| MaxLinear Q2’22 Earnings July 2022 |

| Cautionary Note Concerning Forward-Looking Statements This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Unless otherwise indicated, all forward looking statements are based on estimates, projections, and assumptions of MaxLinear as of the date of this presentation. These forward-looking statements include, among others, statements concerning: run rate for future Wi-Fi revenue, anticipated closing date of proposed acquisition of Silicon Motion and expected financial performance for the third quarter of 2022. These forward-looking statements involve known and unknown risks, uncertainties, and other factors that may cause actual results to be materially different from any future results expressed or implied by the forward-looking statements. Forward-looking statements are based on management’s current, preliminary expectations and are subject to various risks and uncertainties. In particular, our future operating results are substantially dependent on our assumptions about market trends and conditions. Additional risks and uncertainties affecting our business, future operating results and financial condition include, without limitation, risks relating to our proposed merger with Silicon Motion; intense competition in our industry; increasing supply chain risks within our industry, including increases in shipping and material costs and substantial shipping delays resulting in extended lead-times; inflation trends in our supply chain and in the global economy generally; uncertainties concerning the outcome of global trade negotiations, export control limitations, and heightened geopolitical risks generally; our dependence on a limited number of customers for a substantial portion of our revenues; potential decreases in average selling prices for our products; our ability to develop and introduce new and enhanced products on a timely basis and achieve market acceptance of those products, particularly as we seek to expand outside of our historic markets; potential uncertainties arising from continued consolidation among cable television and satellite operators in our target markets and continued consolidation among competitors within the semiconductor industry generally; uncertainties concerning how end user markets for our products will develop, including in particular markets we have entered more recently such as broadband, Wi-Fi and 5G wireless and fiber-optic data center high-speed interconnect infrastructure markets but also existing markets; the impact of our indebtedness and limitations on our operating flexibility based on financial and operating covenants in the applicable term loan agreements, including (without limitation) debt covenant restrictions that may limit our ability to obtain additional financing, granting liens, undergoing certain fundamental changes, or making investments or certain restricted payments, and selling assets; risks relating to intellectual property protection and the prevalence of intellectual property litigation in our industry; our reliance on a limited number of third party manufacturers; the impact of the COVID-19 pandemic; and our lack of long-term supply contracts and dependence on limited sources of supply. In addition to these risks and uncertainties, investors should review the risks and uncertainties contained in our filings with the Securities and Exchange Commission (SEC), including our Annual Report on Form 10-K for the year ended December 31, 2021 filed with the SEC on February 2, 2022, and our Current Reports on Form 8-K, as well as the information to be set forth under the caption “Risk Factors” in MaxLinear’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2022. All forward- looking statements are based on the estimates, projections and assumptions of management as of July 27, 2022, and MaxLinear is under no obligation (and expressly disclaims any such obligation) to update or revise any forward-looking statements whether as a result of new information, future events, or otherwise. Additional Information and Where to Find It This communication makes reference to a proposed business combination involving MaxLinear and Silicon Motion. In connection with the proposed transaction, MaxLinear has filed with the Securities and Exchange Commission (the “SEC”) a Registration Statement on Form S-4 (File No. 333-265645), including a proxy statement of Silicon Motion and a prospectus of MaxLinear. The Registration Statement on Form S-4 was declared effective by the SEC on July 13, 2022 and the proxy statement/prospectus was first mailed to the shareholders of Silicon Motion on July 20, 2022, seeking their approval of their transaction-related proposals. This communication does not constitute an offer to sell or the solicitation of an offer to buy or subscribe for any securities or a solicitation of any vote or approval nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. MAXLINEAR AND SILICON MOTION URGE INVESTORS AND SECURITY HOLDERS TO READ THE REGISTRATION STATEMENT ON FORM S-4, WHICH WILL BE PROVIDED TO SILICON MOTION SECURITY HOLDERS AND OTHER DOCUMENTS PROVIDED TO SILICON MOTION SECURITY HOLDERS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders are able to obtain the Registration Statement on Form S-4 free of charge at the SEC’s website, www.sec.gov. Copies of documents filed with the SEC by MaxLinear (when they become available) may be obtained free of charge on MaxLinear’s website at www.maxlinear.com or by contacting MaxLinear’s Investor Relations Department at IR@MaxLinear.com. Copies of documents filed or furnished by Silicon Motion (when they become available) may be obtained free of charge on Silicon Motion’s website at https://www.siliconmotion.com or by contacting Silicon Motion’s Stock Affair Specialist 2 |

