MaxLinear Investor Presentation May 2023

Disclaimer Cautionary Note Concerning Forward-Looking Statements This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Unless otherwise indicated, all forward looking statements are based on estimates, projections, and assumptions of MaxLinear as of the date of this presentation. These forward-looking statements include, among others, statements concerning: MaxLinear’s growth plan and strategies, including its financial strategy; estimates of total addressable market and serviceable addressable market; anticipated market trends, including growth trends; the potential of MaxLinear’s technology; our financial performance; and our long-term target model, including metrics related to such model. These forward-looking statements involve known and unknown risks, uncertainties, and other factors that may cause actual results to be materially different from any future results expressed or implied by the forward-looking statements. Forward-looking statements are based on management’s current, preliminary expectations and are subject to various risks and uncertainties. In particular, our future operating results are substantially dependent on our assumptions about market trends and conditions. Additional risks and uncertainties affecting our business, future operating results and financial condition include, without limitation, risks relating to our proposed merger with Silicon Motion and the risks related to increased indebtedness; the effect of intense and increasing competition; impacts of a global economic downturn and high inflation; the cyclical nature of the semiconductor industry; the political and economic conditions of the countries in which we conduct business and other factors related to our international operations; increased tariffs or imposition of other trade barriers; our ability to obtain or retain government authorization to export certain of our products or technology; risks related to international geopolitical conflicts; risks related to the loss of, or a significant reduction in orders from major customers; a decrease in the average selling prices of our products; failure to penetrate new applications and markets; development delays and consolidation trends in our industry; inability to make substantial research and development investments; a significant variance in our operating results could lead to substantial volatility in our stock price; our ability to sustain our current level of revenue and/or manage future growth effectively, which is currently exacerbated by the impact of excess inventory in the channel on our customers’ expected demand for certain of our products; claims of intellectual property infringement; our ability to protect our intellectual property; and a failure to manage our relationships with, or negative impacts from, third parties. In addition to these risks and uncertainties, investors should review the risks and uncertainties contained in our filings with the Securities and Exchange Commission (SEC), including our Annual Report on Form 10-K for the year ended December 31, 2022 filed with the SEC on February 1, 2023, and our Current Reports on Form 8-K, as well as the information set forth under the caption “Risk Factors” in MaxLinear’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2023. All forward-looking statements are based on the estimates, projections and assumptions of management as of the date of this presentation, and MaxLinear is under no obligation (and expressly disclaims any such obligation) to update or revise any forward-looking statements whether as a result of new information, future events, or otherwise. Market Information This presentation and the accompanying oral presentation also contain statistical data, estimates and forecasts that are based on independent industry publications or other publicly available information, as well as other information based on our internal sources. This information involves many assumptions and limitations, and you are cautioned not to give undue weight to such information. We have not independently verified the accuracy or completeness of the information contained in the industry publications and other publicly available information. Accordingly, we make no representations as to the accuracy or completeness of that information nor do we undertake to update such information after the date of this presentation. Non-GAAP Financial Measures This communication may contain certain non-GAAP financial measures, which MaxLinear management believes are useful to investors and reflect how management measures MaxLinear’s business. Among other uses, our management uses non-GAAP measures to compare our performance relative to forecasts and strategic plans and to benchmark our performance externally against competitors. In addition, management’s incentive compensation will be determined in part using these non-GAAP measures because we believe non-GAAP measures better reflect our core operating performance. The company’s guidance for non-GAAP financial measures excludes the effects of (i) stock-based compensation expense, (ii) performance-based bonuses, which we settle in shares of our common stock, (iii) amortization of purchased intangible assets, (iv) research and development funded by others, (v) acquisition and integration costs, (vii) impairment losses, and (viii) severance and other restructuring charges; the amount of such exclusions could be significant. Non-GAAP financial measures are not meant to be considered in isolation or as a substitute for the comparable GAAP financial measures. Non-GAAP financial measures are subject to limitations and should be read only in conjunction with the company's consolidated financial statements prepared in accordance with GAAP. Non-GAAP financial measures do not have any standardized meaning and are therefore unlikely to be comparable to similarly titled measures presented by other companies. A description of these non-GAAP financial measures and a reconciliation of the company’s non-GAAP financial measures to their most directly comparable GAAP measures have been provided in the Appendix and investors are encouraged to review the reconciliation. Further detail and reconciliations between the non-GAAP financial measures and the GAAP financial measures are available in the Appendix to this presentation and on the Investor Relations section of MaxLinear’s website as part of its published financial results press release. Because of the inherent uncertainty associated with our ability to project future charges, particularly those related to stock-based compensation and its related tax effects as well as potential impairments, we do not provide reconciliations to forward-looking non-GAAP financial information. 2

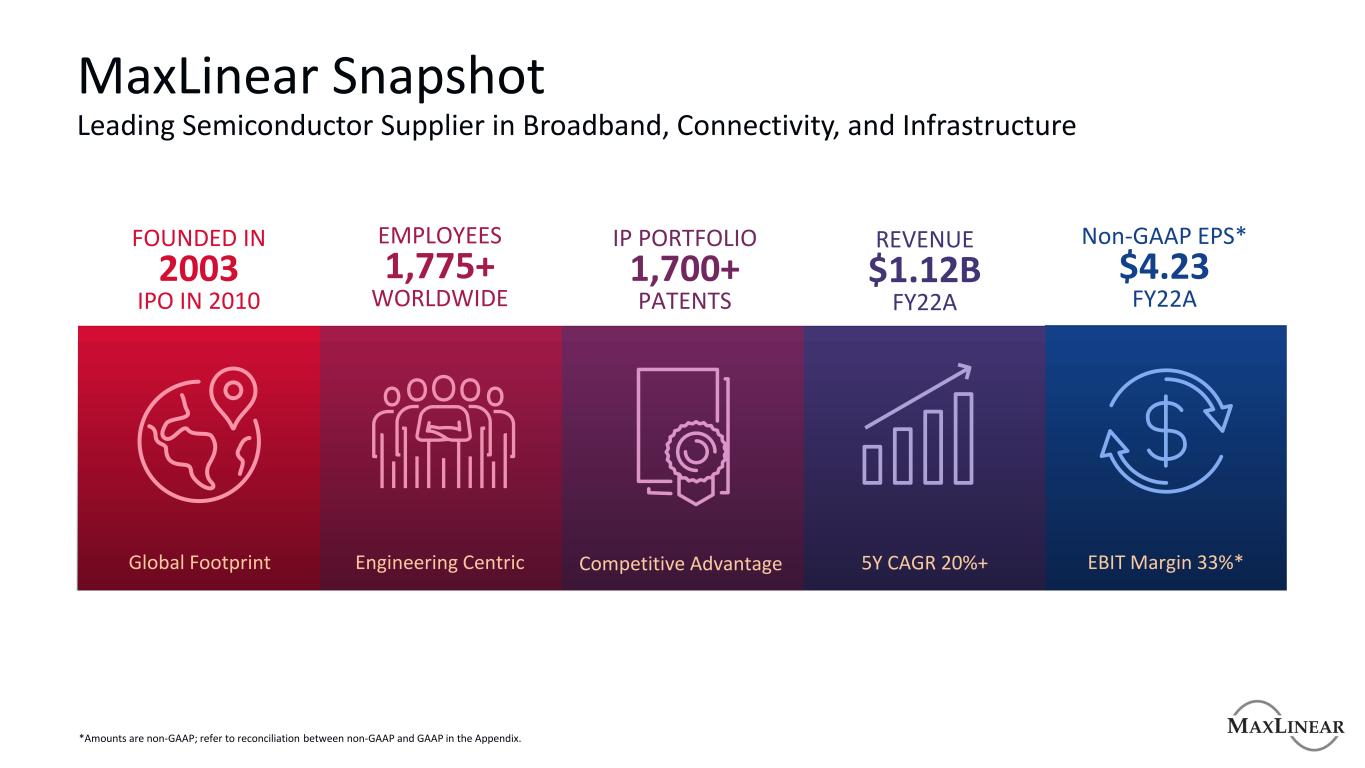

MaxLinear Snapshot Leading Semiconductor Supplier in Broadband, Connectivity, and Infrastructure FOUNDED IN 2003 IPO IN 2010 EMPLOYEES 1,775+ WORLDWIDE IP PORTFOLIO 1,700+ PATENTS REVENUE $1.12B FY22A Non-GAAP EPS* $4.23 FY22A Global Footprint Engineering Centric Competitive Advantage 5Y CAGR 20%+ EBIT Margin 33%* *Amounts are non-GAAP; refer to reconciliation between non-GAAP and GAAP in the Appendix.

