MaxLinear to Acquire Exar March 29, 2017 Exhibit 99.1

Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including statements with respect to the anticipated timing of the proposed tender offer and merger; anticipated effects of the proposed tender offer and merger; prospects for the combined company, including (without limitation) expectations with respect to its addressable markets, opportunities within those markets, and the ability of the combined company to serve those markets; the growth strategies of MaxLinear generally and expectations with respect to the impact of the acquisition on MaxLinear’s growth strategies; expectations with respect to the products and customers of the combined company after the proposed tender offer and merger; strategic and financial synergies anticipated to be realized from the proposed tender offer and merger; and expectations for operating results of MaxLinear and Exar for their quarters ending March 31, 2017 and April 2, 2017, respectively. These statements are based on management’s current expectations and beliefs and are subject to a number of factors and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. Forward-looking statements may contain words such as “will be,” “will,” “expected,” “anticipate,” “continue,” or similar expressions and include the assumptions that underlie such statements. The following factors, among others, could cause actual results to differ materially from those described in the forward-looking statements: failure of the Exar stockholders to tender their shares in connection with the tender offer; failure to receive regulatory approvals; the challenges and costs of closing, integrating, restructuring, and achieving anticipated synergies, particularly in light of differences in the businesses and operations of the two companies; the ability to retain key employees, customers and suppliers; and other factors affecting the business, operating results, and financial condition of either MaxLinear or Exar, including those set forth in the most recent Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K reports filed by MaxLinear and Exar, as applicable, with the Securities and Exchange Commission (the “SEC”). All forward-looking statements are based on the estimates, projections, and assumptions of MaxLinear or Exar management, as applicable, as of the date hereof, and MaxLinear and Exar are under no obligation (and expressly disclaim any such obligation) to update or revise any forward-looking statements whether as a result of new information, future events, or otherwise. Additional Information and Where to Find It In connection with the proposed merger, MaxLinear and its subsidiary will commence a tender offer (the “Offer”) and file a Tender Offer Statement on Schedule TO with the SEC, and Exar will file a Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC. EXAR STOCKHOLDERS AND OTHER INVESTORS ARE URGED TO READ THE OFFER MATERIALS (INCLUDING THE OFFER TO PURCHASE, RELATED LETTER OF TRANSMITTAL, AND CERTAIN OTHER OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT, INCLUDING ALL AMENDMENTS TO THOSE MATERIALS. SUCH DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION, WHICH SHOULD BE READ CAREFULLY BEFORE ANY DECISION IS MADE WITH RESPECT TO THE TENDER OFFER. The Tender Offer Statement and the Solicitation/Recommendation Statement will be available without charge at the SEC’s website at www.sec.gov. Free copies of these materials and certain other offering documents will be sent to Exar’s stockholders by the information agent for the Offer. These documents may also be obtained for free by contacting MaxLinear Investor Relations at http://investors.maxlinear.com/, at IR@MaxLinear.com or by telephone at (760) 517-1112 or by contacting Exar Investor Relations at www.investorrelations@exar.com or by telephone at (510) 668-7201. The contents of the websites referenced above are not deemed to be incorporated by reference into the Offer documents. Non-GAAP Financial Measures This communication may contain certain non-GAAP financial measures, which MaxLinear management believes are useful to investors and others in evaluating business combinations. Further detail and reconciliations between the non-GAAP financial measures and the GAAP financial measures are available in the Appendix to this presentation. DISClaimer

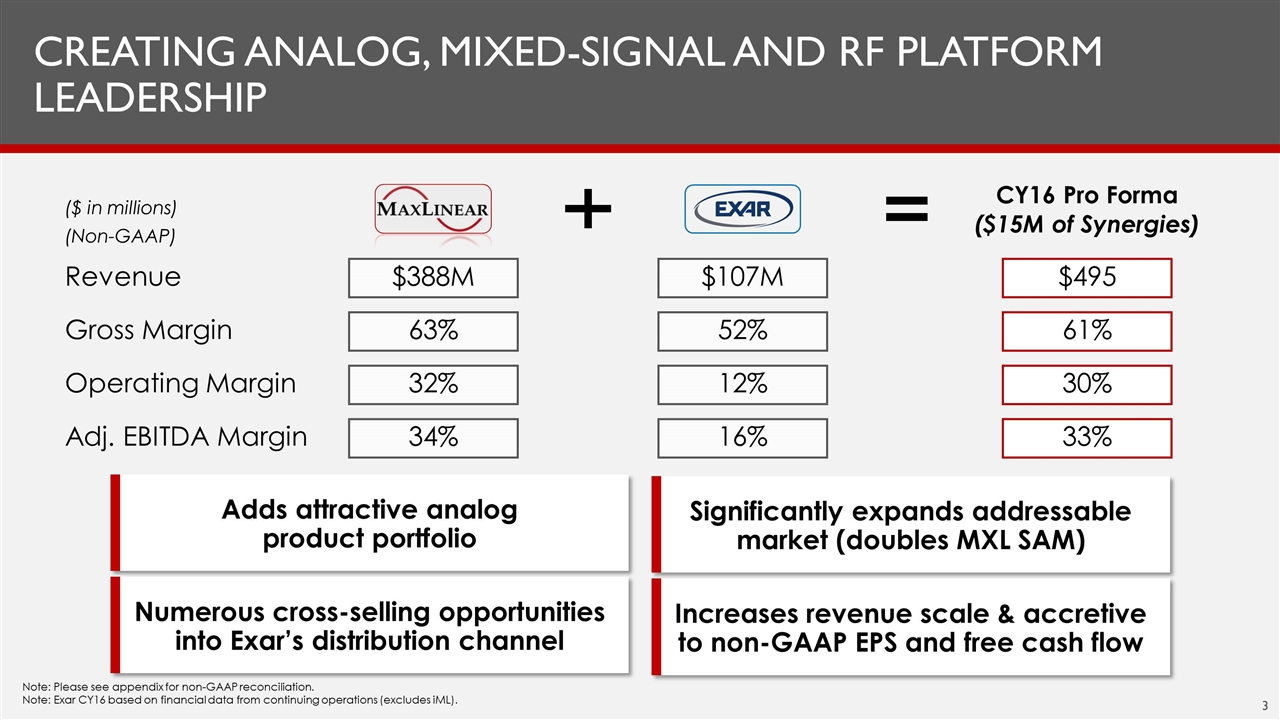

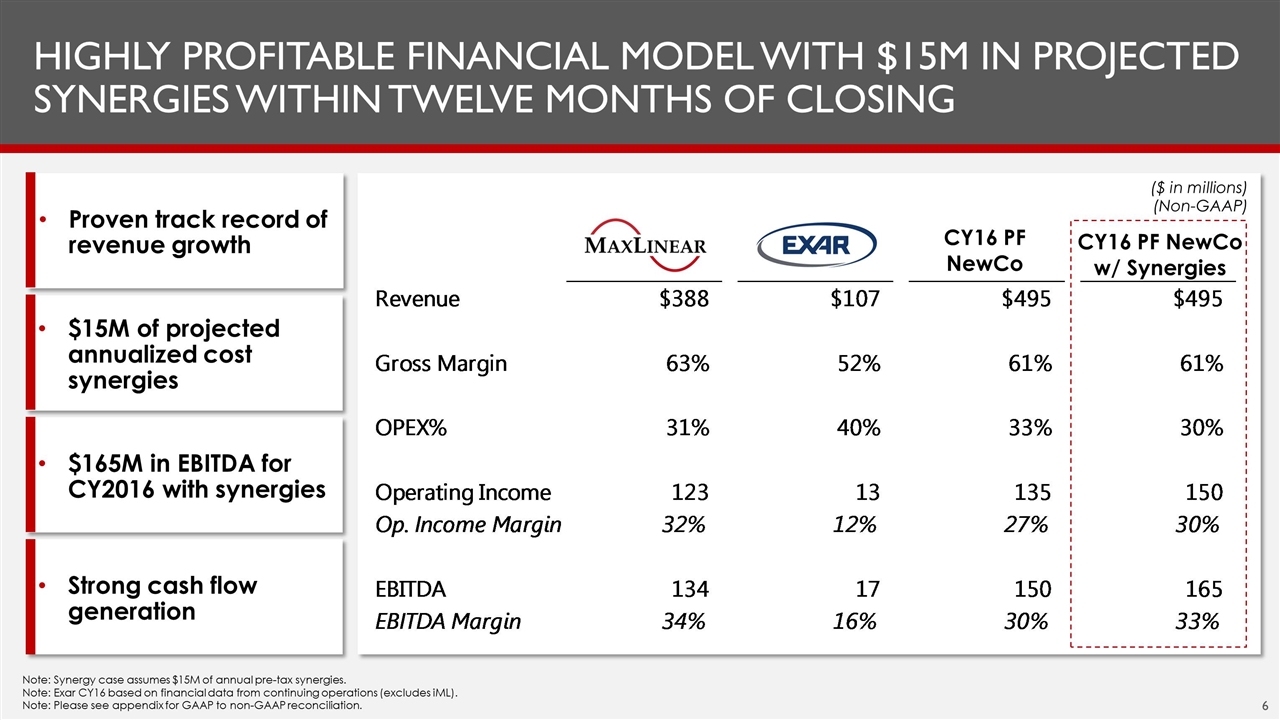

Creating analog, Mixed-Signal and RF Platform Leadership Revenue Gross Margin Operating Margin EBITDA Margin $388M $107M $495 63% 52% 61% 32% 12% 30% 34% 16% 33% Note: Please see appendix for non-GAAP reconciliation. Note: Exar CY16 based on financial data from continuing operations (excludes iML). CY16 Pro Forma ($15M of Synergies) Adds attractive analog product portfolio Significantly expands addressable market (doubles MXL SAM) Numerous cross-selling opportunities into Exar’s distribution channel Increases revenue scale & accretive to non-GAAP EPS and free cash flow Adj. EBITDA Margin (Non-GAAP) ($ in millions)