| Disclaimer Non-GAAP Financial Measures This communication may contain certain non-GAAP financial measures, which MaxLinear management believes are useful to investors and reflect how management measures MaxLinear’s business. Further detail and reconciliations between the non-GAAP financial measures and the GAAP financial measures are available in the Appendix to this presentation and on the Investor Relations section of MaxLinear’s website as part of its published financial results press release. Because of the inherent uncertainty associated with our ability to project future charges, particularly those related to stock-based compensation and its related tax effects as well as potential impairments, we do not provide reconciliations to forward-looking non-GAAP financial information. 3 |

| Q2’22 Financial Highlights .. Revenue of $280.0 million, an increase of 36% YoY and 6% QoQ .. GAAP and Non-GAAP gross margin was 58.7% and 62.3% .. GAAP and Non-GAAP operating margin was 13.9% and 32.2% .. GAAP and Non-GAAP earnings per share was $0.40 and $1.11 .. Cash generated from operations was $123.4 million |

| Q2’22 Business Highlights .. Company-specific growth drivers enabled us to outperform the market in the second quarter. .. Continued strong growth in fiber broadband access and 5G wireless infrastructure end- markets. .. On a run rate to more than double Wi-Fi revenue in 2022, with a path to exceed $200M in 2023. .. Second quarter infrastructure revenue grew 22% year-over-year, driven by strong performance in HPA products and continued growth in 5G wireless backhaul .. New product innovations announced in the quarter included: › A single-chip solution to enable network OEMs and operators to deliver the ultra-high-capacity payloads associated with 5G applications on existing frequency spectrum resources › A high-efficiency power amplifier solution that addresses size, weight, and power consumption challenges for massive MIMO radios .. Announced execution of definitive agreement to acquire Silicon Motion, a global leader in NAND flash controllers for solid state storage devices |