Diversified End-Market Portfolio Across the Board Secular and MXL Specific Growth Opportunities BROADBAND CONNECTIVITY INDUSTRIAL / MULTI-MARKET INFRASTRUCTURE Gateway SoC RF Front-End MoCA / Ethernet WiFi Power / Analog Interface PAM4 DSP TRX / MOD

ADDRESS GROWING MARKETS INCREASE SHARE & CONTENT DRIVE OPERATING LEVERAGE Execute Plan to Deliver Profitable Growth 5 Utilize superior technology to outperform our growing end-markets and deliver strong returns Market Strategy Growth Strategy Financial Strategy

Market Strategy Target and Address Dynamic Growth Markets

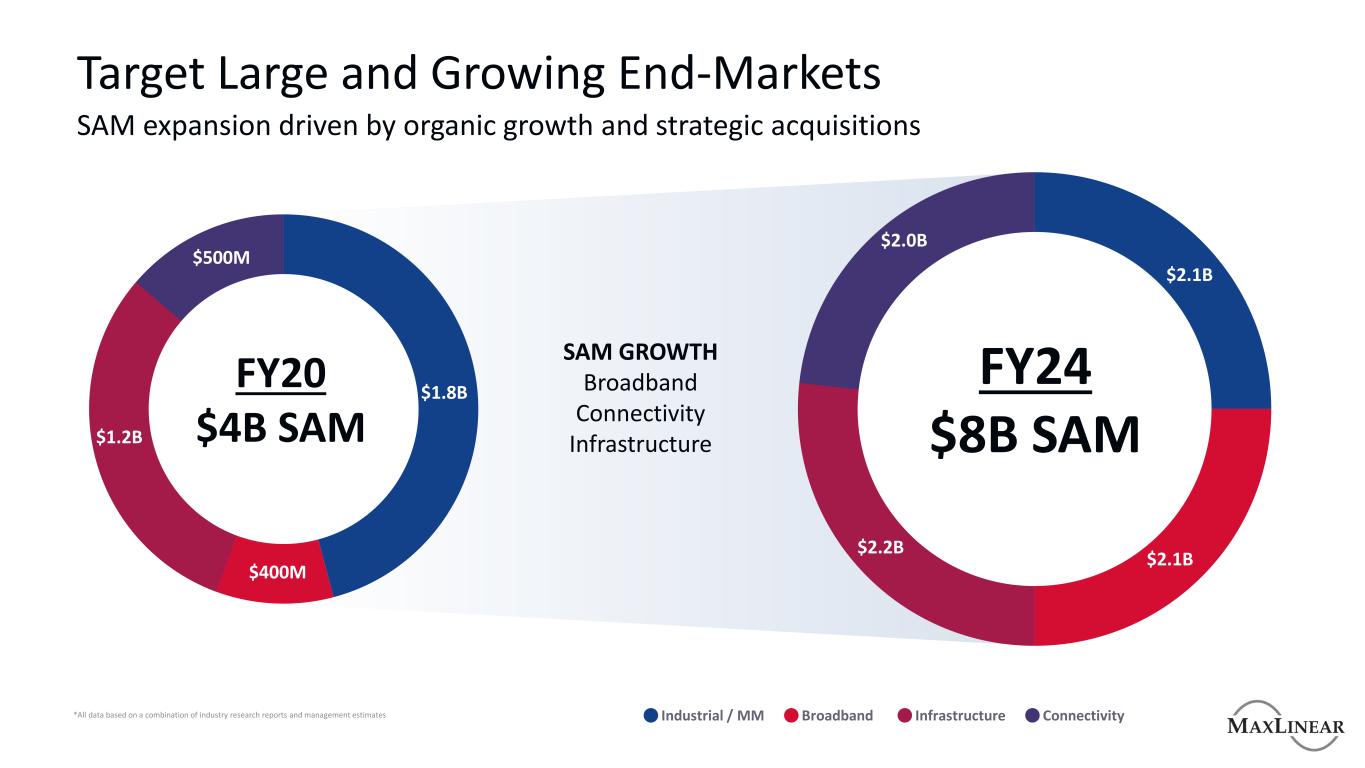

*All data based on a combination of industry research reports and management estimates Target Large and Growing End-Markets SAM expansion driven by organic growth and strategic acquisitions SAM GROWTH Broadband Connectivity Infrastructure FY20 $4B SAM $500M $1.8B $1.2B $400M FY24 $8B SAM $2.2B $2.0B $2.1B $2.1B Industrial / MM Broadband Infrastructure Connectivity

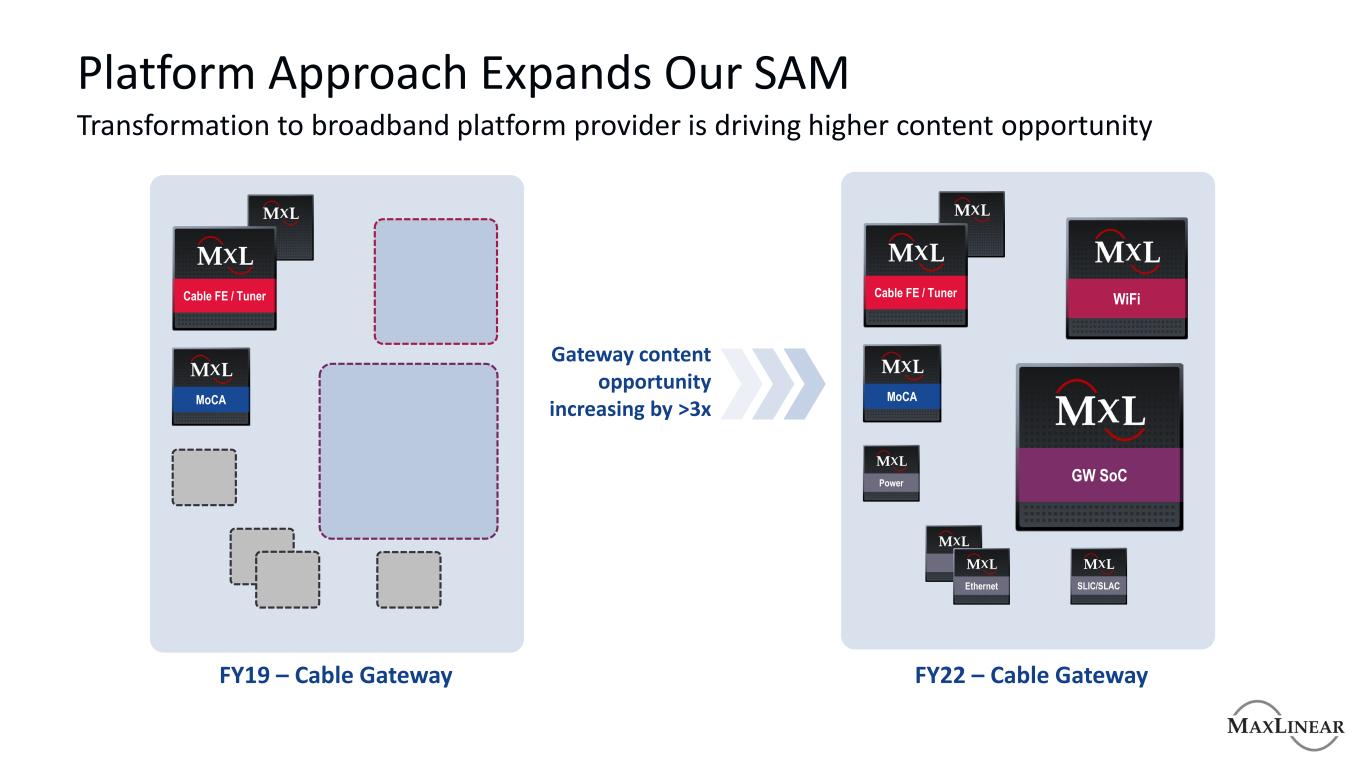

Platform Approach Expands Our SAM Transformation to broadband platform provider is driving higher content opportunity FY19 – Cable Gateway FY22 – Cable Gateway Cable FE / Tuner MoCA Cable FE / Tuner MoCA WiFi GW SoCPower Ethernet SLIC/SLAC Gateway content opportunity increasing by >3x