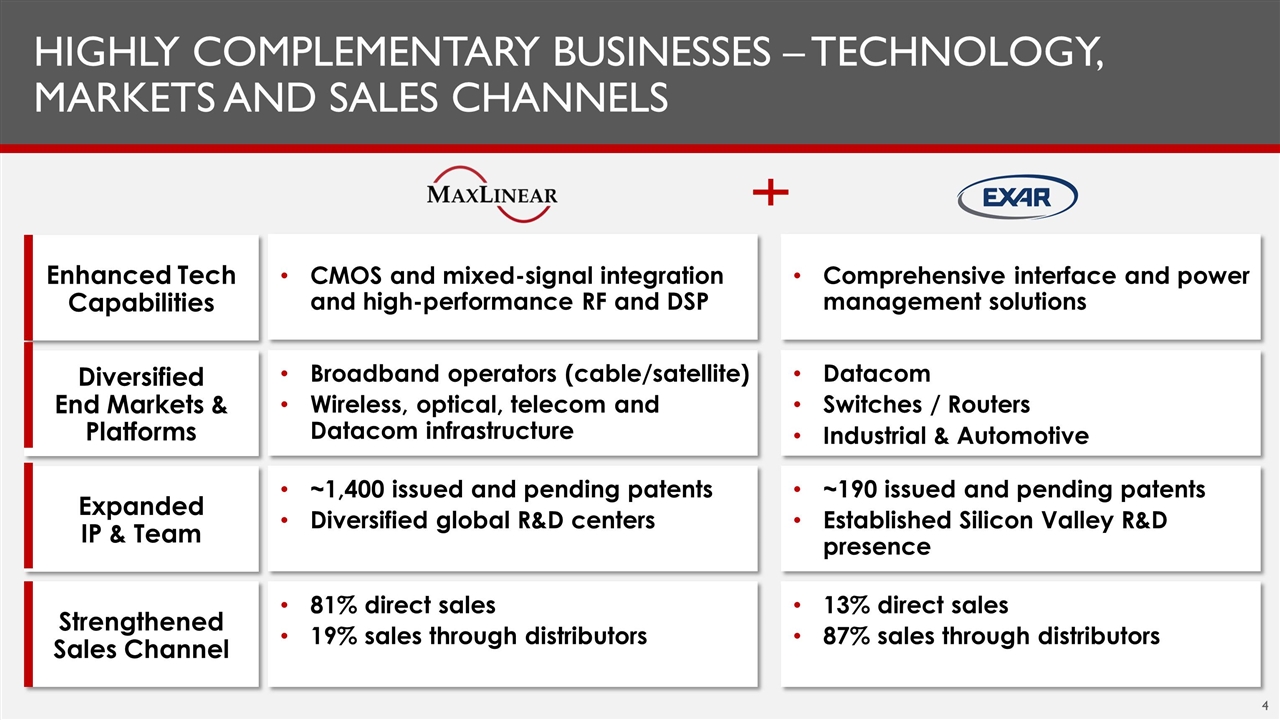

Highly Complementary Businesses – Technology, markets and sales channels Enhanced Tech Capabilities Diversified End Markets & Platforms Expanded IP & Team Strengthened Sales Channel CMOS and mixed-signal integration and high-performance RF and DSP Broadband operators (cable/satellite) Wireless, optical, telecom and Datacom infrastructure ~1,400 issued and pending patents Diversified global R&D centers 81% direct sales 19% sales through distributors Comprehensive interface and power management solutions Datacom Switches / Routers Industrial & Automotive ~190 issued and pending patents Established Silicon Valley R&D presence 13% direct sales 87% sales through distributors

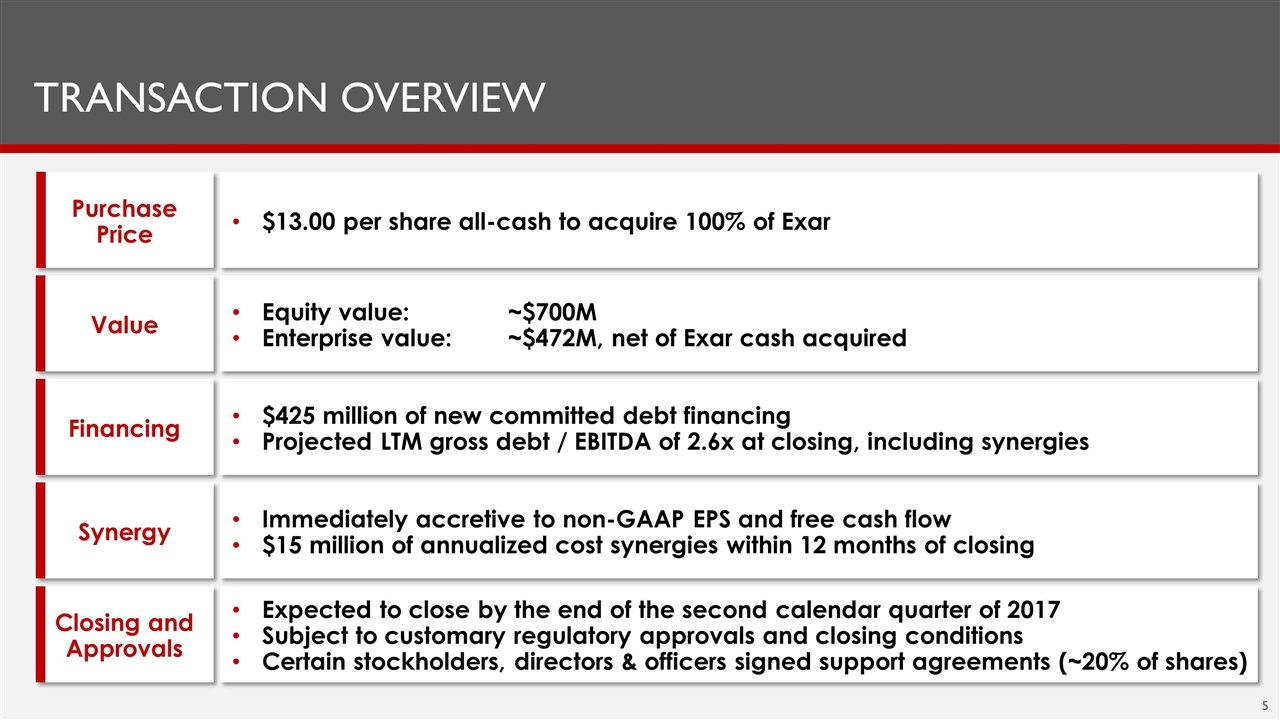

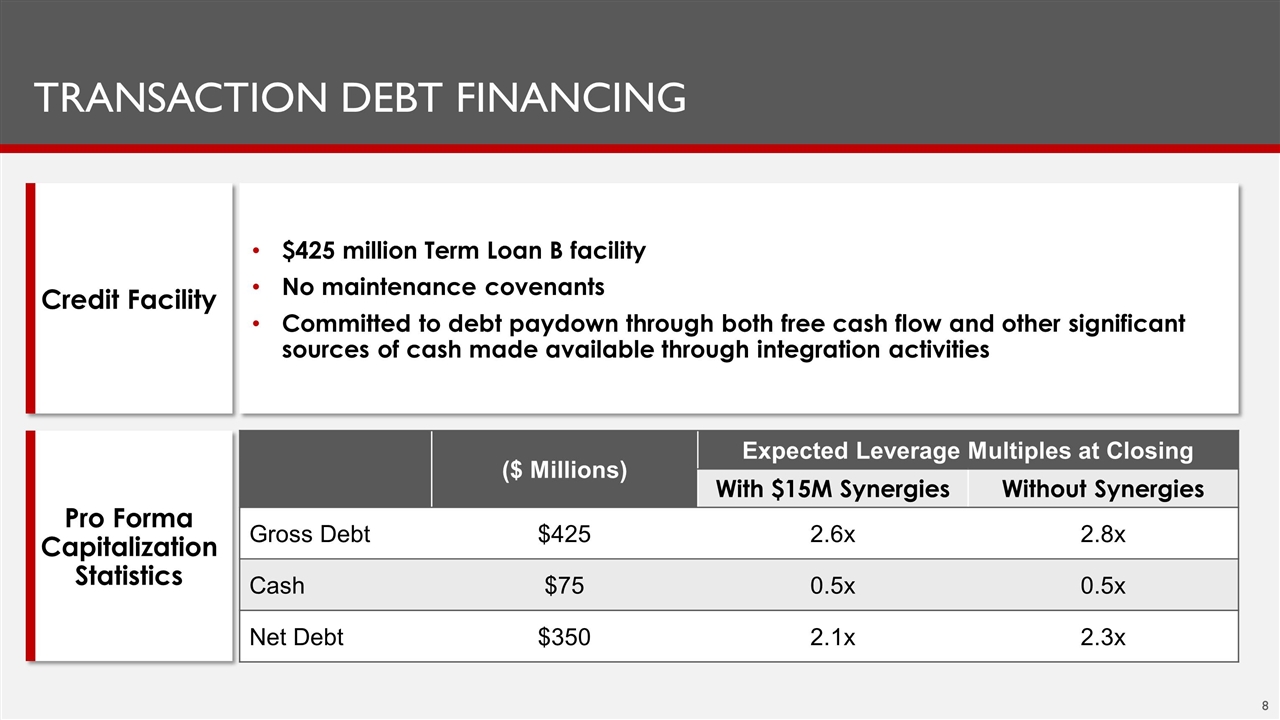

Transaction overview Purchase Price $13.00 per share all-cash to acquire 100% of Exar Value Equity value:~$700M Enterprise value:~$472M, net of Exar cash acquired Financing $425 million of new committed debt financing Projected LTM gross debt / EBITDA of 2.6x at closing, including synergies Immediately accretive to non-GAAP EPS and free cash flow $15 million of annualized cost synergies within 12 months of closing Closing and Approvals Expected to close by the end of the second calendar quarter of 2017 Subject to customary regulatory approvals and closing conditions Certain stockholders, directors & officers signed support agreements (~20% of shares) Synergy

Strong cash flow generation CY16 PF NewCo CY16 PF NewCo w/ Synergies Note: Synergy case assumes $15M of annual pre-tax synergies. Note: Exar CY16 based on financial data from continuing operations (excludes iML). Note: Please see appendix for GAAP to non-GAAP reconciliation. Highly profitable financial model with $15M in projected synergies within twelve months of closing Proven track record of revenue growth $15M of projected annualized cost synergies $165M in EBITDA for CY2016 with synergies (Non-GAAP) ($ in millions)