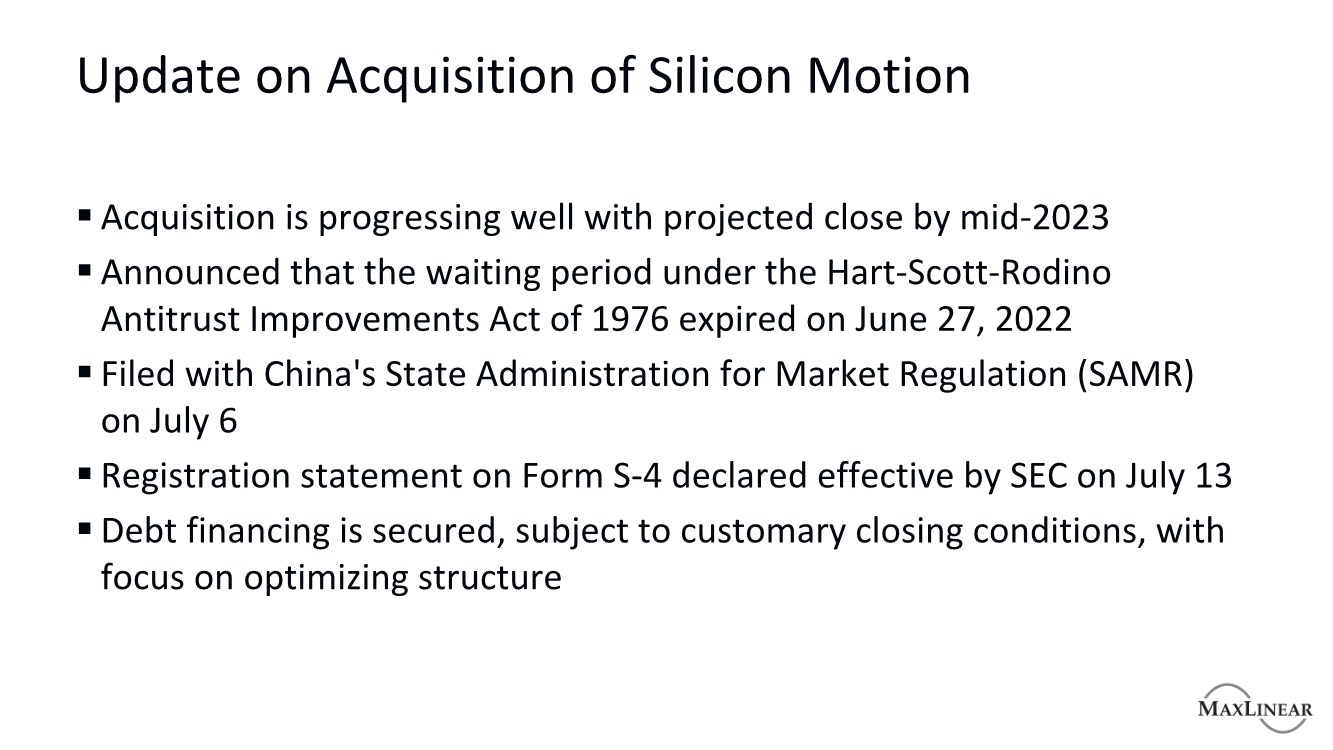

| Update on Acquisition of Silicon Motion .. Acquisition is progressing well with projected close by mid-2023 .. Announced that the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 expired on June 27, 2022 .. Filed with China's State Administration for Market Regulation (SAMR) on July 6 .. Registration statement on Form S-4 declared effective by SEC on July 13 .. Debt financing is secured, subject to customary closing conditions, with focus on optimizing structure |

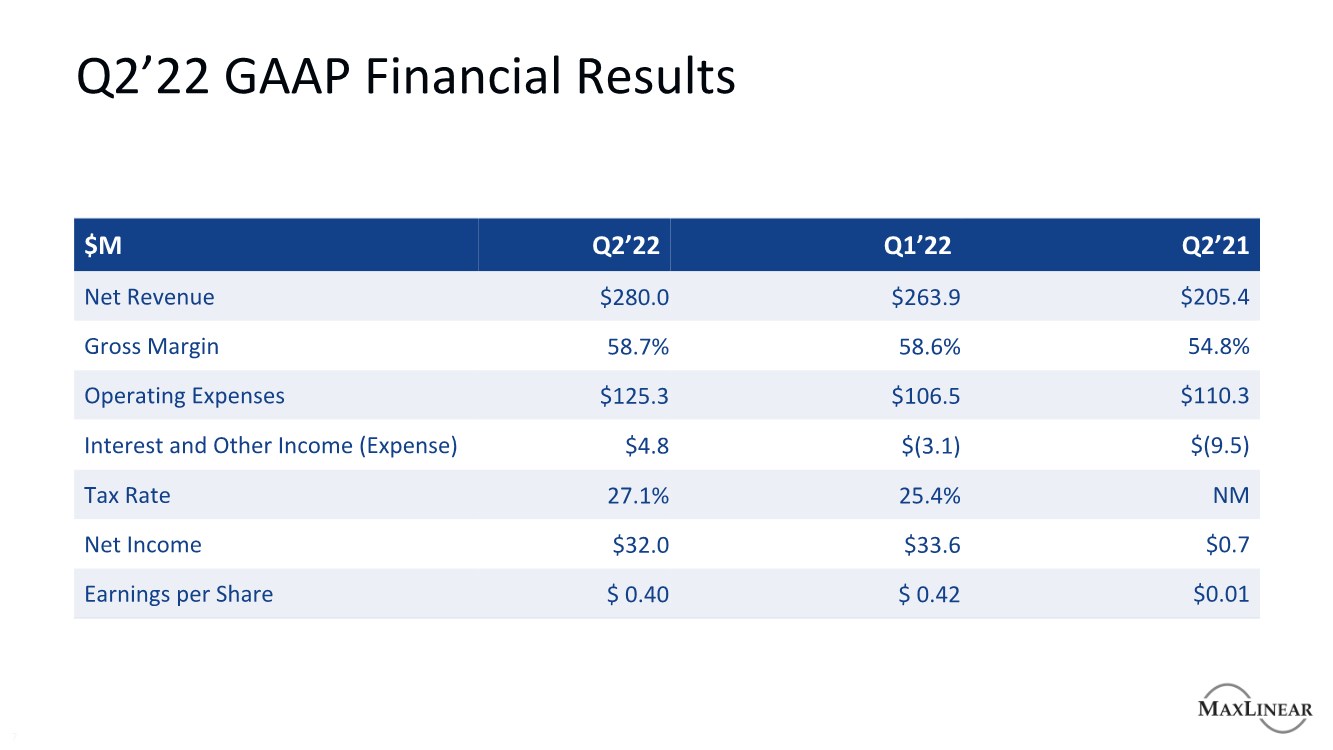

| Q2’22 GAAP Financial Results 7 $M Q2’22 Q1’22 Q2’21 Net Revenue $280.0 $263.9 $205.4 Gross Margin 58.7% 58.6% 54.8% Operating Expenses $125.3 $106.5 $110.3 Interest and Other Income (Expense) $4.8 $(3.1) $(9.5) Tax Rate 27.1% 25.4% NM Net Income $32.0 $33.6 $0.7 Earnings per Share $ 0.40 $ 0.42 $0.01 |