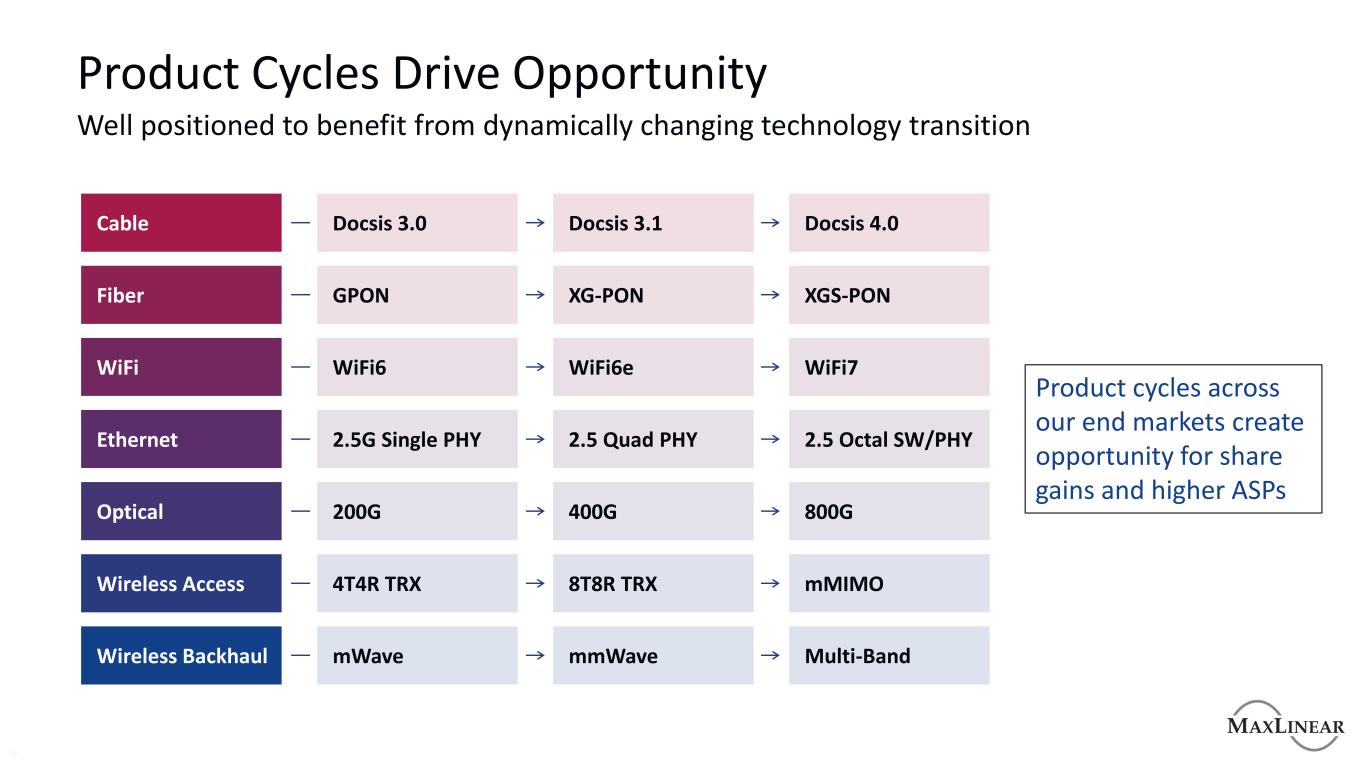

Product Cycles Drive Opportunity 9 Well positioned to benefit from dynamically changing technology transition Product cycles across our end markets create opportunity for share gains and higher ASPs Wireless Backhaul Wireless Access Optical Ethernet WiFi Fiber Cable mWave 4T4R TRX 200G 2.5G Single PHY WiFi6 GPON Docsis 3.0 mmWave 8T8R TRX 400G 2.5 Quad PHY WiFi6e XG-PON Docsis 3.1 Multi-Band mMIMO 800G 2.5 Octal SW/PHY WiFi7 XGS-PON Docsis 4.0

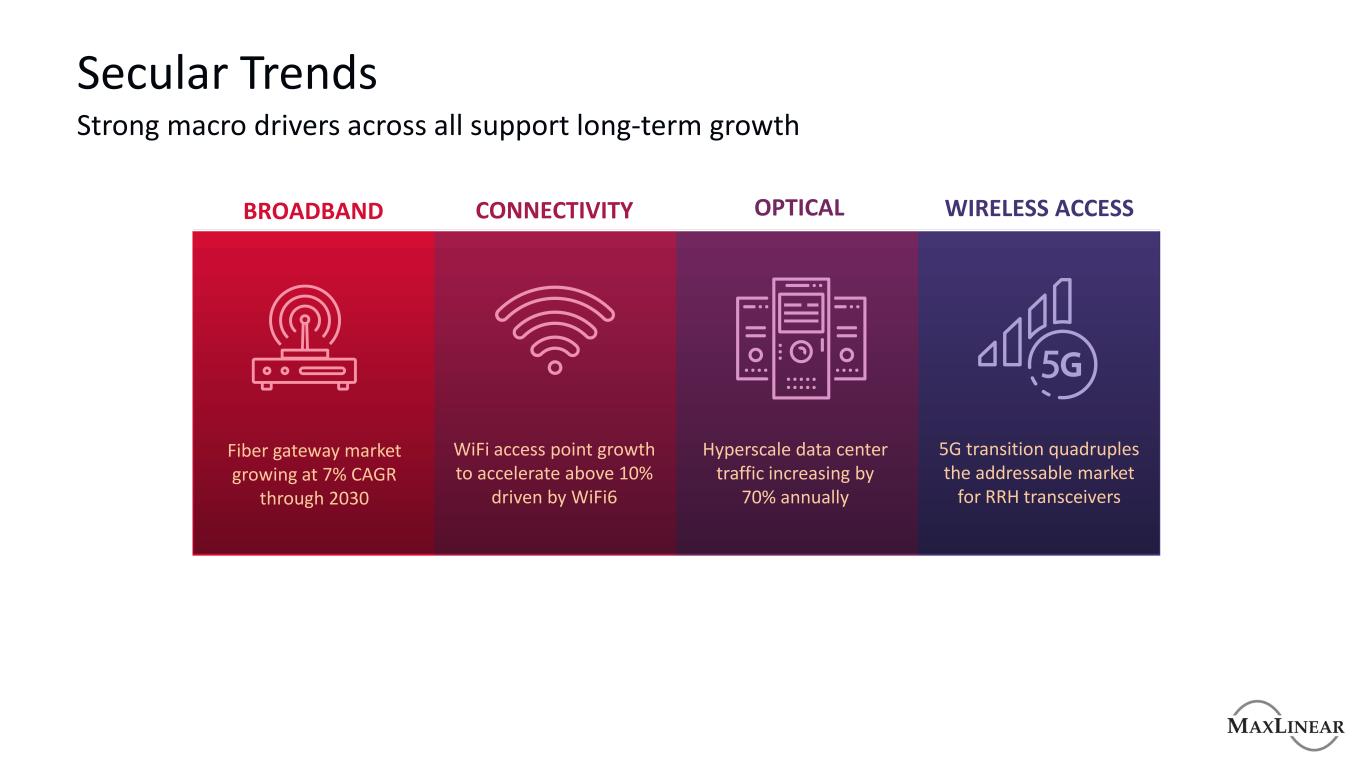

Secular Trends Strong macro drivers across all support long-term growth BROADBAND CONNECTIVITY OPTICAL WIRELESS ACCESS Fiber gateway market growing at 7% CAGR through 2030 WiFi access point growth to accelerate above 10% driven by WiFi6 Hyperscale data center traffic increasing by 70% annually 5G transition quadruples the addressable market for RRH transceivers