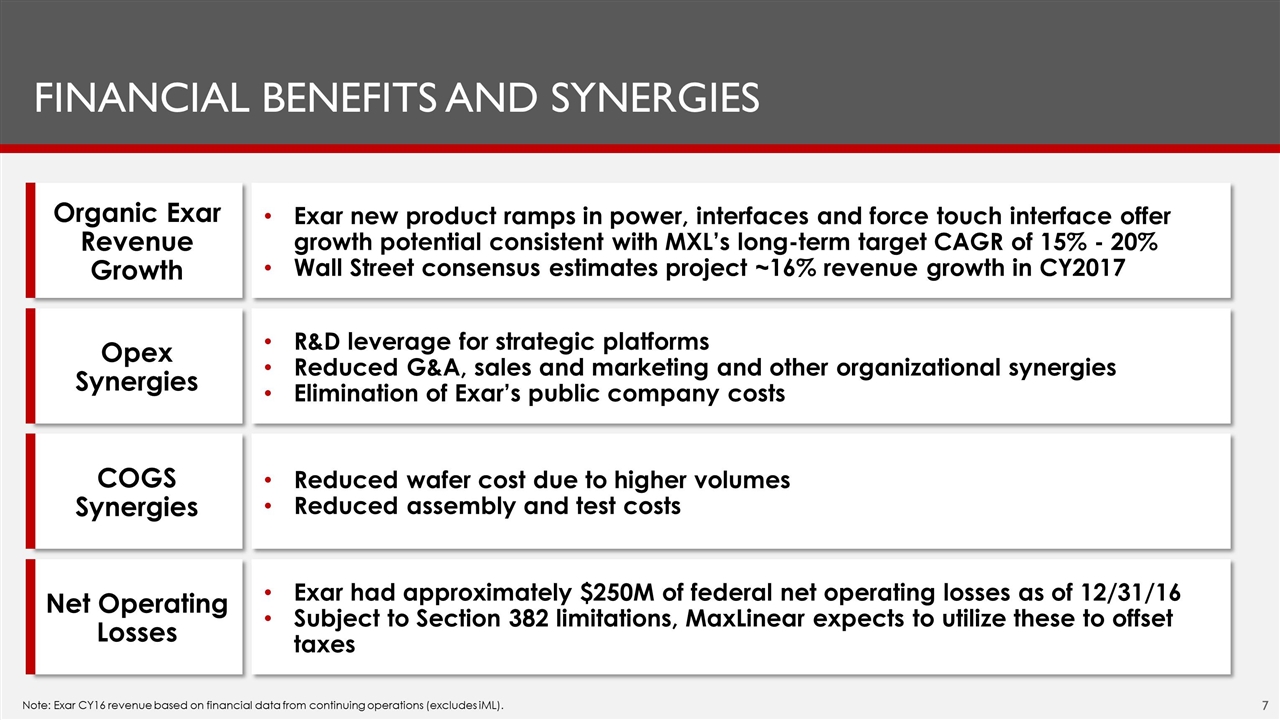

Financial benefits and synergies Opex Synergies R&D leverage for strategic platforms Reduced G&A, sales and marketing and other organizational synergies Elimination of Exar’s public company costs COGS Synergies Net Operating Losses Reduced wafer cost due to higher volumes Reduced assembly and test costs Exar had approximately $250M of federal net operating losses as of 12/31/16 Subject to Section 382 limitations, MaxLinear expects to utilize these to offset taxes Exar new product ramps in power, interfaces and force touch interface offer growth potential consistent with MXL’s long-term target CAGR of 15% - 20% Wall Street consensus estimates project ~16% revenue growth in CY2017 Organic Exar Revenue Growth Note: Exar CY16 revenue based on financial data from continuing operations (excludes iML).

($ Millions) Expected Leverage Multiples at Closing With $15M Synergies Without Synergies Gross Debt $425 2.6x 2.8x Cash $75 0.5x 0.5x Net Debt $350 2.1x 2.3x Transaction Debt financing Credit Facility Pro Forma Capitalization Statistics $425 million Term Loan B facility No maintenance covenants Committed to debt paydown through both free cash flow and other significant sources of cash made available through integration activities

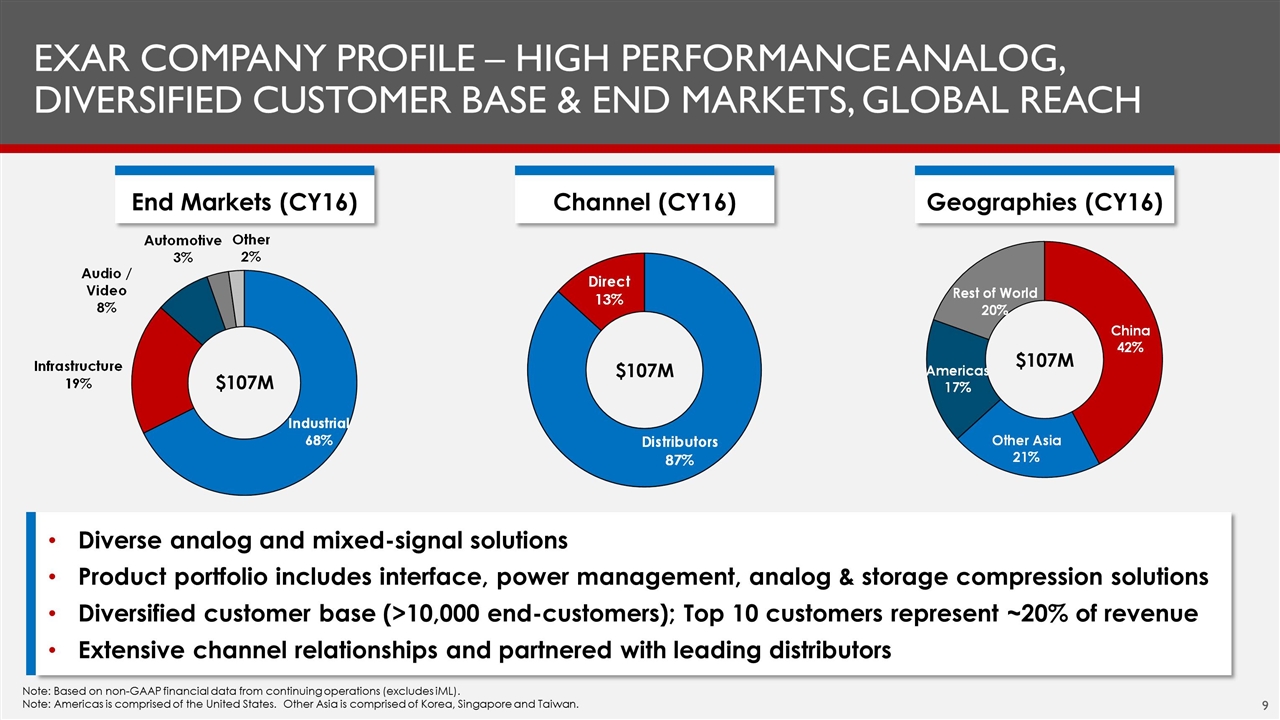

Exar Company profile – high performance analog, diversified customer base & end markets, global reach Note: Based on non-GAAP financial data from continuing operations (excludes iML). Note: Americas is comprised of the United States. Other Asia is comprised of Korea, Singapore and Taiwan. End Markets (CY16) Channel (CY16) Geographies (CY16) Diverse analog and mixed-signal solutions Product portfolio includes interface, power management, analog & storage compression solutions Diversified customer base (>10,000 end-customers); Top 10 customers represent ~20% of revenue Extensive channel relationships and partnered with leading distributors $107M $107M $107M

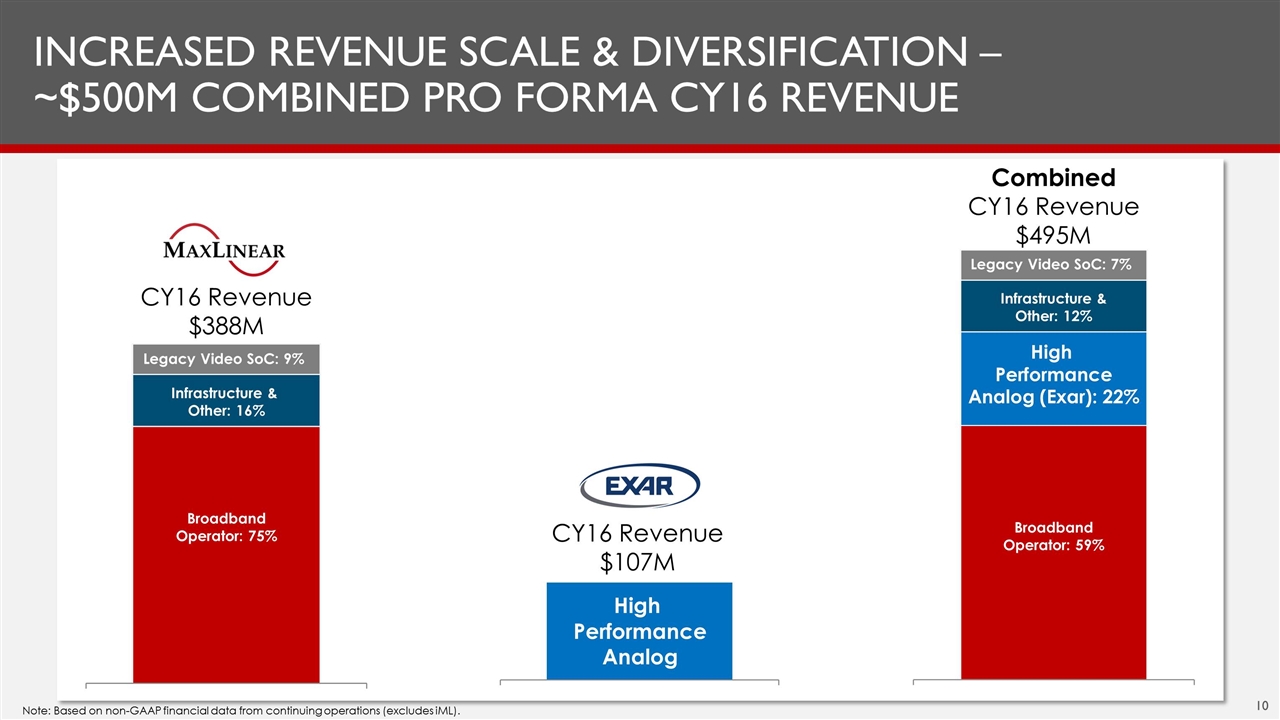

Increased REVENUE scale & Diversification – ~$500M combined pro forma cy16 revenue CY16 Revenue $107M High Performance Analog CY16 Revenue $388M Broadband Operator: 75% Infrastructure & Other: 16% Legacy Video SoC: 9% Combined CY16 Revenue $495M Broadband Operator: 59% Infrastructure & Other: 12% Legacy Video SoC: 7% High Performance Analog (Exar): 22% Note: Based on non-GAAP financial data from continuing operations (excludes iML).