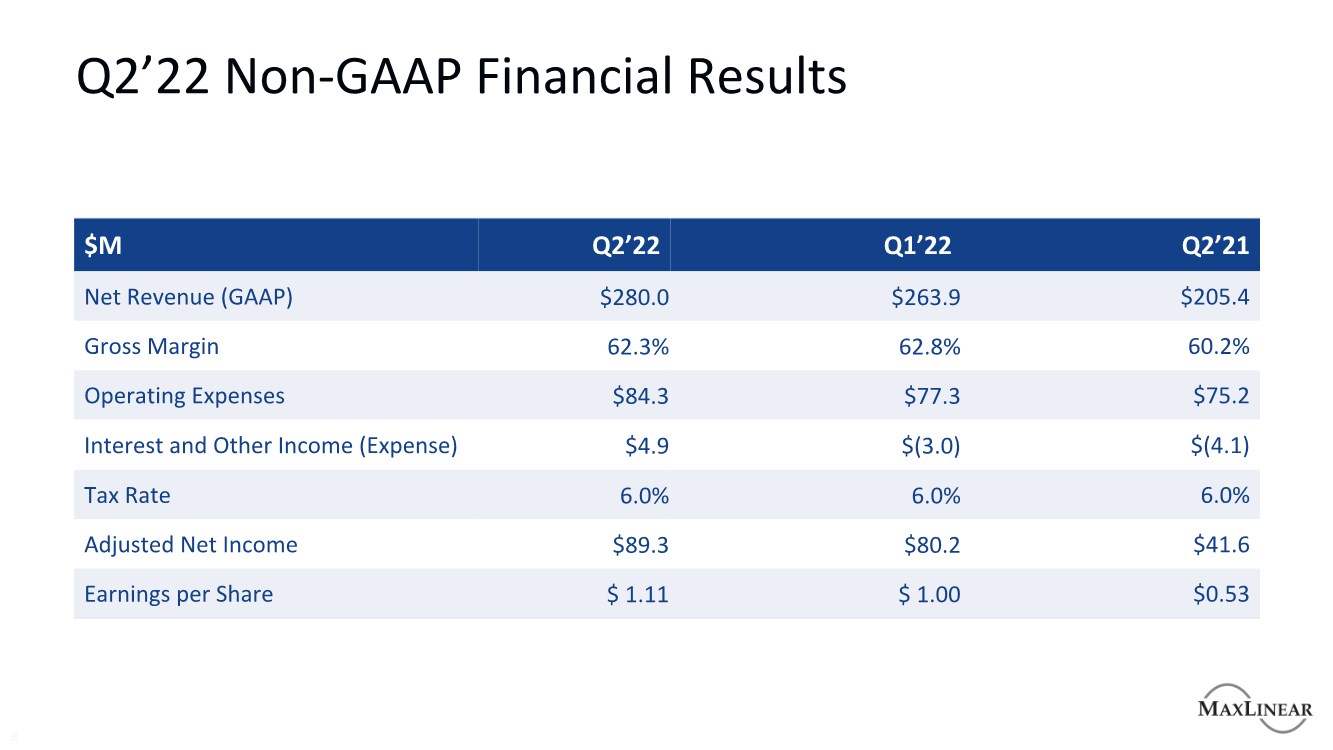

| Q2’22 Non-GAAP Financial Results 8 $M Q2’22 Q1’22 Q2’21 Net Revenue (GAAP) $280.0 $263.9 $205.4 Gross Margin 62.3% 62.8% 60.2% Operating Expenses $84.3 $77.3 $75.2 Interest and Other Income (Expense) $4.9 $(3.0) $(4.1) Tax Rate 6.0% 6.0% 6.0% Adjusted Net Income $89.3 $80.2 $41.6 Earnings per Share $ 1.11 $ 1.00 $0.53 |

