 Amortization of purchased intangible assets 25 36 34 9 9 10 11 38 11 40 Depreciation of fixed asset step-up 0 0 - - - - - - - - Deferred profit eliminated in purchase price accounting 5 - - - - - - - - - Non-GAAP gross profit $264 $246 $202 $40 $42 $91 $113 $285 $123 $368 Non-GAAP gross profit margin 63% 64% 64% 64% 64% 58% 58% 59% 59% 59%

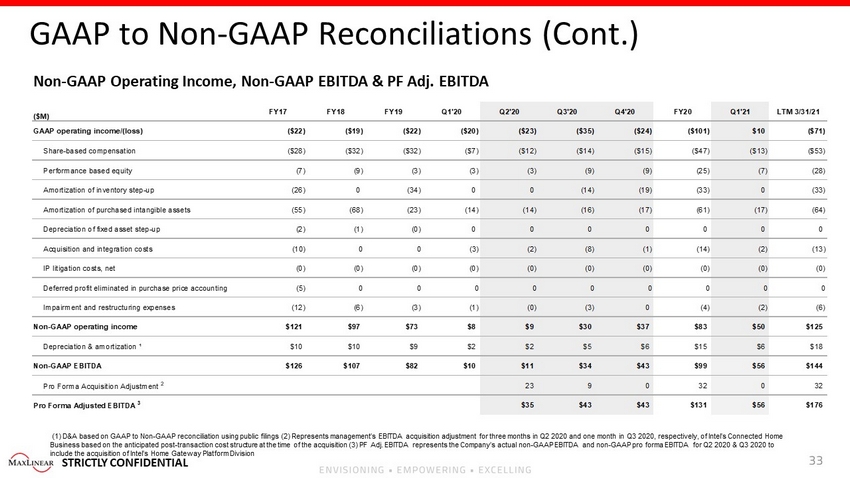

STRICTLY CONFIDENTIAL 33 GAAP to Non - GAAP Reconciliations (Cont.) Non - GAAP Operating Income, Non - GAAP EBITDA & PF Adj. EBITDA ($M) FY17 FY18 FY19 Q1'20 Q2'20 Q3'20 Q4'20 FY20 Q1'21 LTM 3/31/21 GAAP operating income/(loss) ($22) ($19) ($22) ($20) ($23) ($35) ($24) ($101) $10 ($71) Share-based compensation ($28) ($32) ($32) ($7) ($12) ($14) ($15) ($47) ($13) ($53) Performance based equity (7) (9) (3) (3) (3) (9) (9) (25) (7) (28) Amortization of inventory step-up (26) 0 (34) 0 0 (14) (19) (33) 0 (33) Amortization of purchased intangible assets (55) (68) (23) (14) (14) (16) (17) (61) (17) (64) Depreciation of fixed asset step-up (2) (1) (0) 0 0 0 0 0 0 0 Acquisition and integration costs (10) 0 0 (3) (2) (8) (1) (14) (2) (13) IP litigation costs, net (0) (0) (0) (0) (0) (0) (0) (0) (0) (0) Deferred profit eliminated in purchase price accounting (5) 0 0 0 0 0 0 0 0 0 Impairment and restructuring expenses (12) (6) (3) (1) (0) (3) 0 (4) (2) (6) Non-GAAP operating income $121 $97 $73 $8 $9 $30 $37 $83 $50 $125 Depreciation & amortization ¹ $10 $10 $9 $2 $2 $5 $6 $15 $6 $18 Non-GAAP EBITDA $126 $107 $82 $10 $11 $34 $43 $99 $56 $144 Pro Forma Acquisition Adjustment 2 23 9 0 32 0 32 Pro Forma Adjusted EBITDA 3 $35 $43 $43 $131 $56 $176 (1) D&A based on GAAP to Non - GAAP reconciliation using public filings (2) Represents management’s EBITDA acquisition adjustment for three months in Q2 2020 and one month in Q3 2020, respectively, of Intel’s Connected Home Business based on the anticipated post - transaction cost structure at the time of the acquisition (3) PF Adj. EBITDA represents t he Company’s actual non - GAAP EBITDA and non - GAAP pro forma EBITDA for Q2 2020 & Q3 2020 to include the acquisition of Intel’s Home Gateway Platform Division

STRICTLY CONFIDENTIAL Thank You