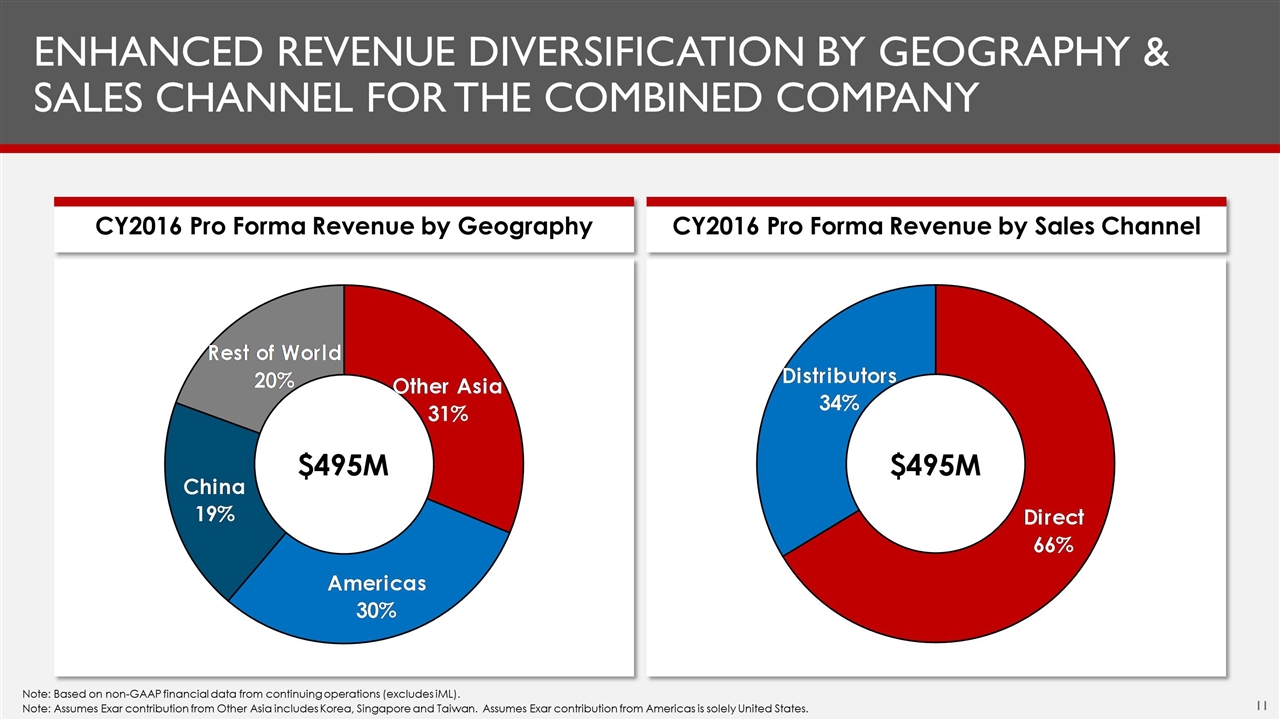

Note: Assumes Exar contribution from Other Asia includes Korea, Singapore and Taiwan. Assumes Exar contribution from Americas is solely United States. Enhanced revenue diversification by geography & sales channel for the combined company $495M $495M CY2016 Pro Forma Revenue by Geography CY2016 Pro Forma Revenue by Sales Channel Note: Based on non-GAAP financial data from continuing operations (excludes iML).

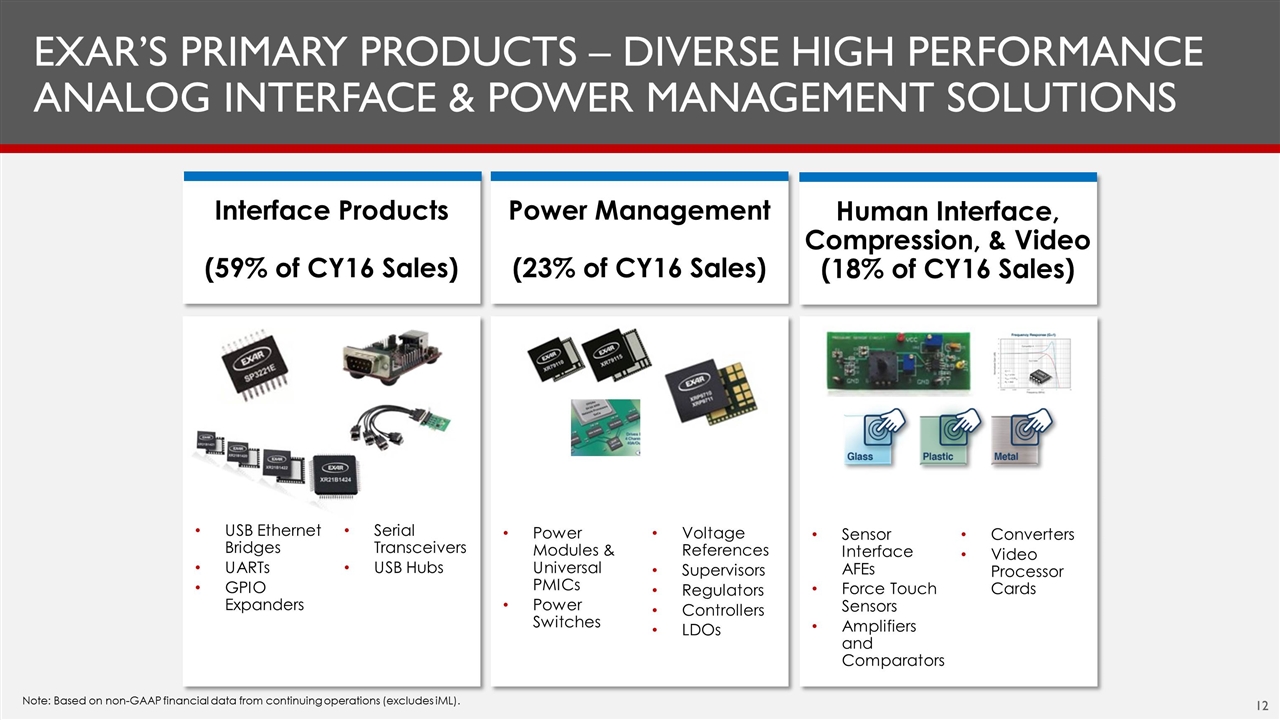

Exar’s primary products – Diverse high performance analog interface & power management solutions Interface Products (59% of CY16 Sales) Power Management (23% of CY16 Sales) Human Interface, Compression, & Video (18% of CY16 Sales) USB Ethernet Bridges UARTs GPIO Expanders Serial Transceivers USB Hubs Power Modules & Universal PMICs Power Switches Voltage References Supervisors Regulators Controllers LDOs Sensor Interface AFEs Force Touch Sensors Amplifiers and Comparators Converters Video Processor Cards Note: Based on non-GAAP financial data from continuing operations (excludes iML).

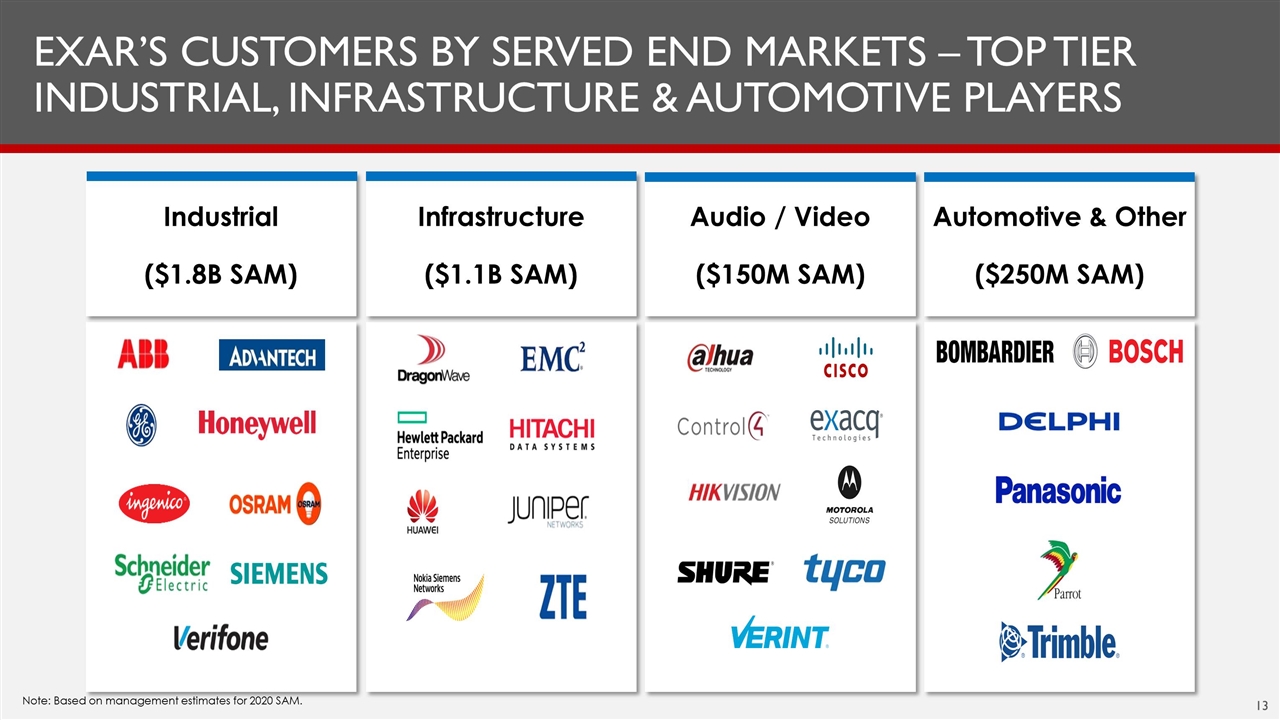

Exar’s customers by served end markets – top tier industrial, infrastructure & automotive players Industrial ($1.8B SAM) Infrastructure ($1.1B SAM) Audio / Video ($150M SAM) Automotive & Other ($250M SAM) Note: Based on management estimates for 2020 SAM.