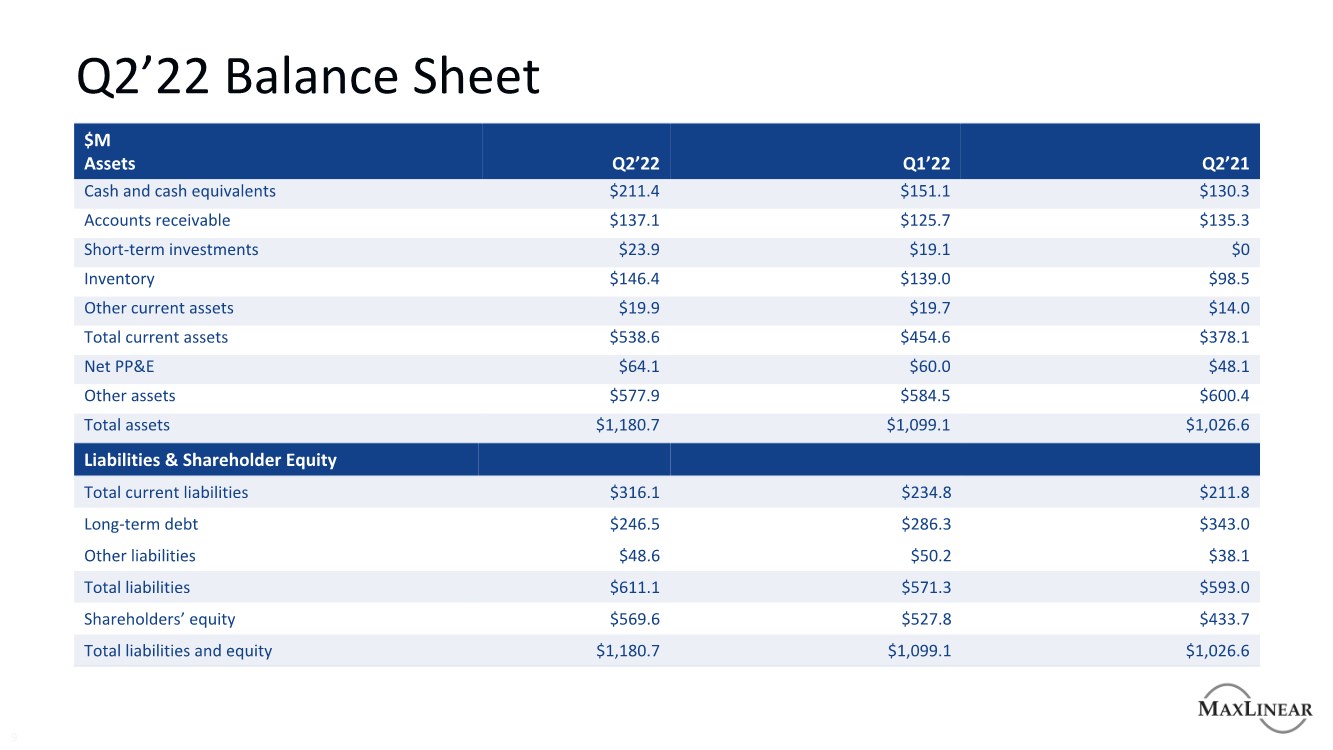

| Q2’22 Balance Sheet 9 $M Assets Q2’22 Q1’22 Q2’21 Cash and cash equivalents $211.4 $151.1 $130.3 Accounts receivable $137.1 $125.7 $135.3 Short-term investments $23.9 $19.1 $0 Inventory $146.4 $139.0 $98.5 Other current assets $19.9 $19.7 $14.0 Total current assets $538.6 $454.6 $378.1 Net PP&E $64.1 $60.0 $48.1 Other assets $577.9 $584.5 $600.4 Total assets $1,180.7 $1,099.1 $1,026.6 Liabilities & Shareholder Equity Total current liabilities $316.1 $234.8 $211.8 Long-term debt $246.5 $286.3 $343.0 Other liabilities $48.6 $50.2 $38.1 Total liabilities $611.1 $571.3 $593.0 Shareholders’ equity $569.6 $527.8 $433.7 Total liabilities and equity $1,180.7 $1,099.1 $1,026.6 |