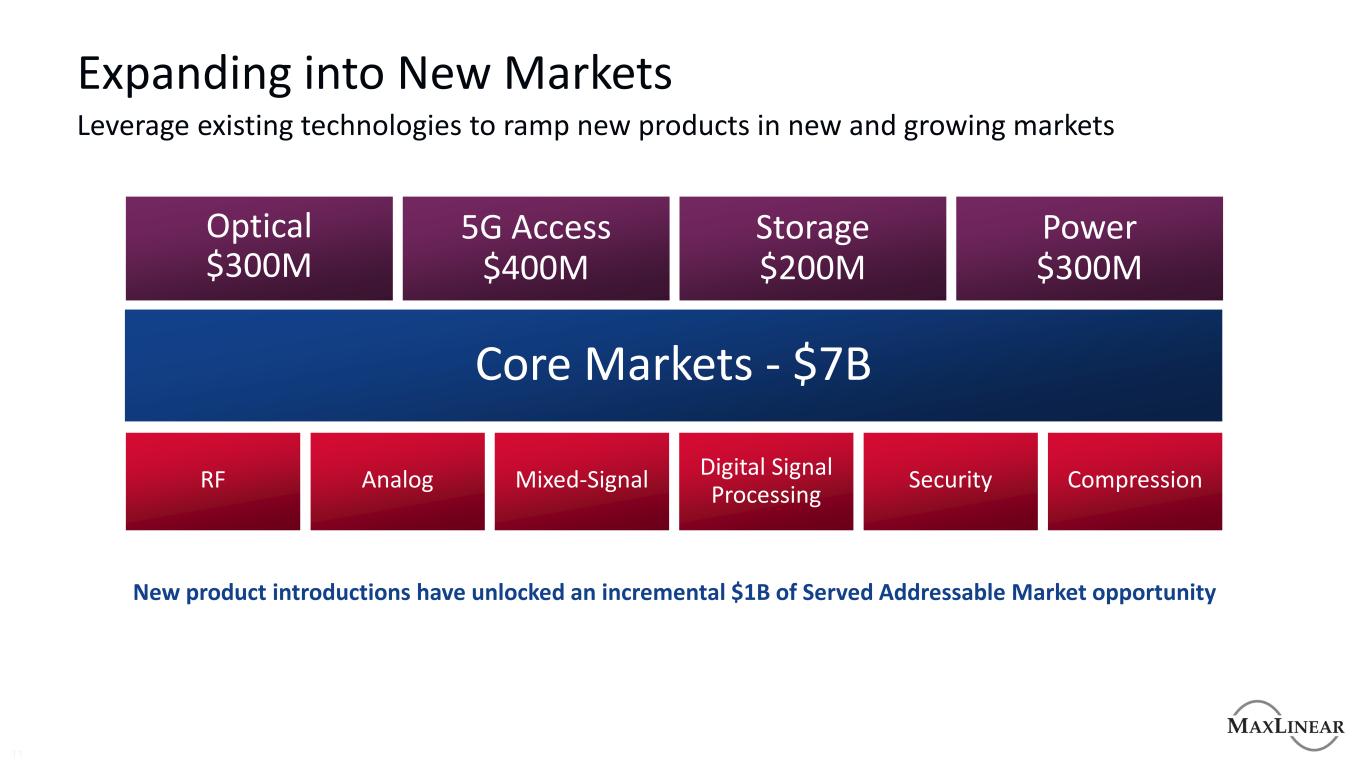

Expanding into New Markets 11 Leverage existing technologies to ramp new products in new and growing markets RF Analog Mixed-Signal Digital Signal Processing Security Compression Optical $300M 5G Access $400M Storage $200M Power $300M Core Markets - $7B New product introductions have unlocked an incremental $1B of Served Addressable Market opportunity

Growth Strategy Increase Market Share and Content Per Platform

Long-Term Growth Drivers Product Innovation Drives Opportunity to Grow Content and Market Share FIBER GATEWAY WIFI WIRELESS INFRASTRUCTURE OPTICAL STORAGE

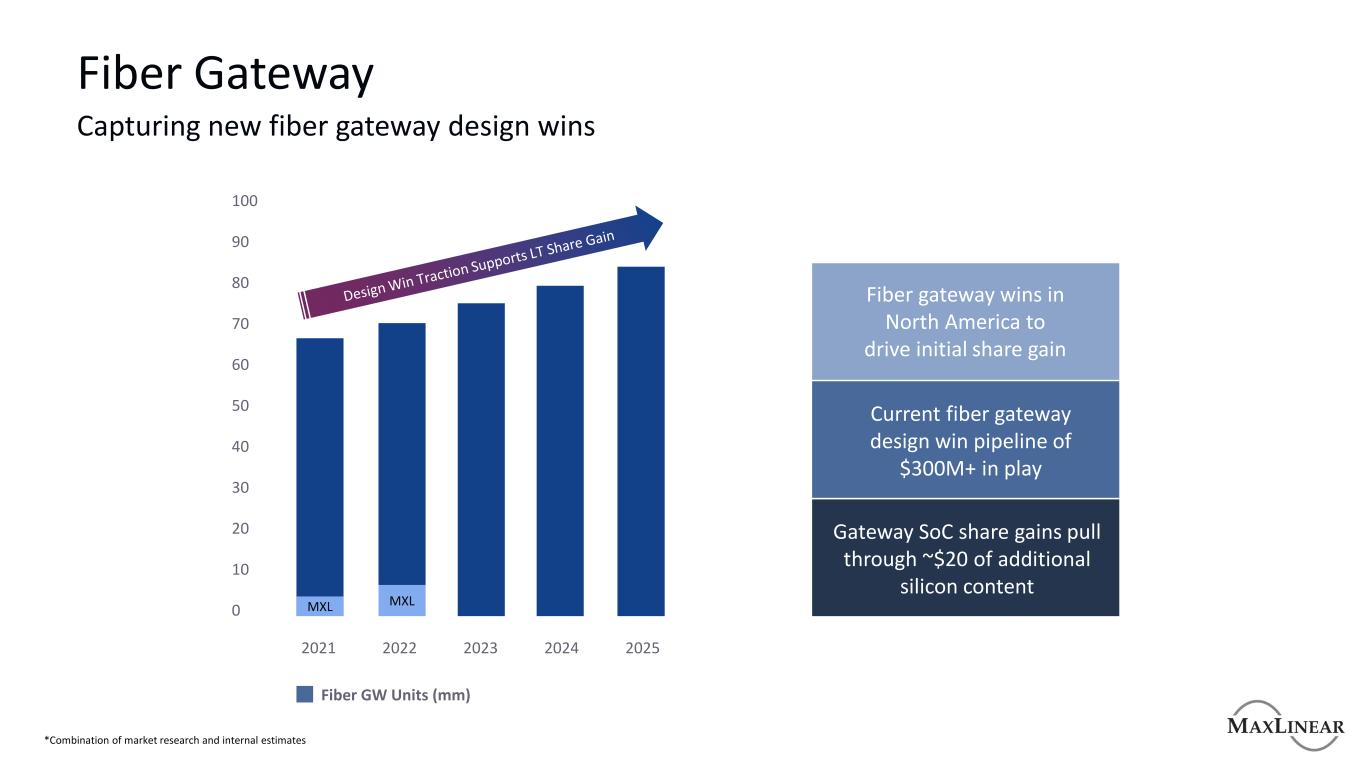

Fiber Gateway Capturing new fiber gateway design wins 2022 2023 2024 20252021 MXL 100 90 80 70 60 50 40 30 20 10 0 Fiber GW Units (mm) Fiber gateway wins in North America to drive initial share gain Current fiber gateway design win pipeline of $300M+ in play Gateway SoC share gains pull through ~$20 of additional silicon content *Combination of market research and internal estimates MXL

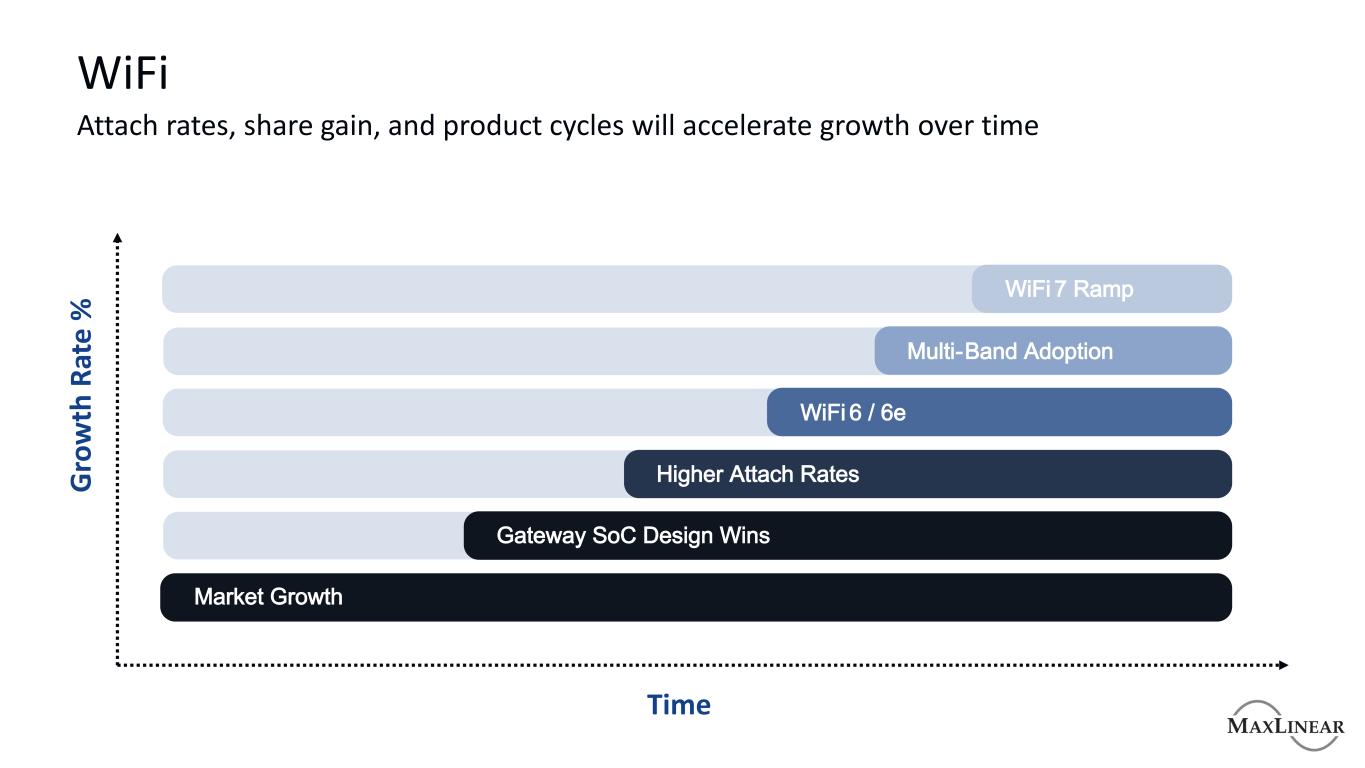

WiFi Attach rates, share gain, and product cycles will accelerate growth over time G ro w th R at e % Time WiFi 7 Ramp Multi-Band Adoption WiFi 6 / 6e Higher Attach Rates Gateway SoC Design Wins Market Growth