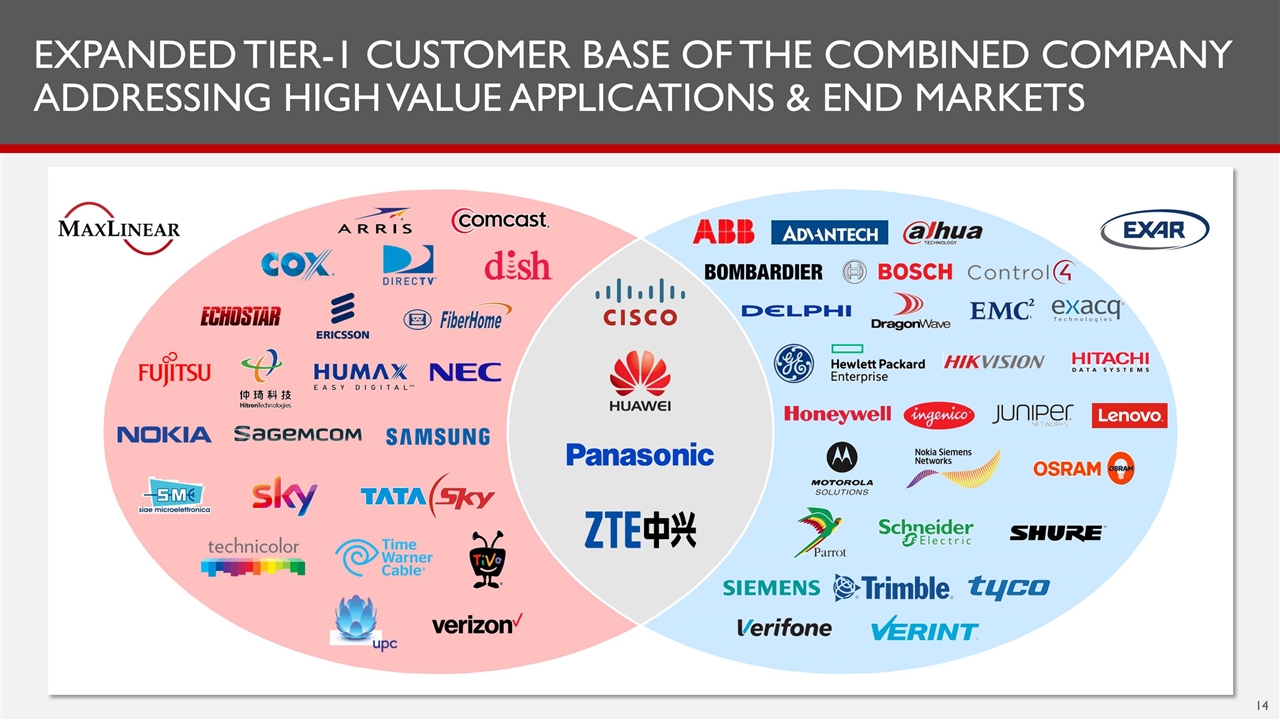

Expanded tier-1 customer base of the combined company addressing high value applications & end markets

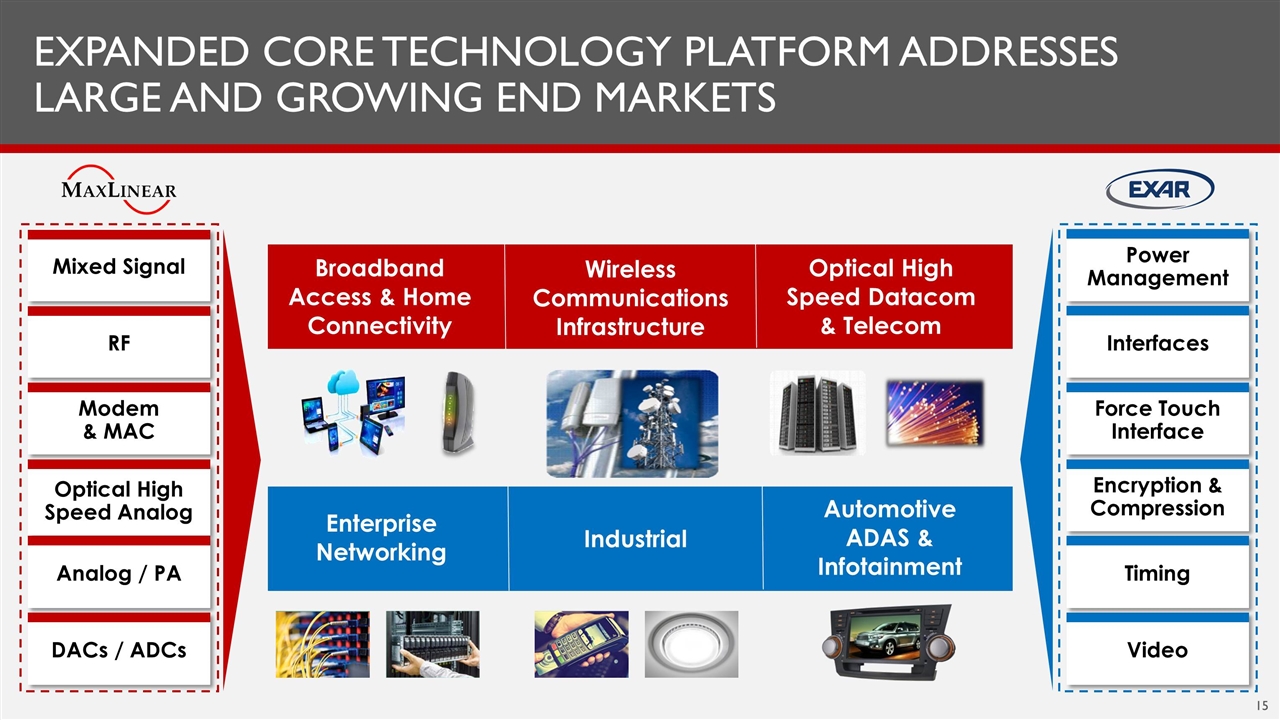

expanded core technology platform addresses large and Growing end markets RF Mixed Signal Modem & MAC Optical High Speed Analog Analog / PA DACs / ADCs Power Management Interfaces Force Touch Interface Encryption & Compression Timing Video Broadband Access & Home Connectivity Wireless Communications Infrastructure Optical High Speed Datacom & Telecom Enterprise Networking Industrial Automotive ADAS & Infotainment

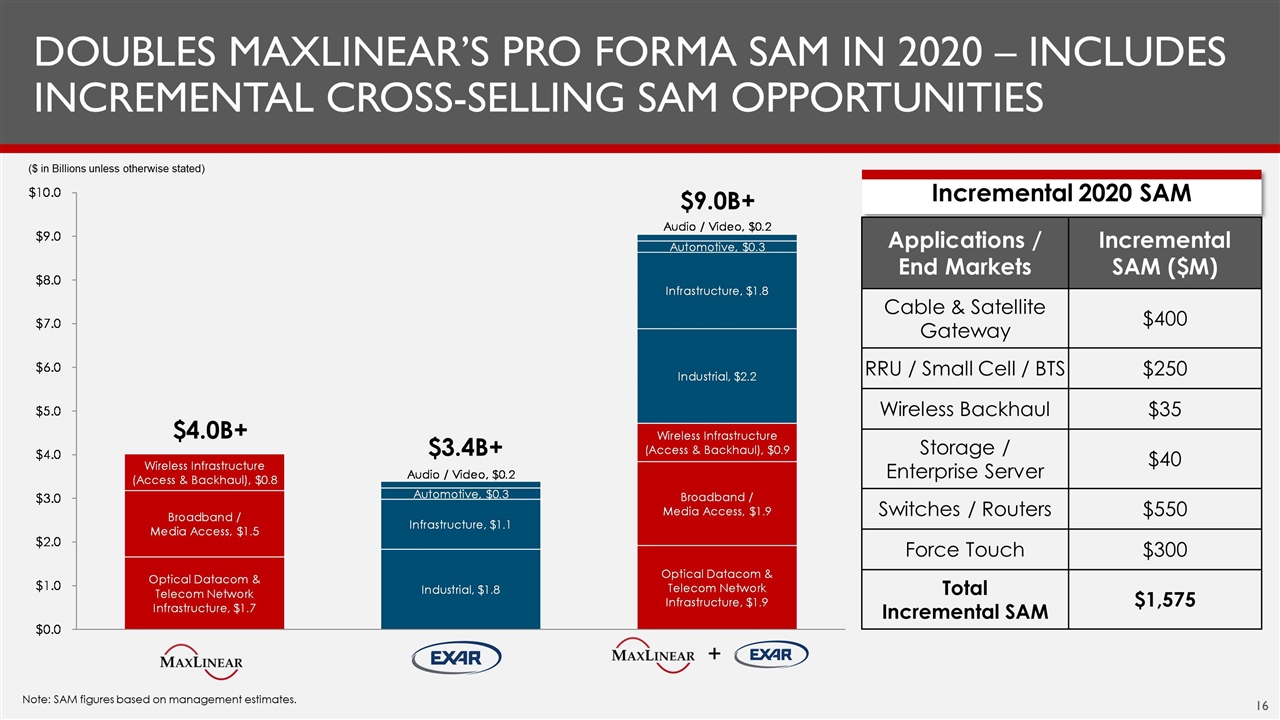

($ in Billions unless otherwise stated) $4.0B+ $3.4B+ $9.0B+ + Note: SAM figures based on management estimates. Incremental 2020 SAM Doubles maxlinear’s pro forma sam in 2020 – includes incremental cross-selling sam opportunities Applications / End Markets Incremental SAM ($M) Cable & Satellite Gateway $400 RRU / Small Cell / BTS $250 Wireless Backhaul $35 Storage / Enterprise Server $40 Switches / Routers $550 Force Touch $300 Total Incremental SAM $1,575