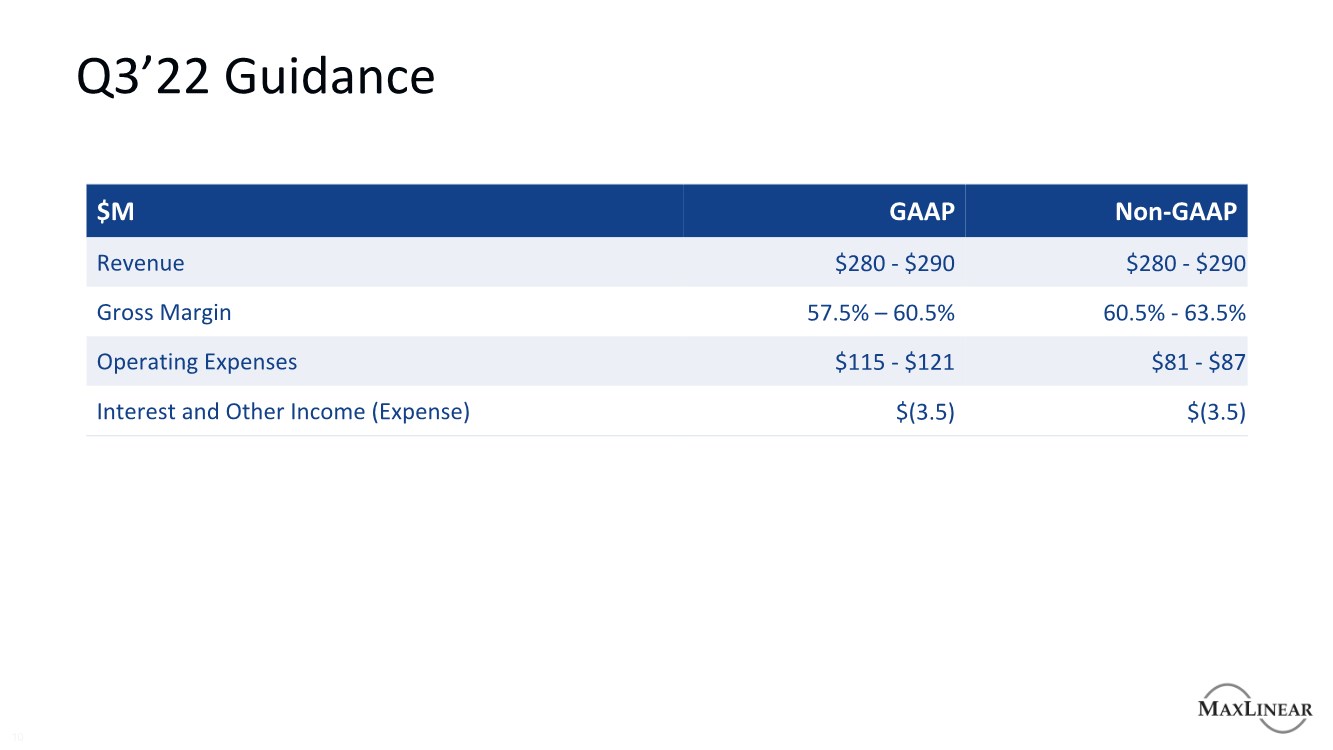

| Q3’22 Guidance 10 $M GAAP Non-GAAP Revenue $280 - $290 $280 - $290 Gross Margin 57.5% – 60.5% 60.5% - 63.5% Operating Expenses $115 - $121 $81 - $87 Interest and Other Income (Expense) $(3.5) $(3.5) |