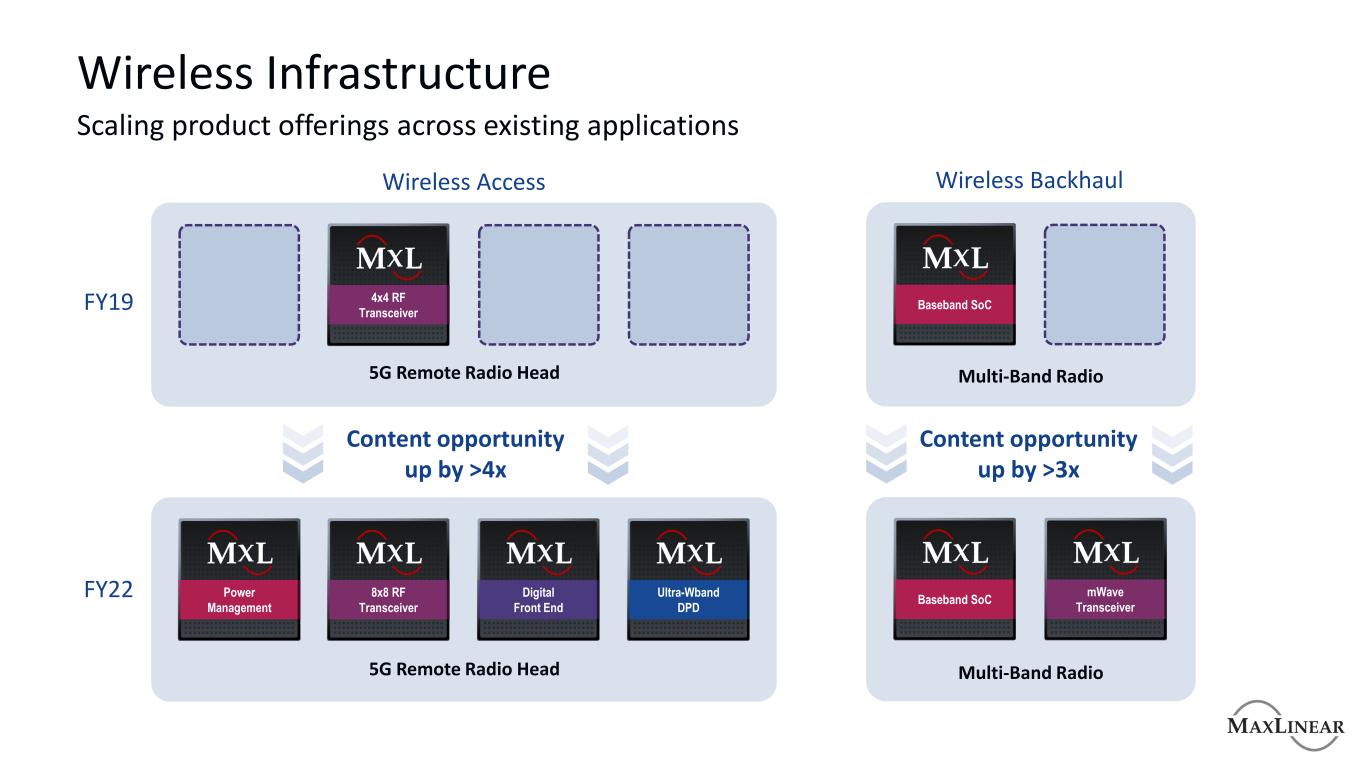

Wireless Infrastructure Scaling product offerings across existing applications Wireless Access Wireless Backhaul FY19 FY22 Content opportunity up by >4x Content opportunity up by >3x 4x4 RF Transceiver Baseband SoC 8x8 RF Transceiver Baseband SoCPower Management Ultra-Wband DPD Digital Front End mWave Transceiver 5G Remote Radio Head 5G Remote Radio Head Multi-Band Radio Multi-Band Radio

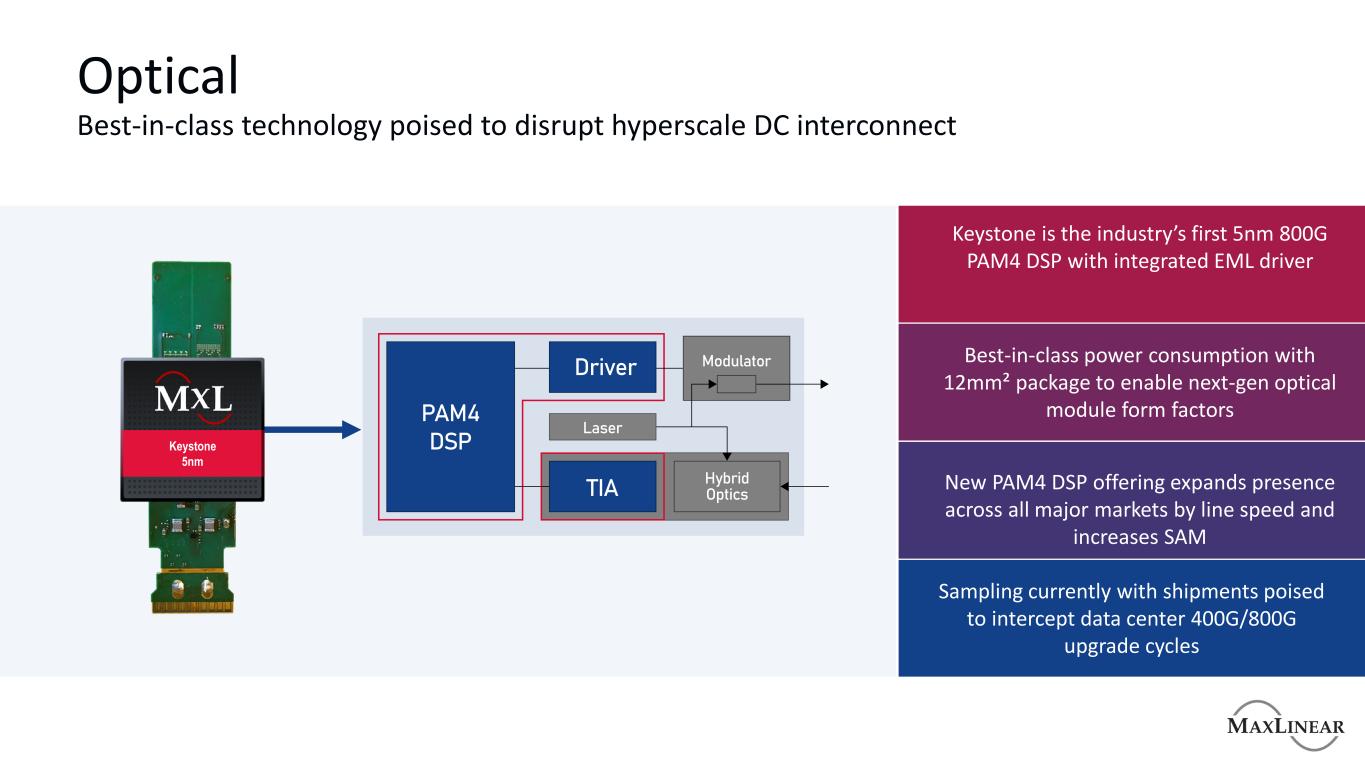

Optical Best-in-class technology poised to disrupt hyperscale DC interconnect Keystone is the industry’s first 5nm 800G PAM4 DSP with integrated EML driver Best-in-class power consumption with 12mm² package to enable next-gen optical module form factors New PAM4 DSP offering expands presence across all major markets by line speed and increases SAM Keystone 5nm Sampling currently with shipments poised to intercept data center 400G/800G upgrade cycles