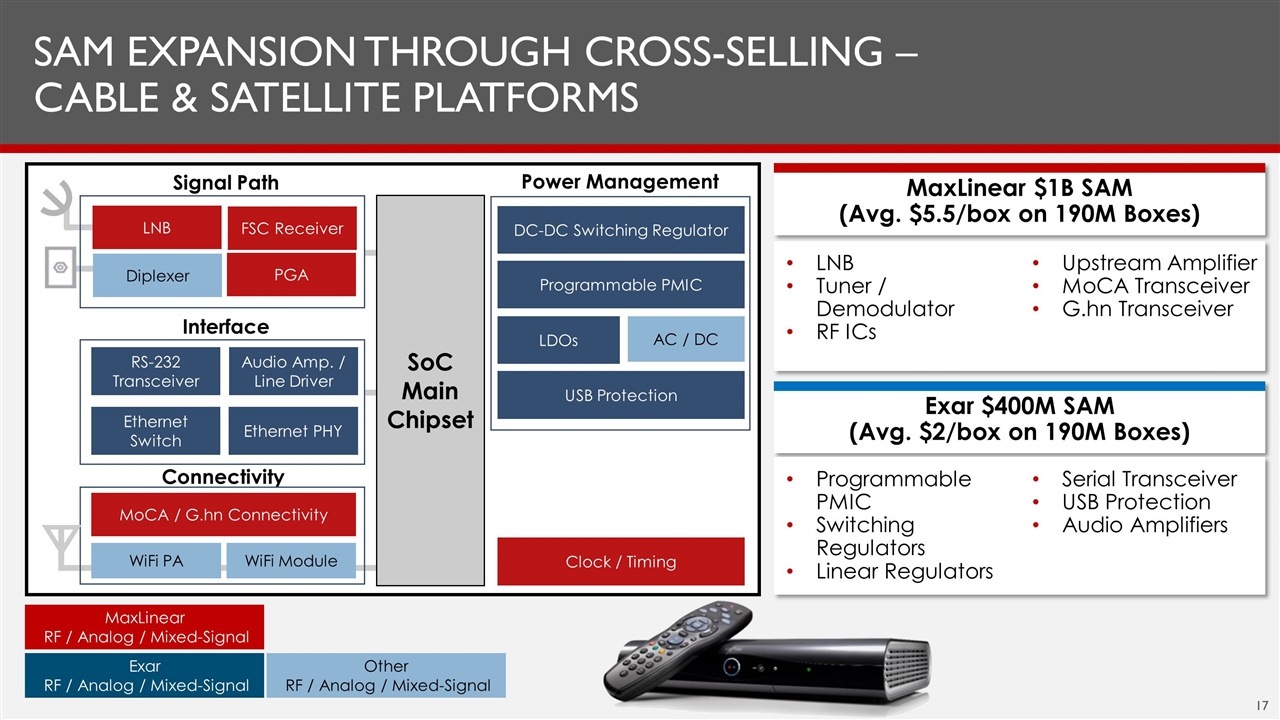

SAM Expansion Through Cross-Selling – cable & satellite platforms SoC Main Chipset Connectivity WiFi PA WiFi Module MaxLinear $1B SAM (Avg. $5.5/box on 190M Boxes) Exar $400M SAM (Avg. $2/box on 190M Boxes) LNB Tuner / Demodulator RF ICs Upstream Amplifier MoCA Transceiver G.hn Transceiver Programmable PMIC Switching Regulators Linear Regulators Serial Transceiver USB Protection Audio Amplifiers MoCA / G.hn Connectivity PGA Diplexer LNB FSC Receiver Interface Ethernet Switch Ethernet PHY RS-232 Transceiver Audio Amp. / Line Driver Clock / Timing Power Management USB Protection LDOs DC-DC Switching Regulator Programmable PMIC Signal Path AC / DC MaxLinear RF / Analog / Mixed-Signal Exar RF / Analog / Mixed-Signal Other RF / Analog / Mixed-Signal

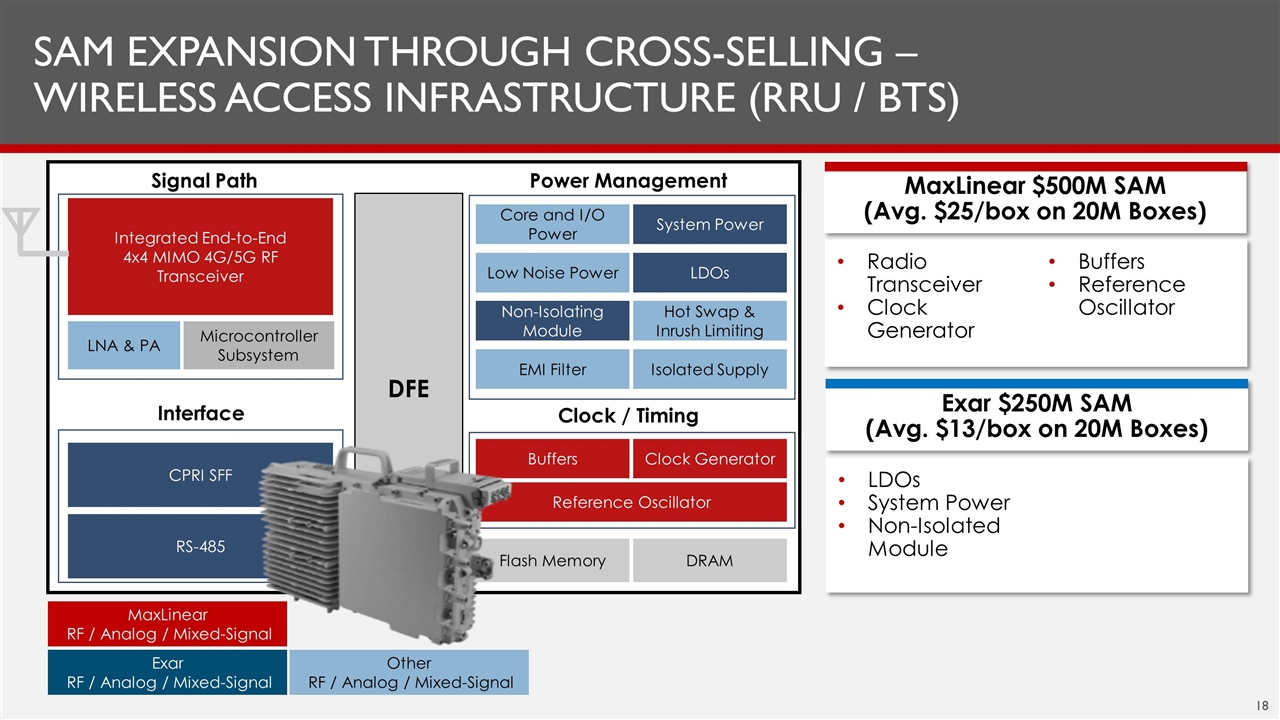

SAM Expansion Through Cross-Selling – wireless ACCESS Infrastructure (RRU / BTS) MaxLinear $500M SAM (Avg. $25/box on 20M Boxes) Exar $250M SAM (Avg. $13/box on 20M Boxes) Radio Transceiver Clock Generator Buffers Reference Oscillator LDOs System Power Non-Isolated Module DFE Power Management Interface Clock / Timing Signal Path Core and I/O Power System Power Low Noise Power Non-Isolating Module Hot Swap & Inrush Limiting EMI Filter Isolated Supply LDOs Clock Generator Reference Oscillator Buffers Flash Memory DRAM Integrated End-to-End 4x4 MIMO 4G/5G RF Transceiver Microcontroller Subsystem RS-485 CPRI SFF MaxLinear RF / Analog / Mixed-Signal Exar RF / Analog / Mixed-Signal Other RF / Analog / Mixed-Signal LNA & PA

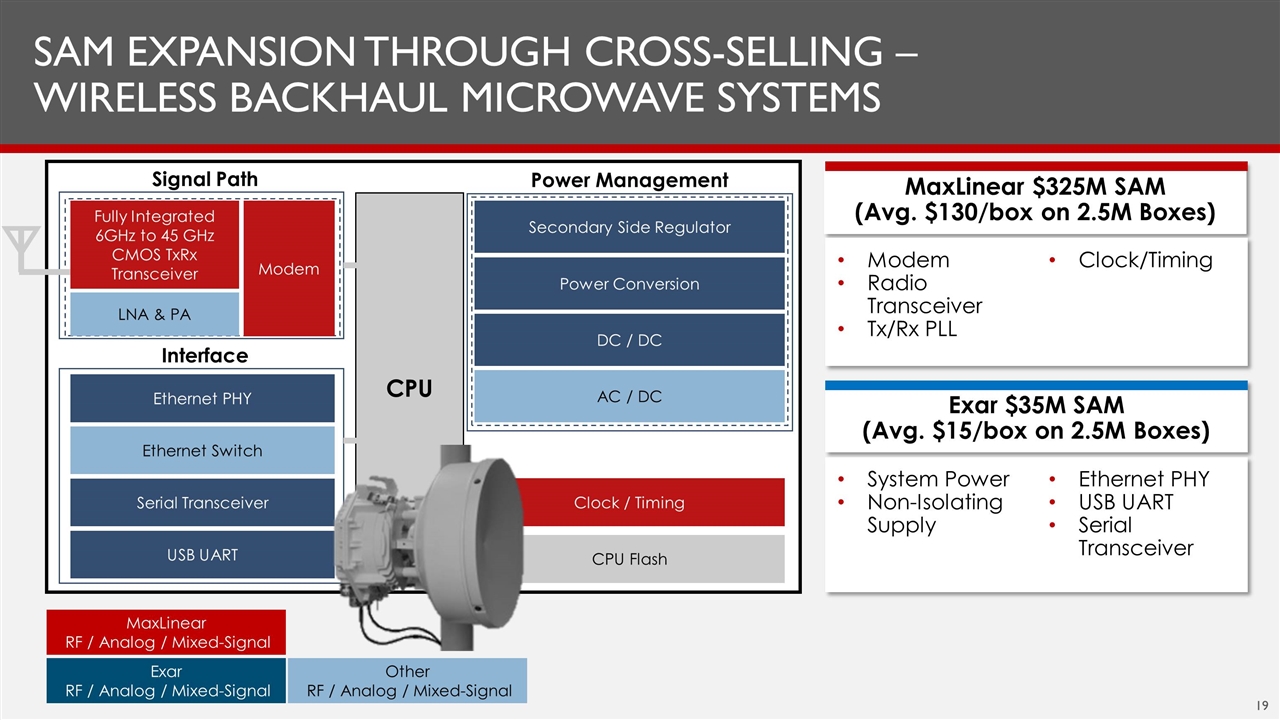

SAM Expansion Through Cross-SellinG – Wireless Backhaul Microwave systems MaxLinear $325M SAM (Avg. $130/box on 2.5M Boxes) Exar $35M SAM (Avg. $15/box on 2.5M Boxes) Modem Radio Transceiver Tx/Rx PLL Clock/Timing System Power Non-Isolating Supply Ethernet PHY USB UART Serial Transceiver CPU Power Management Signal Path Interface Ethernet PHY Ethernet Switch Serial Transceiver USB UART Clock / Timing CPU Flash Fully Integrated 6GHz to 45 GHz CMOS TxRx Transceiver Modem AC / DC DC / DC Secondary Side Regulator Power Conversion MaxLinear RF / Analog / Mixed-Signal Exar RF / Analog / Mixed-Signal Other RF / Analog / Mixed-Signal LNA & PA