| Appendix |

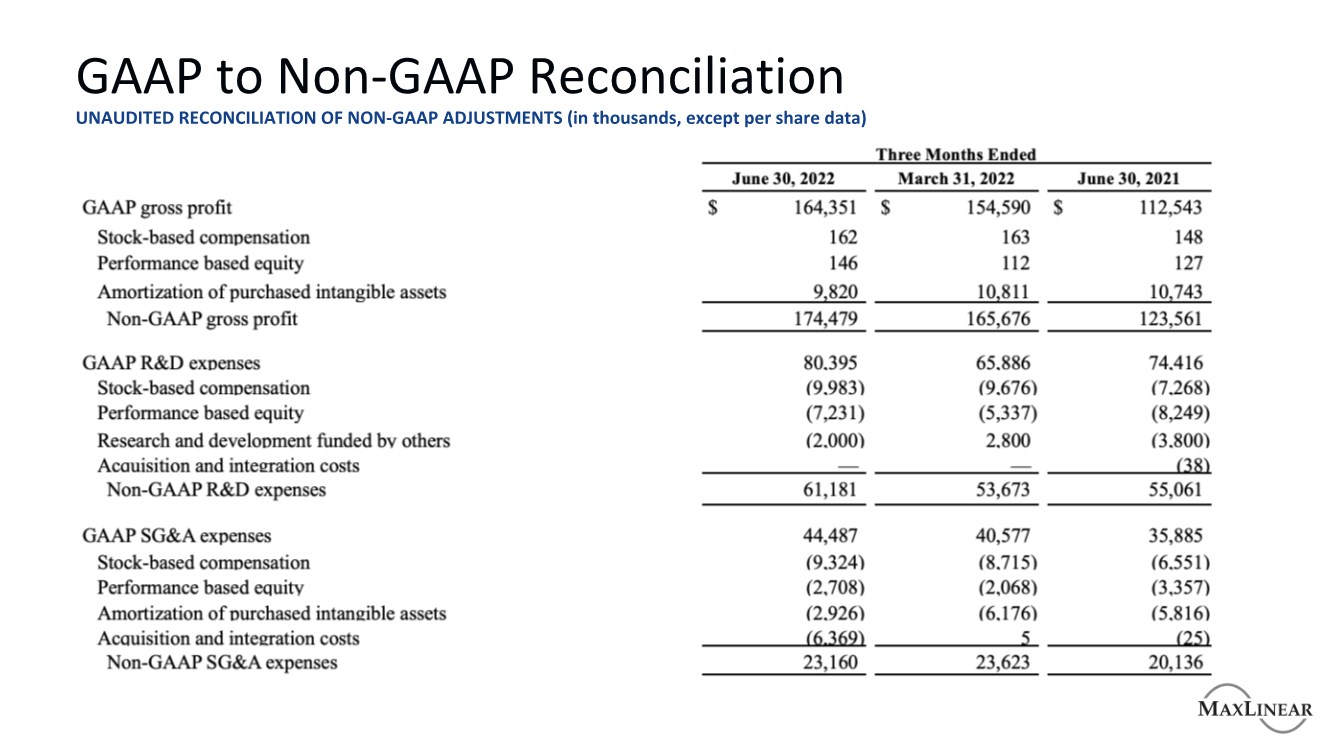

| GAAP to Non-GAAP Reconciliation UNAUDITED RECONCILIATION OF NON-GAAP ADJUSTMENTS (in thousands, except per share data) |