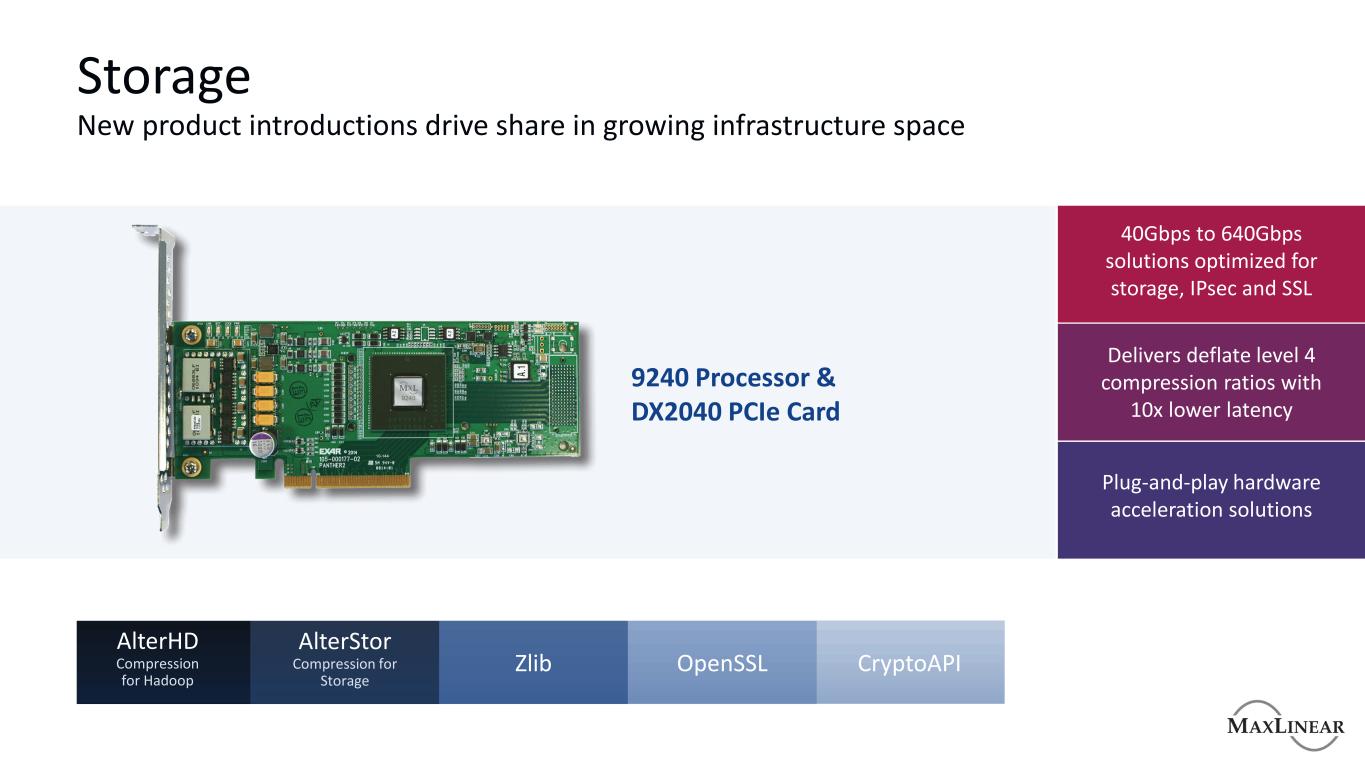

Storage New product introductions drive share in growing infrastructure space AlterHD Compression for Hadoop AlterStor Compression for Storage Zlib OpenSSL CryptoAPI 40Gbps to 640Gbps solutions optimized for storage, IPsec and SSL Delivers deflate level 4 compression ratios with 10x lower latency Plug-and-play hardware acceleration solutions 9240 Processor & DX2040 PCIe Card

Financial Strategy Drive operating leverage and shareholder returns

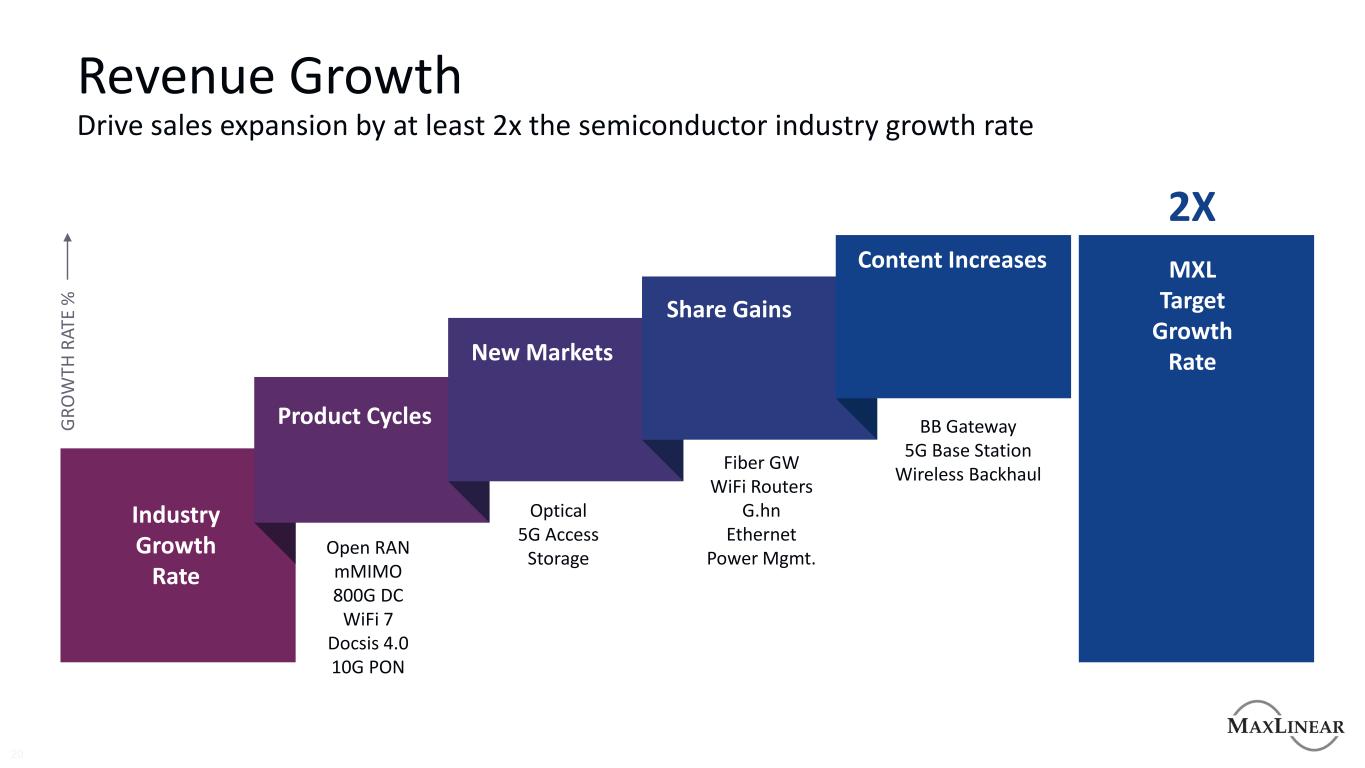

Revenue Growth 20 Drive sales expansion by at least 2x the semiconductor industry growth rate Industry Growth Rate MXL Target Growth Rate Product Cycles Content Increases New Markets Share Gains Fiber GW WiFi Routers G.hn Ethernet Power Mgmt. BB Gateway 5G Base Station Wireless Backhaul Optical 5G Access StorageOpen RAN mMIMO 800G DC WiFi 7 Docsis 4.0 10G PON 2X G RO W TH R AT E %

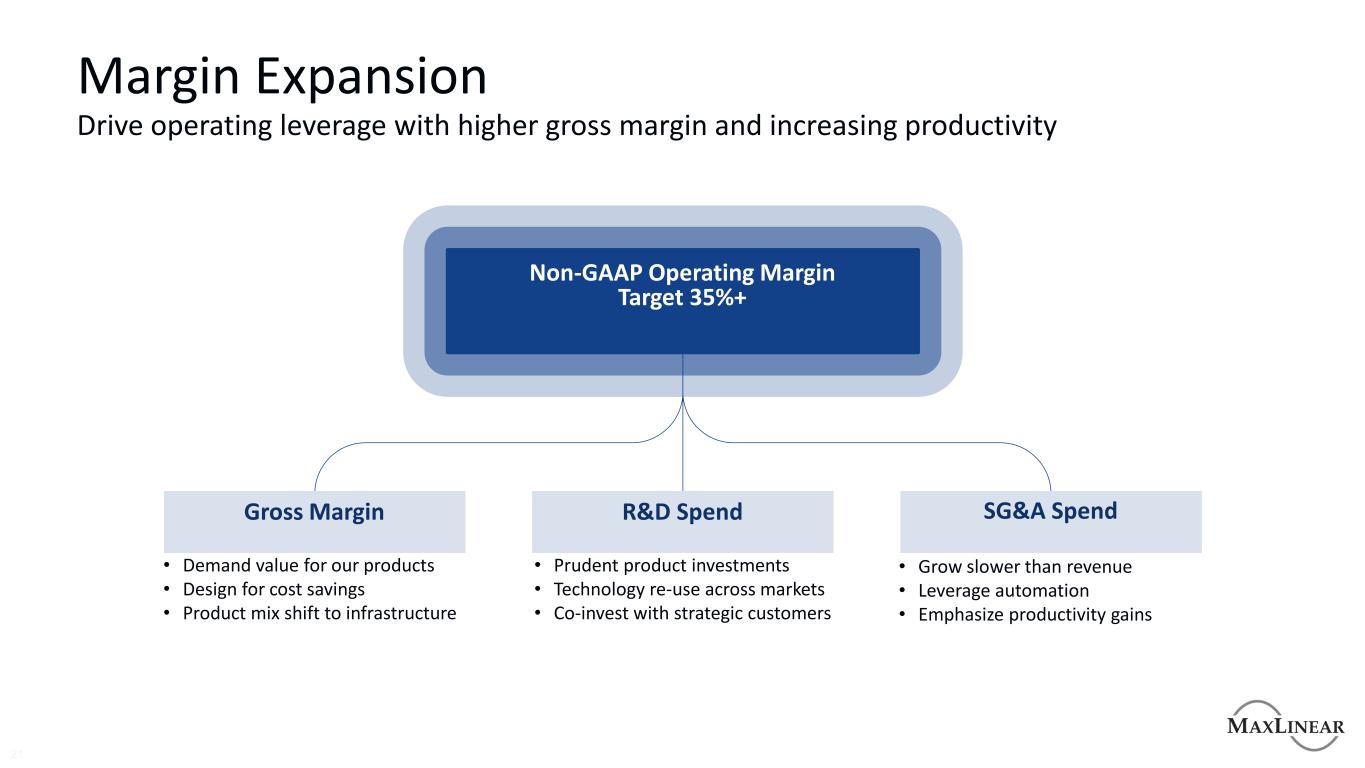

Margin Expansion 21 Drive operating leverage with higher gross margin and increasing productivity • Grow slower than revenue • Leverage automation • Emphasize productivity gains • Prudent product investments • Technology re-use across markets • Co-invest with strategic customers • Demand value for our products • Design for cost savings • Product mix shift to infrastructure Gross Margin Non-GAAP Operating Margin Target 35%+ R&D Spend SG&A Spend