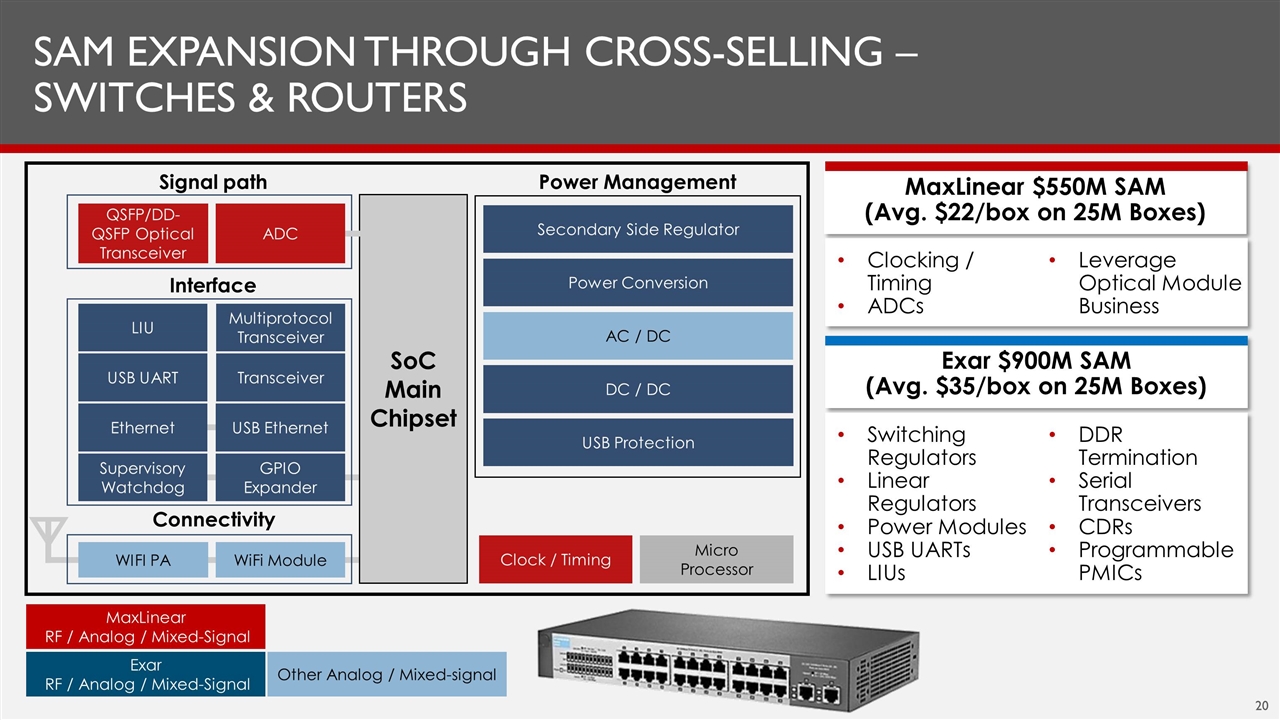

SAM Expansion Through Cross-SellinG – Switches & Routers MaxLinear $550M SAM (Avg. $22/box on 25M Boxes) Exar $900M SAM (Avg. $35/box on 25M Boxes) Clocking / Timing ADCs Leverage Optical Module Business Switching Regulators Linear Regulators Power Modules USB UARTs LIUs DDR Termination Serial Transceivers CDRs Programmable PMICs SoC Main Chipset Power Management Connectivity Signal path Interface QSFP/DD-QSFP Optical Transceiver ADC Supervisory Watchdog GPIO Expander Ethernet USB Ethernet USB UART Transceiver Multiprotocol Transceiver LIU WIFI PA WiFi Module Clock / Timing USB Protection AC / DC DC / DC Secondary Side Regulator Power Conversion Micro Processor MaxLinear RF / Analog / Mixed-Signal Exar RF / Analog / Mixed-Signal Other Analog / Mixed-signal

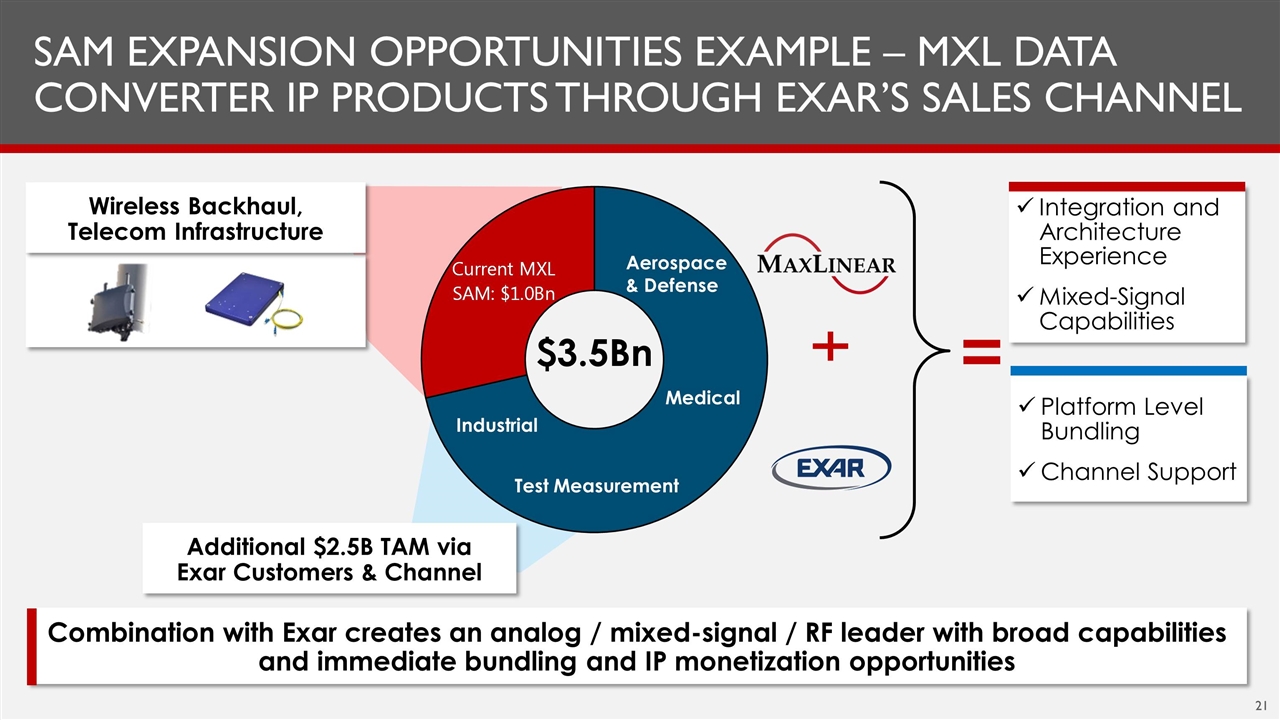

$3.5Bn sam expansion Opportunities example – MXL DATA CONVERTER IP Products THROUGH Exar’s SALES CHANNEL Wireless Backhaul, Telecom Infrastructure Combination with Exar creates an analog / mixed-signal / RF leader with broad capabilities and immediate bundling and IP monetization opportunities Integration and Architecture Experience Mixed-Signal Capabilities Platform Level Bundling Channel Support Additional $2.5B TAM via Exar Customers & Channel Industrial Test Measurement Aerospace & Defense Medical

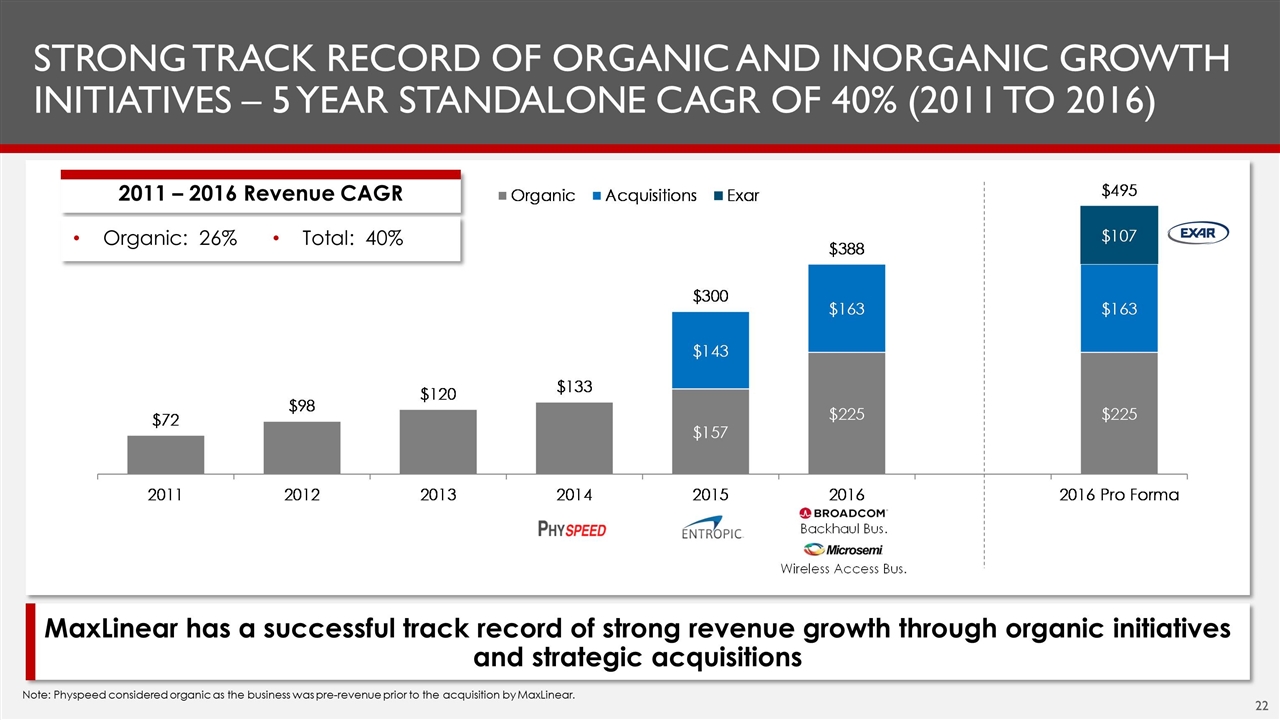

Note: Physpeed considered organic as the business was pre-revenue prior to the acquisition by MaxLinear. Strong track record of organic and inorganic growth initiatives – 5 year standalone cagr of 40% (2011 to 2016) MaxLinear has a successful track record of strong revenue growth through organic initiatives and strategic acquisitions 2011 – 2016 Revenue CAGR Organic: 26% Total: 40%