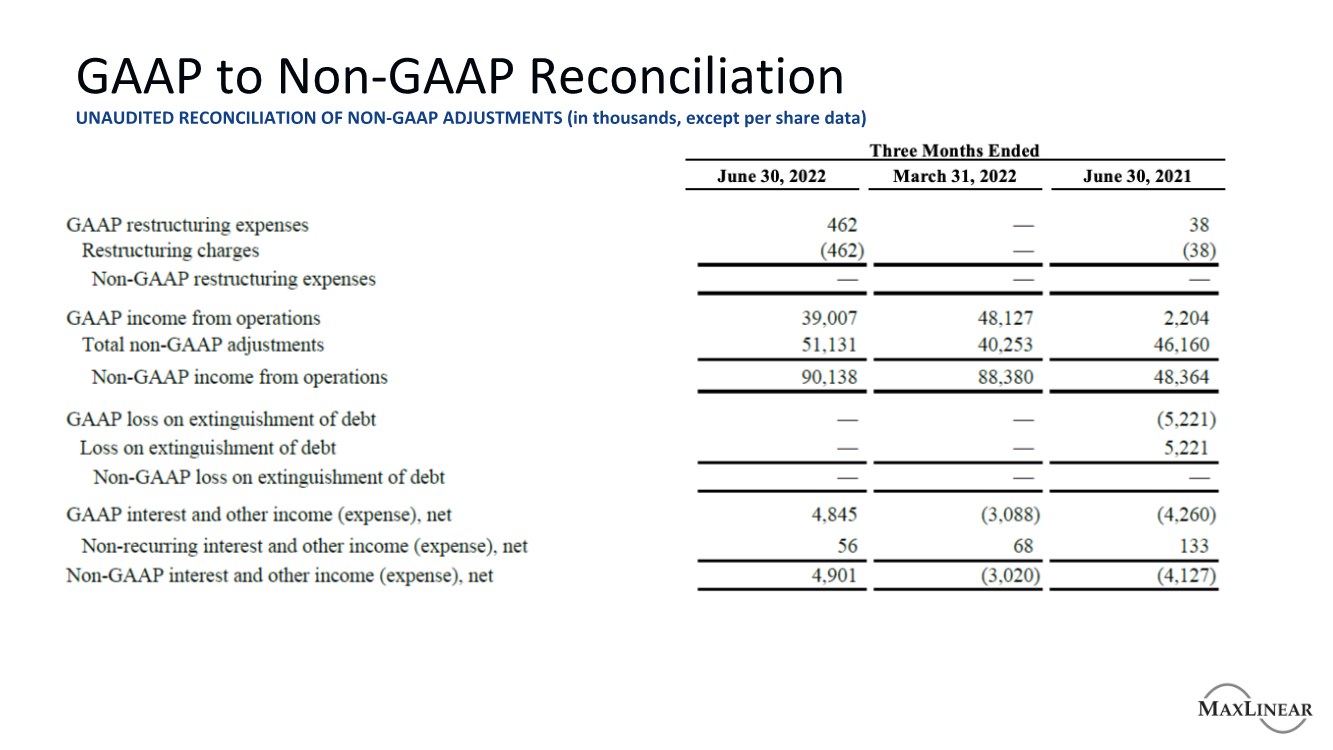

| GAAP to Non-GAAP Reconciliation UNAUDITED RECONCILIATION OF NON-GAAP ADJUSTMENTS (in thousands, except per share data) |

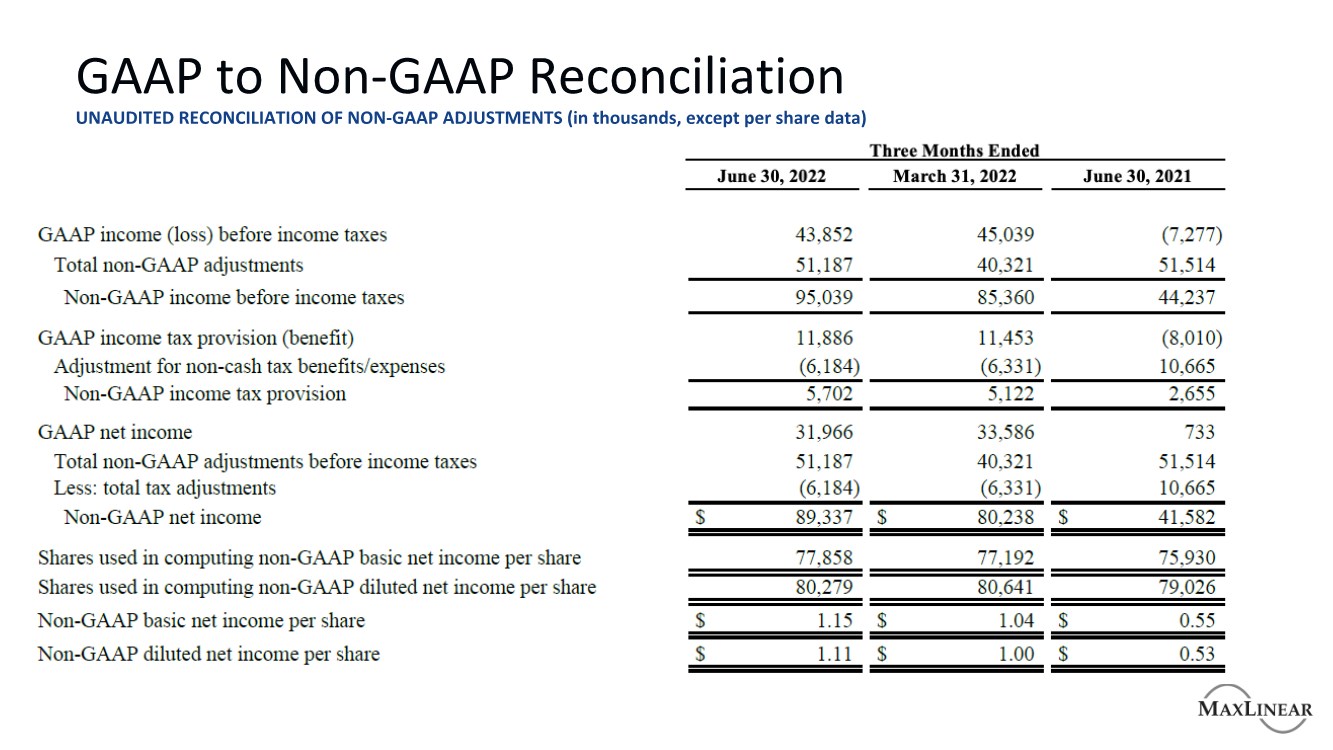

| GAAP to Non-GAAP Reconciliation UNAUDITED RECONCILIATION OF NON-GAAP ADJUSTMENTS (in thousands, except per share data) |

| Thank You |