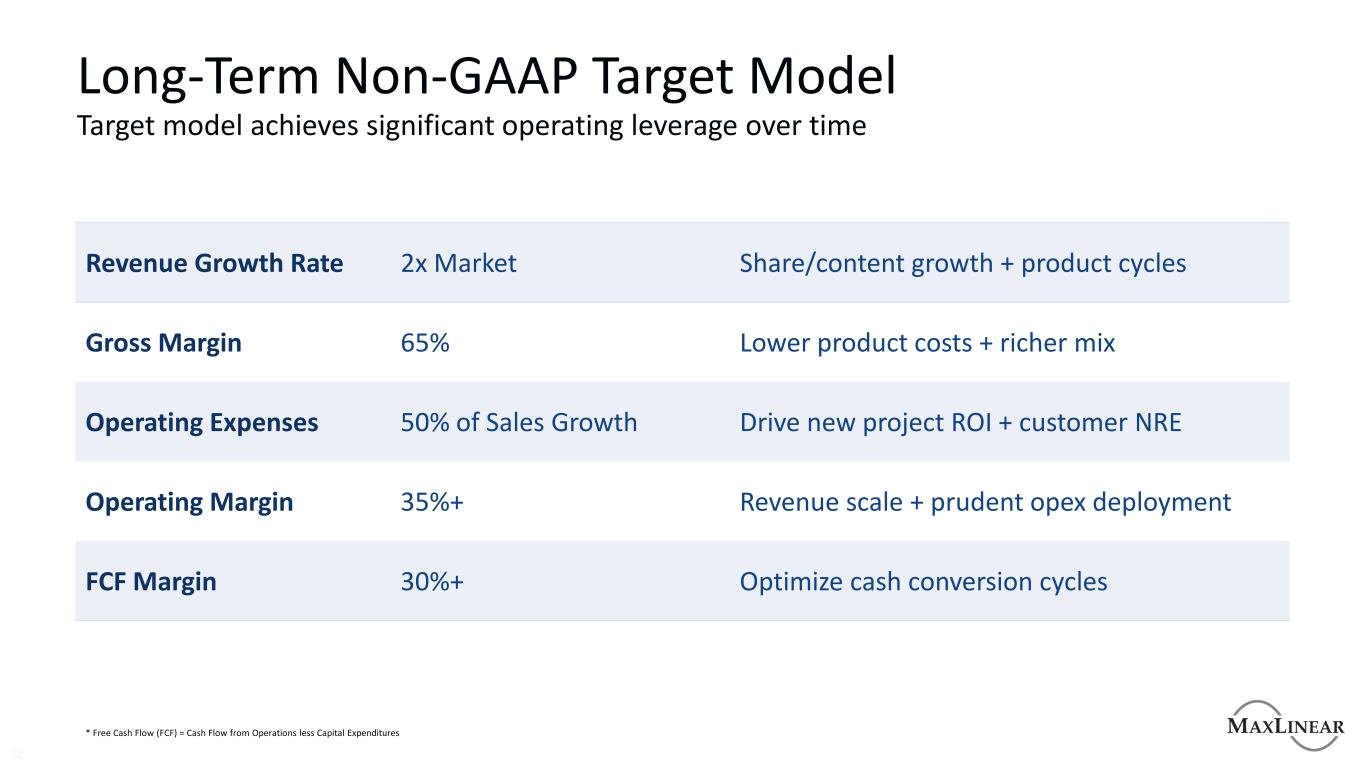

Long-Term Non-GAAP Target Model 22 Target model achieves significant operating leverage over time Revenue Growth Rate 2x Market Share/content growth + product cycles Gross Margin 65% Lower product costs + richer mix Operating Expenses 50% of Sales Growth Drive new project ROI + customer NRE Operating Margin 35%+ Revenue scale + prudent opex deployment FCF Margin 30%+ Optimize cash conversion cycles * Free Cash Flow (FCF) = Cash Flow from Operations less Capital Expenditures

Appendix

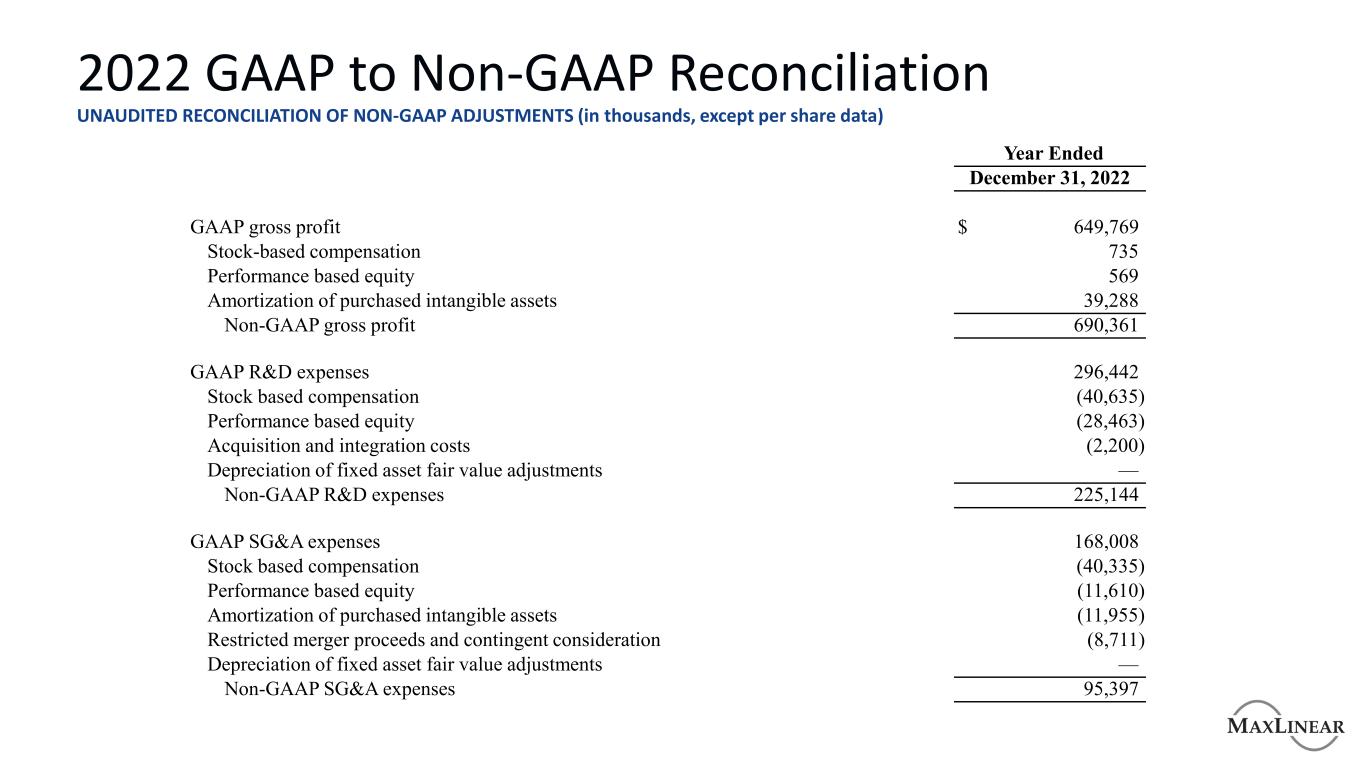

2022 GAAP to Non-GAAP Reconciliation UNAUDITED RECONCILIATION OF NON-GAAP ADJUSTMENTS (in thousands, except per share data) Year Ended December 31, 2022 GAAP gross profit $ 649,769 Stock-based compensation 735 Performance based equity 569 Amortization of purchased intangible assets 39,288 Non-GAAP gross profit 690,361 GAAP R&D expenses 296,442 Stock based compensation (40,635) Performance based equity (28,463) Acquisition and integration costs (2,200) Depreciation of fixed asset fair value adjustments — Non-GAAP R&D expenses 225,144 GAAP SG&A expenses 168,008 Stock based compensation (40,335) Performance based equity (11,610) Amortization of purchased intangible assets (11,955) Restricted merger proceeds and contingent consideration (8,711) Depreciation of fixed asset fair value adjustments — Non-GAAP SG&A expenses 95,397