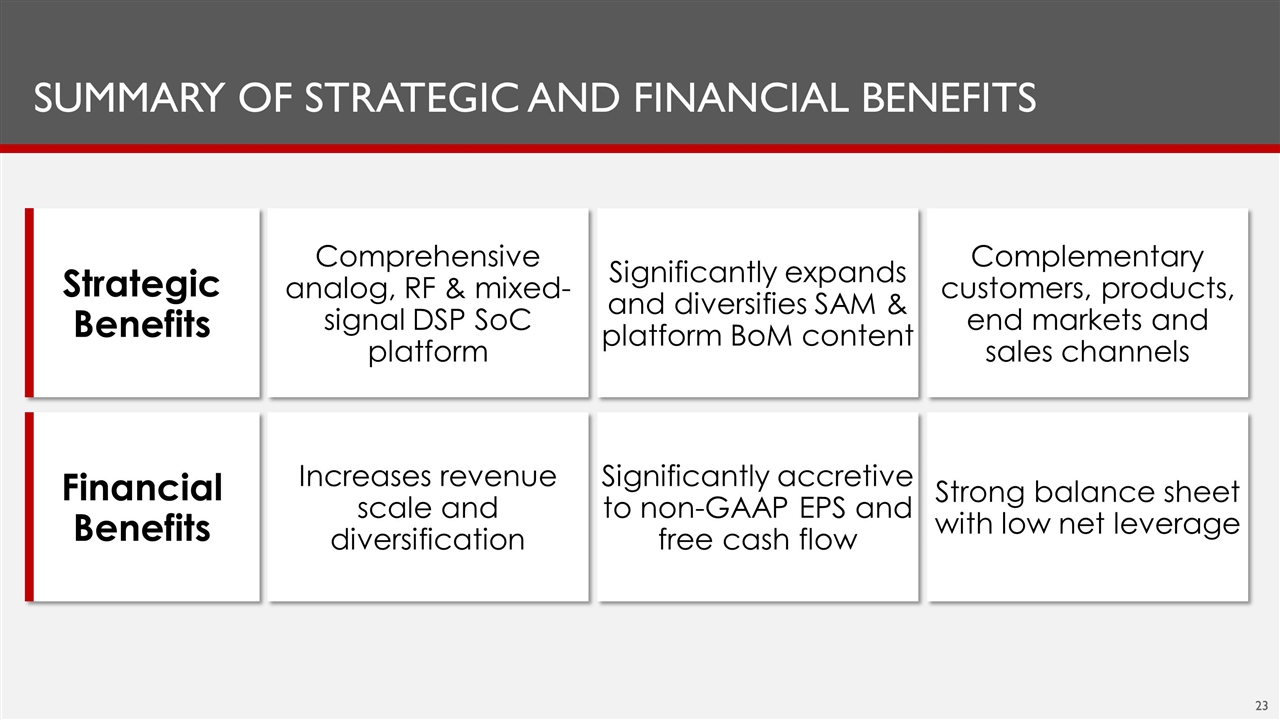

Summary of Strategic and financial benefits Comprehensive analog, RF & mixed-signal DSP SoC platform Significantly expands and diversifies SAM & platform BoM content Complementary customers, products, end markets and sales channels Increases revenue scale and diversification Significantly accretive to non-GAAP EPS and free cash flow Strong balance sheet with low net leverage Strategic Benefits Financial Benefits

Appendix

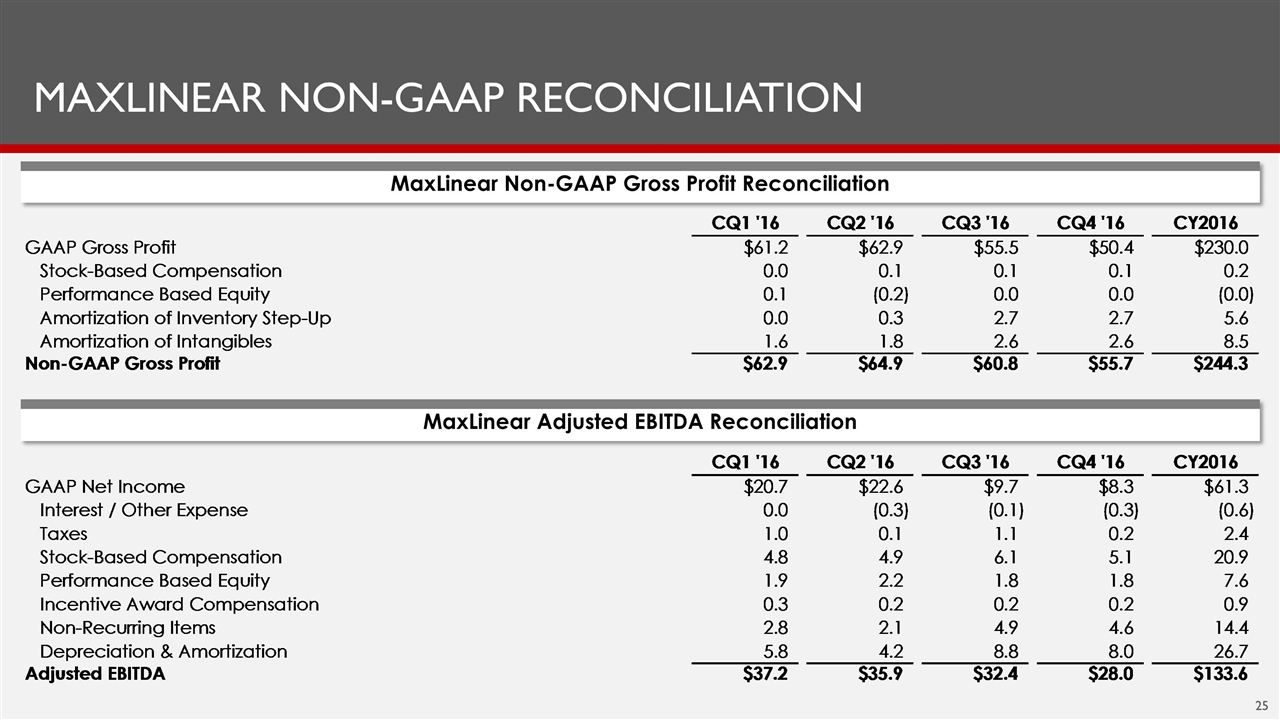

MaxLinear non-gaap reconciliation MaxLinear Non-GAAP Gross Profit Reconciliation MaxLinear Adjusted EBITDA Reconciliation

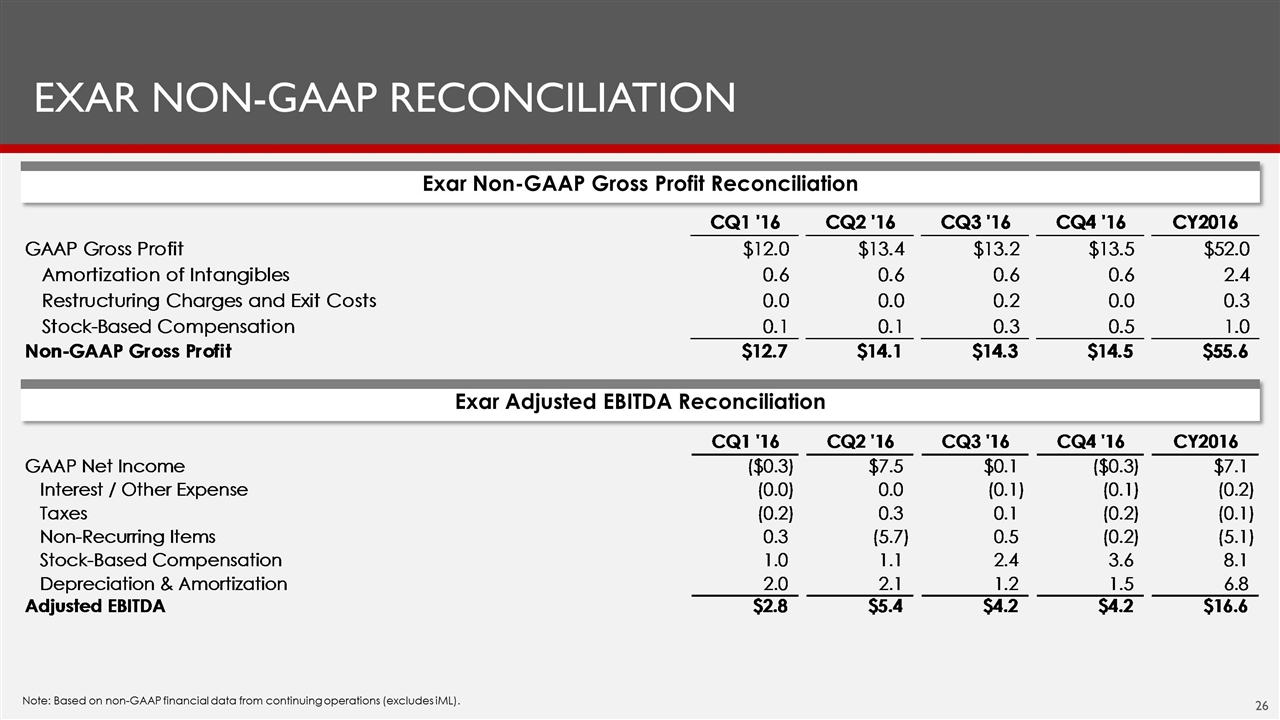

Exar Non-gaap reconciliation Exar Non-GAAP Gross Profit Reconciliation Exar Adjusted EBITDA Reconciliation Note: Based on non-GAAP financial data from continuing operations (excludes iML).