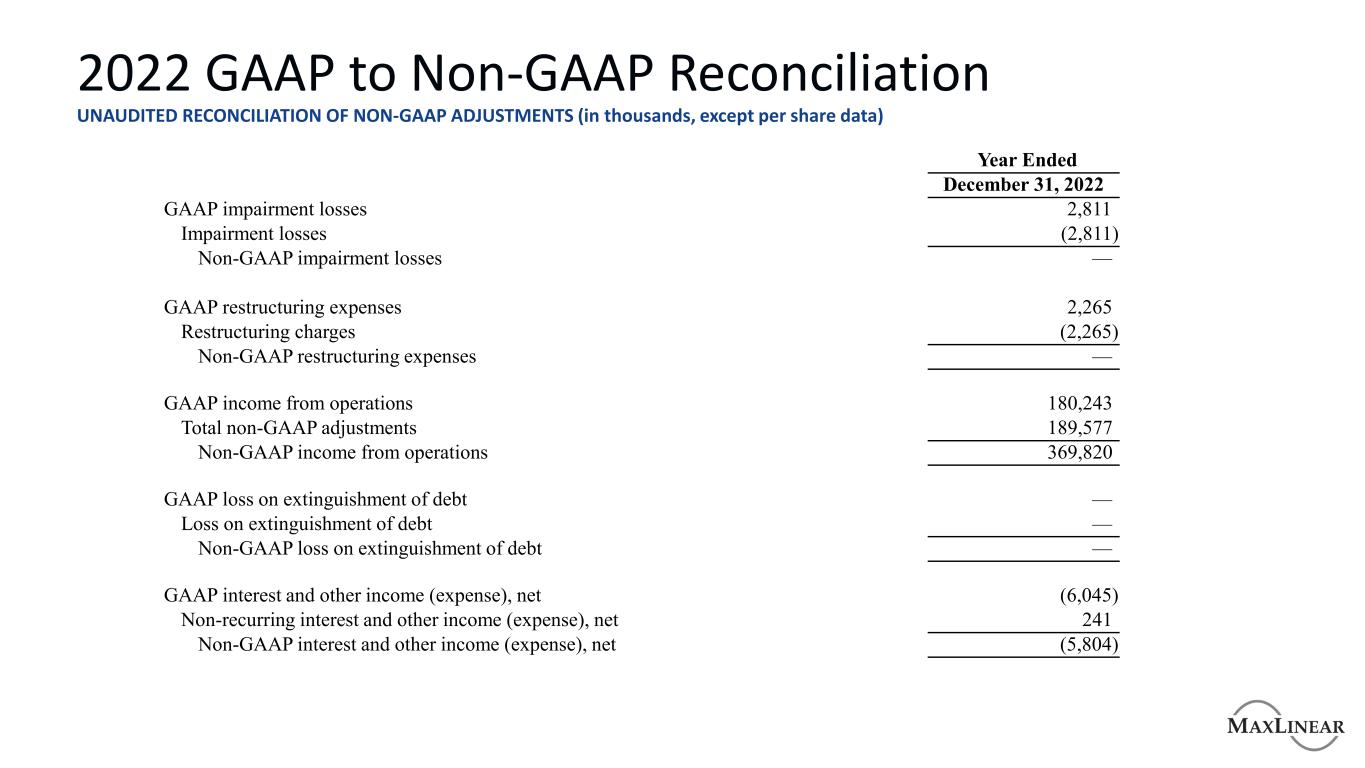

2022 GAAP to Non-GAAP Reconciliation UNAUDITED RECONCILIATION OF NON-GAAP ADJUSTMENTS (in thousands, except per share data) Year Ended December 31, 2022 GAAP impairment losses 2,811 Impairment losses (2,811) Non-GAAP impairment losses — GAAP restructuring expenses 2,265 Restructuring charges (2,265) Non-GAAP restructuring expenses — GAAP income from operations 180,243 Total non-GAAP adjustments 189,577 Non-GAAP income from operations 369,820 GAAP loss on extinguishment of debt — Loss on extinguishment of debt — Non-GAAP loss on extinguishment of debt — GAAP interest and other income (expense), net (6,045) Non-recurring interest and other income (expense), net 241 Non-GAAP interest and other income (expense), net (5,804)

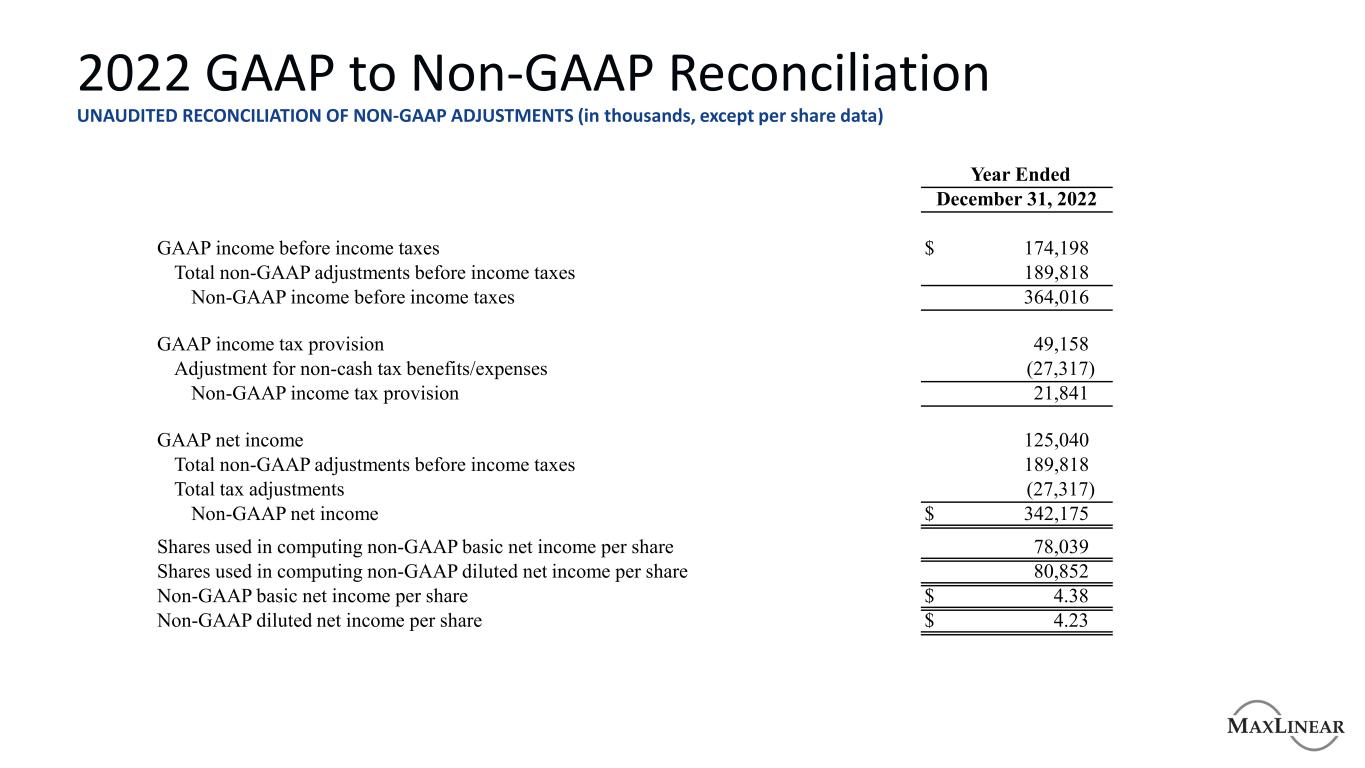

2022 GAAP to Non-GAAP Reconciliation UNAUDITED RECONCILIATION OF NON-GAAP ADJUSTMENTS (in thousands, except per share data) Year Ended December 31, 2022 GAAP income before income taxes $ 174,198 Total non-GAAP adjustments before income taxes 189,818 Non-GAAP income before income taxes 364,016 GAAP income tax provision 49,158 Adjustment for non-cash tax benefits/expenses (27,317) Non-GAAP income tax provision 21,841 GAAP net income 125,040 Total non-GAAP adjustments before income taxes 189,818 Total tax adjustments (27,317) Non-GAAP net income $ 342,175 Shares used in computing non-GAAP basic net income per share 78,039 Shares used in computing non-GAAP diluted net income per share 80,852 Non-GAAP basic net income per share $ 4.38 Non-GAAP diluted net income per share $ 4.23

Thank you